As volatility engulfs the cryptocurrency market amid war tensions, on-chain data shows that the Bitcoin short-term holders are selling at a loss.

Bitcoin Short-Term Holders Just Made Large Exchange Inflows At A Loss

In a new post on X, CryptoQuant author Axel Adler Jr has talked about how the Bitcoin short-term holders have reacted to the price volatility that has come alongside rising tensions in the Middle East following US strikes on three nuclear facilities in Iran.

The short-term holders (STHs) refer to the BTC investors who purchased their coins within the past 155 days. The other side of the network, the holders with a holding time greater than 155 days, are termed as the long-term holders (LTHs). The former group contains the new entrants and low conviction holders, who generally panic easily whenever some change occurs in the market. On the other hand, the latter cohort includes the veterans of the market, who tend to sit tight through crashes and rallies alike.

As such, given the recent sharp price action that has occurred in the sector, the STHs are likely to have made some moves. And indeed, on-chain data would confirm so.

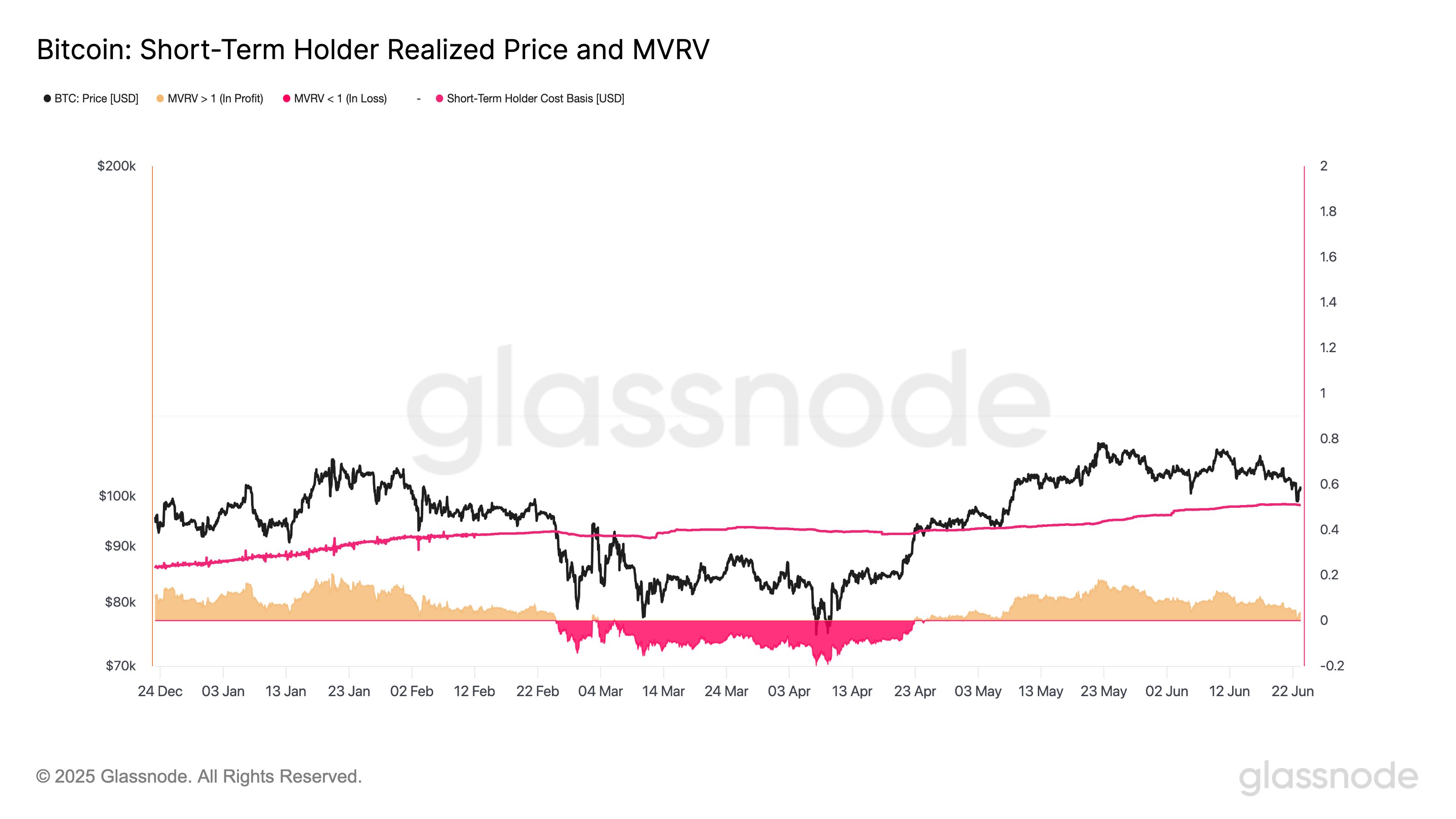

The above chart, shared by the analyst, shows the data for the profit and loss exchange deposit transactions that the STHs as a whole are making. Investors usually transfer to these centralized platforms when they want to sell, so inflows going to them can provide hints about whether selling is elevated or not.

From the graph, it’s visible that the loss transactions going to the exchanges from this cohort have amounted to 14,700 BTC, which, although lower than the two major capitulation events from the past couple of months, is significant. Thus, it would appear that some of the STHs have reacted to the news by exiting the market, even if it means taking a loss.

It’s also apparent from the chart that the profitable transfers have remained relatively low at 3,100 BTC. This is likely down to the fact that the STHs are left with little profit following the price decline, as the on-chain analytics firm Glassnode has pointed out in an X post.

In the chart, the trend of the STH Realized Price is displayed. This indicator keeps track of the Bitcoin cost basis or acquisition level of the average STH. During the crash, the price almost retested the line, and even after the rebound, it remains close to it, meaning the profit margin for the cohort is still tight.

BTC Price

At the time of writing, Bitcoin is trading around $101,300, down over 5% in the last week.

Featured image from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Read the full article here