The crypto market has kicked off this week with a slight recovery following last week’s steep decline. Bullish sentiment is slowly attempting a comeback, with several ‘Made in USA’ coins flashing signs of strength.

Some US-founded projects stand out for their strong fundamentals and active development pipelines. These tokens are drawing attention for their potential to outperform in Q3, especially if the broader market recovery holds.

LINK is one of the most important ‘made in USA’ coins to watch in Q3, thanks to a major partnership between Chainlink and Mastercard to bridge traditional finance with crypto.

This collaboration will enable Mastercard’s three billion cardholders to purchase crypto directly on-chain.

Through integrations with Web3 entities like Shift4 Payments, Swapper Finance, XSwap, and ZeroHash, users will be able to convert fiat to crypto seamlessly without prior Web3 experience.

As Chainlink powers the oracle infrastructure behind these integrations, demand for LINK could rise significantly in Q3.

At press time, the altcoin trades at $13.15. A resurgence in news demand for the altcoin could push its price toward $14.17.

On the other hand, if bear pressure strengthens as we approach Q3, the altcoin could fall toward $10.94.

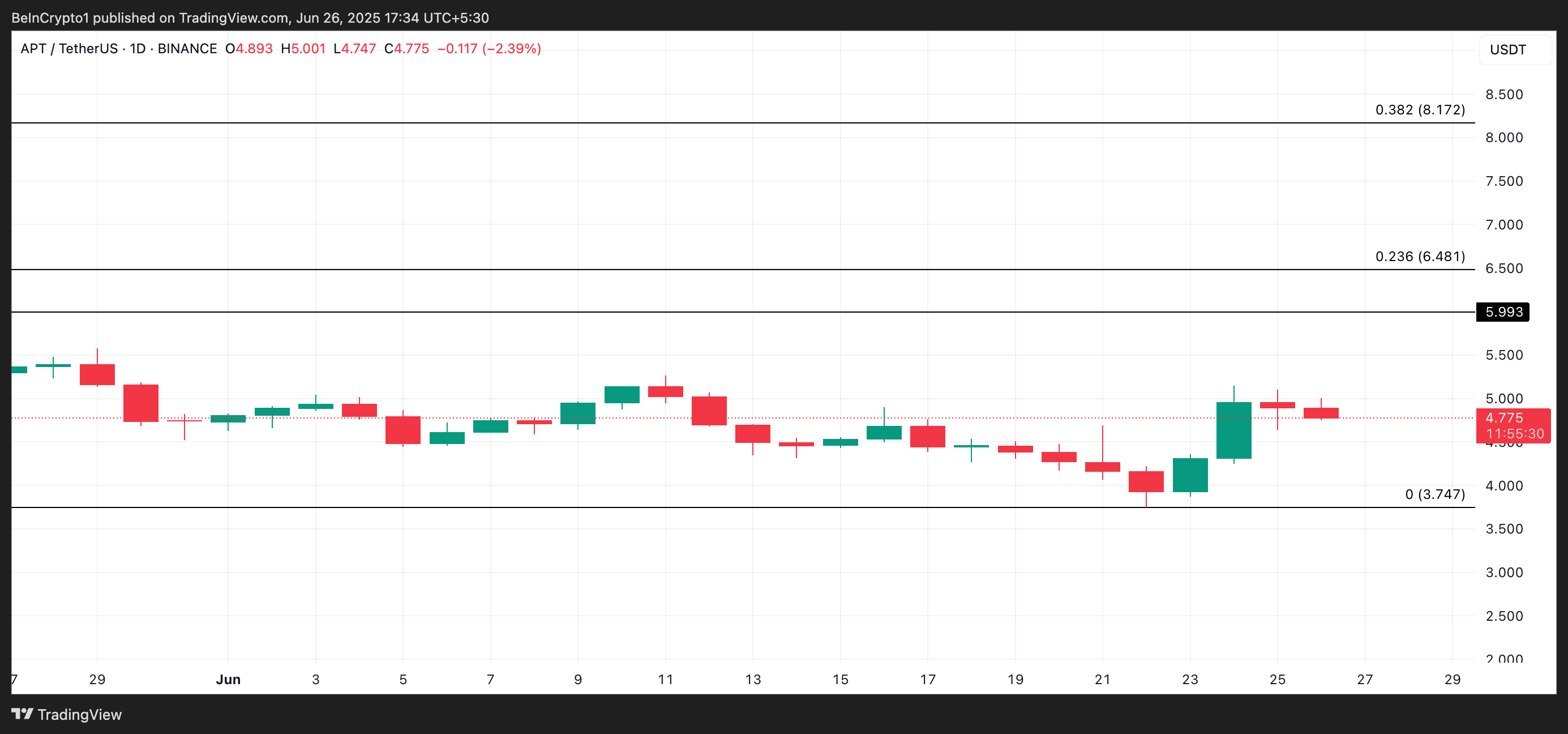

Aptos (APT)

APT is another US-founded project to watch in Q3, as it stands at the center of growing stablecoin adoption momentum. The state of Wyoming is reportedly moving forward with plans to launch its own stablecoin, known as the Wyoming Stable Token (WYST).

Aptos is one of the top contenders for the underlying blockchain infrastructure.

A special state-appointed Wyoming Stable Token Commission evaluated several networks, and Aptos tied for first place with Solana, scoring highest on criteria like technical robustness and vendor support.

If Wyoming selects Aptos for its stablecoin rollout, it would mark a significant milestone for the network and push demand for its APT token.

Currently, the altcoin trades at $4.77. If this development spurs increased demand for the altcoin going into Q3, it could push its price to $5.99.

However, if selling pressure increases, APT’s price could drop to $3.74.

SEI

SEI is another altcoin to watch closely in Q3. The State of Wyoming has also selected it as one of the underlying infrastructures for its upcoming WYST stablecoin.

This decision puts Sei in the spotlight amid intensifying competition among blockchains to secure real-world adoption.

