The Ethereum network continues to grow steadily, reaching new highs in validators and staked Ether this year, but this might not be the best outcome for the ecosystem going forward.

According to the Beacon Chain, the amount of staked Ether has been growing yearly, increasing by over 6 million throughout 2024 and hitting a peak of over 34 million on Oct. 2.

Lachlan Feeney, founder and CEO of Ethereum infrastructure firm Labrys, told Cryptopolitan the growth is steady because that’s what the system has been designed to incentivize.

The Ethereum Network has more staked Ether and validators than ever, hitting new highs in 2024. Source: Beacon Chain

The more ETH staked, the lower the yield for all stakers. However, he says it’s important to recognize that the Ethereum ecosystem is not trying to grow the amount of staked Ether.

“It continues to grow because for many investors who intended to hold ETH anyway, they may as well stake it, regardless of how low the staking APY is, and earn additional yield,” he said.

“However, investors who were initially attracted to ETH due to high yield have mostly stopped adding to their stake by now. The Ethereum ecosystem is not trying to grow the amount of staked ETH. Slowing staked ETH is a good thing.”

Amount of staked Ether already passed the point of positivity

Roughly 28.43% of the 120.39 million circulating supply of Ether has been staked at the moment. In January, the percentage of Ether staked was 23.8%, which means that an additional 5.1% was staked in the last 10 months, according to an Oct. 8 X post from on-chain data provider IntoTheBlock.

Feeney says the amount of staked Ether has already likely passed the point of positivity for the network; more won’t necessarily add any benefits.

He thinks any additional staked Ether is adding a non-significant amount of security to the network, meaning that further growth is not necessarily desirable.

“No one knows exactly what the ideal amount of staked ETH is, but there is a limit. Personally, I believe we’ve already passed that limit,” Feeney said.

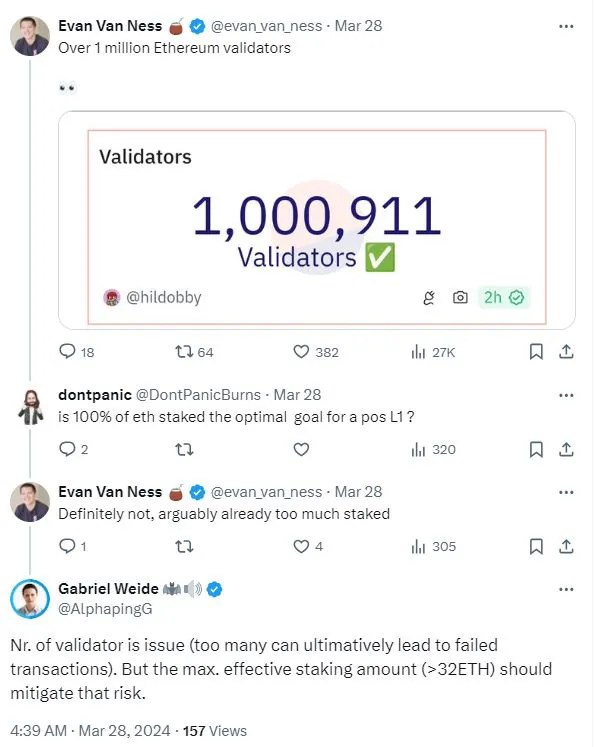

When the network clocked over one million validators and over 32 million Ether staked in March, concerns were raised that this could create issues for the Ethereum ecosystem.

While the number of validators could translate into higher security for a blockchain, some community members questioned if too many validators and staked Ether could pose issues for the network.

Source: Evan Van Ness

Venture investor and Ethereum advocate Evan Van Ness said there was already “too much” staked. Gabriel Weide, who runs a staking pool, speculated that too many validators might eventually lead to “failed transactions.”

More isn’t always better

“One might think that surely the more ETH staked the better, as staked ETH represents the security of the network, however, if you take that argument to an extreme where 100% of all ETH in existence is staked, this is clearly not a desirable outcome,” Feeney said.

While that scenario is unlikely, Feeney says any significant amount of Ether, 90%, 80%, or even 70%, is a less-than-ideal outcome for the network. Aside from the risk of failed transactions speculated by others, he thinks a larger issue could arise.

“One obvious problem is that without ETH available, you can’t pay for gas which must be paid in ETH, users will need to use stETH and cbETH and swETH in any application where ETH is currently used,” he said.

“This forces the user to pick an LST, liquid staking token, which comes with unnecessary risk. Native ETH should always remain the primary risk-free asset within the Ethereum ecosystem.”

Despite the rising interest in staking Ether, its price has declined since its all time high of over $4,000, which it hit on March 12, according to CoinMarketCap.

As of Oct. 24, the price is hovering around $ 2,500.

Read the full article here