Ethereum (ETH) is at a critical juncture as it approaches the $2,700 resistance level. This level could determine whether the altcoin market will see gains. After recovering from a sharp dip, Ethereum is trying to break through this resistance, which could set the stage for a rally to the $3,000 to $3,200 range.

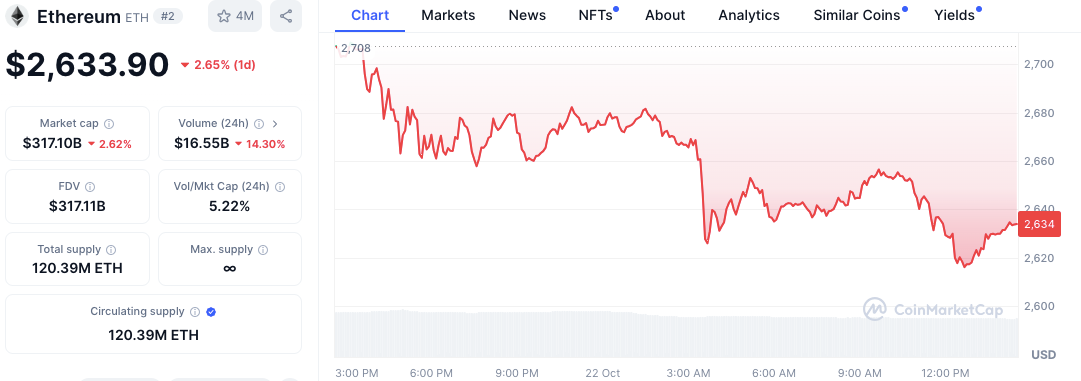

At its current price of $2,633.90, Ethereum remains in a trading range, with support zones at $2,556.77, $2,443.87, and $2,309.04. The resistance level is around $2,768, where it has historically encountered selling pressure.

Source: Michaël van de Poppe

Ethereum recently experienced a sharp sell-off, with its price falling to a low of $2,145.29 before recovering and retesting the resistance.

Michaël van de Poppe noted that this resistance test is typical market behavior. He added that the bullish momentum could continue even if Ethereum dips to the $2,500-$2,550 range.

#Ethereum did have a test at resistance, and couldn’t break through it.

That’s actually quite normal.

Even a test at $2,500-2,550 would still be valid for bullish continuation.

Breakout above $2,700 and the next target is $3,000-3,200 and #Altcoins to do well. pic.twitter.com/MDd5berpbK

— Michaël van de Poppe (@CryptoMichNL) October 22, 2024

According to van de Poppe, if Ethereum breaks above $2,700, it could reach the $3,000-$3,200 range, which would likely benefit the altcoin market.

Market Sentiment and Technical Indicators

Ethereum fell 2.71% yesterday, with the price currently at $2,633.90. Its market cap has also decreased by 2.75% to $317.10 billion.

Source: CoinMarketCap

Short-term market sentiment appears bearish as selling pressure persists. Ethereum dropped to around $2,620 but has since begun to recover.

Technical indicators give mixed signals. The MACD is above the signal line, suggesting bullish crossover momentum. However, the MACD histogram shows declining bullish strength, raising concerns about a potential slowdown.

Source: TradingView

The RSI is at 56.49, just above the neutral 50 level, indicating that Ethereum is neither overbought nor oversold.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here