Coinbase Institutional identifies three major trends that will shape the crypto market in the second half of 2025: an improving macroeconomic outlook, rising short-term corporate demand, and increasing regulatory clarity.

It says these dynamics could lead to significant growth and structural shifts across the digital asset ecosystem.

3 Trends Set to Define Crypto Markets in H2 2025

An improving macroeconomic outlook with reduced recession risks is the first trend highlighted by Coinbase.

“We could see an economic slowdown or mild recession this year – if not avoid a recession altogether – rather than a severe recession or stagflation scenario,” the report stated.

It notes a more optimistic US economic growth outlook, particularly as the Federal Reserve (Fed) is likely to cut interest rates by late 2025.

Given rising liquidity metrics like US M2 money supply and expanding global central bank balance sheets, Coinbase believes “conditions are unlikely to cause asset prices to revert to 2024 levels,” implying bitcoin’s upward trend will likely continue. This fosters crypto market capitalization growth, especially with controlled inflation and supportive fiscal policies.

Strong short-term corporate demand is the second factor, as companies increasingly view cryptocurrencies as an asset allocation tool. According to Coinbase, approximately 228 public companies hold 820,000 BTC globally, with some investing in ETH, SOL, and XRP.

Per Galaxy Digital, about 20 companies employ leveraged funding strategies pioneered by Strategy (formerly MicroStrategy). Updated FASB accounting rules allow digital assets to be recorded at fair market value, replacing prior loss-only recognition and encouraging corporate participation.

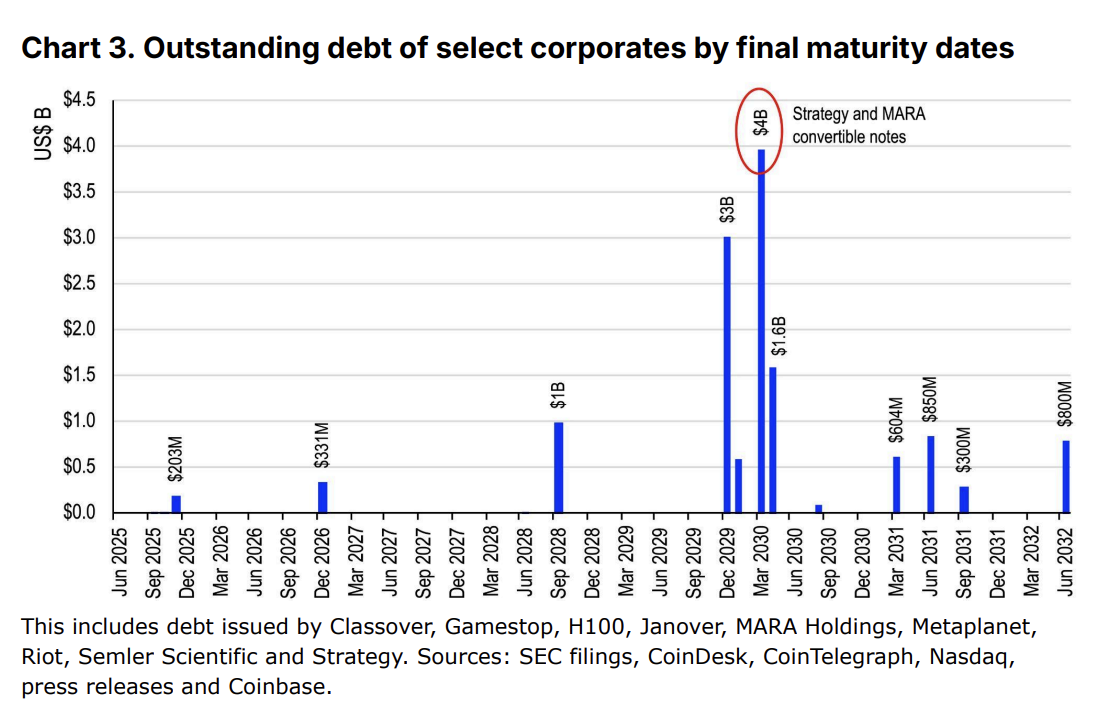

A new trend is the rise of publicly-traded crypto vehicles (PTCVs), focused solely on crypto accumulation via equity and convertible bond issuance. However, this brings risks: forced selling pressure (due to bond debts) and discretionary selling (eroding market confidence).

Short-term risks are also low, as most debts mature between 2029 and 2030. With reasonable loan-to-value ratios, large firms can refinance without liquidating assets, supporting continued crypto accumulation in 2H25.

A clearer regulatory roadmap is the third trend, with significant progress in stablecoin and market structure legislation.

Unlike the prior “regulation by enforcement” approach, the White House and Congress are advancing a comprehensive framework. Moreover, stablecoin laws, via the STABLE Act and GENIUS Act, are expected to be a breakthrough, establishing reserve requirements, anti-money laundering compliance, and user protections.

These bills may be unified by August 2025. Crypto market structure laws, like the CLARITY Act, clarify CFTC and SEC roles, building on FIT21.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here