Over the past month, the Sei Network has seen an uptick in user activity. Per Artemis, during that period, the number of daily active users on the blockchain has soared to 609,448, rising by 17.36%.

The network’s total value locked (TVL) has also risen by 14.11%, hitting $563 million, indicating growing user confidence and liquidity inflows. Fees collected on the network have rocketed by 196%, reaching $519, while SEI’s price jumped nearly 25% to $0.28 over the past month.

If this trend continues, SEI’s price could climb toward $0.305.

Conversely, if demand dips, the coin’s price could fall to $0.23.

Plume Network (PLUME)

PLUME is another altcoin to watch in Q3, as it continues to gain significant traction in the real-world asset (RWA) tokenization space. The project recently achieved a major regulatory milestone after the token passed the EU’s Markets in Crypto-Assets (MiCA) compliance review, making it eligible for listing on regulated exchanges across all 27 EU member states.

This opens the door for a wave of European institutional and retail investment, strengthening Plume’s credibility as a compliant blockchain for real-world asset infrastructure.

In addition to regulatory wins, Plume Network has surpassed 100,000 RWA holder addresses, overtaking Ethereum as the blockchain with the largest number of RWA holders.

With regulatory approval and record-breaking user adoption, PLUME is well-positioned for further upside in Q3. If demand climbs, PLUME’s price could reach $0.095.

On the other hand, if buying activity drops, the coin’s price could break below $0.075.

Worlcoin (WLD)

WLD is another altcoin to keep an eye on in Q3, driven by fresh speculation about a potential partnership with Reddit. According to an earlier report, Reddit is reportedly discussing integrating Worldcoin’s Orb biometric technology to verify users and combat bots and fake accounts.

If true, this move would represent a major leap for decentralized identity adoption within mainstream social platforms, especially in response to growing concerns about generative AI and online misinformation.

The circulating news has contributed to a mild recovery in the WLD token’s price. If buying pressure continues to build, WLD could break above the $0.97 resistance level.

However, if demand fades or the rumors fail to materialize, the token risks falling toward the $0.57 support zone.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here