Dogecoin, the world’s top meme cryptocurrency, has surged onto investors’ radar, making a comeback with a 16.13% gain in the past 24 hours. As of press time, the DOGE token trades at $0.1677, driven by a volatile 24-hour period marked by 6.1% swings, while its market cap stands at $24.4 billion.

This bullish outlook has entitled the meme coin to erase last week’s losses, reawakening interest and optimism in the DOGE community. The rally traces back to an event in New York, where the cryptocurrency’s ticker unexpectedly appeared at a Donald Trump rally. This surprising mention caught the market’s attention and spurred new buying interest, reminiscent of earlier surges inspired by similar publicity.

#ElonMusk is loving that energy inside #MSG. 🇺🇸

Can’t wait for the Department of Government Efficiency #DOGE to kick in to cut all that unnecessary waste!

VOTE VOTE VOTE! pic.twitter.com/iJVZYPcUGW

— Dark Tidings (@unitedtidings) October 27, 2024

Fueling the momentum further, Elon Musk shared a bold proposal aimed at saving American taxpayers $2 trillion through a concept dubbed the “Department of Government Efficiency.” Its initials—D.O.G.E.—align perfectly with Musk’s favorite cryptocurrency, sparking renewed enthusiasm among Dogecoin traders. The sentiment is similar to an earlier rally on October 15, triggered by another nod from Musk.

The DOGE’s Golden Cross Effect

Adding to the excitement, technical analysis has revealed a “golden cross” pattern on Dogecoin’s daily chart. This bullish indicator emerged when DOGE’s 50-day EMA crossed above its 200-day EMA on October 25, a classic sign of upward momentum in technical trading circles. Analysts see this crossover as a key shift from bearish to bullish sentiment.

As of October 29, the Dogecoin token has been holding above its crucial 0.5 Fibonacci retracement level, around $0.1358, which had previously acted as a solid resistance point in July. Maintaining this position could set the stage for the DOGE token to target the $0.1832 and $0.2292 ranges, which align with the 0.78.6 and 1.0 Fibonacci retracement levels for November. However, a dip below $0.1358 would bring the cryptocurrency’s ascending trendline support into focus, potentially testing the waters at $0.1201 and $0.1031, aligning with the 0.382 and 0.236 Fibonacci retracement levels.

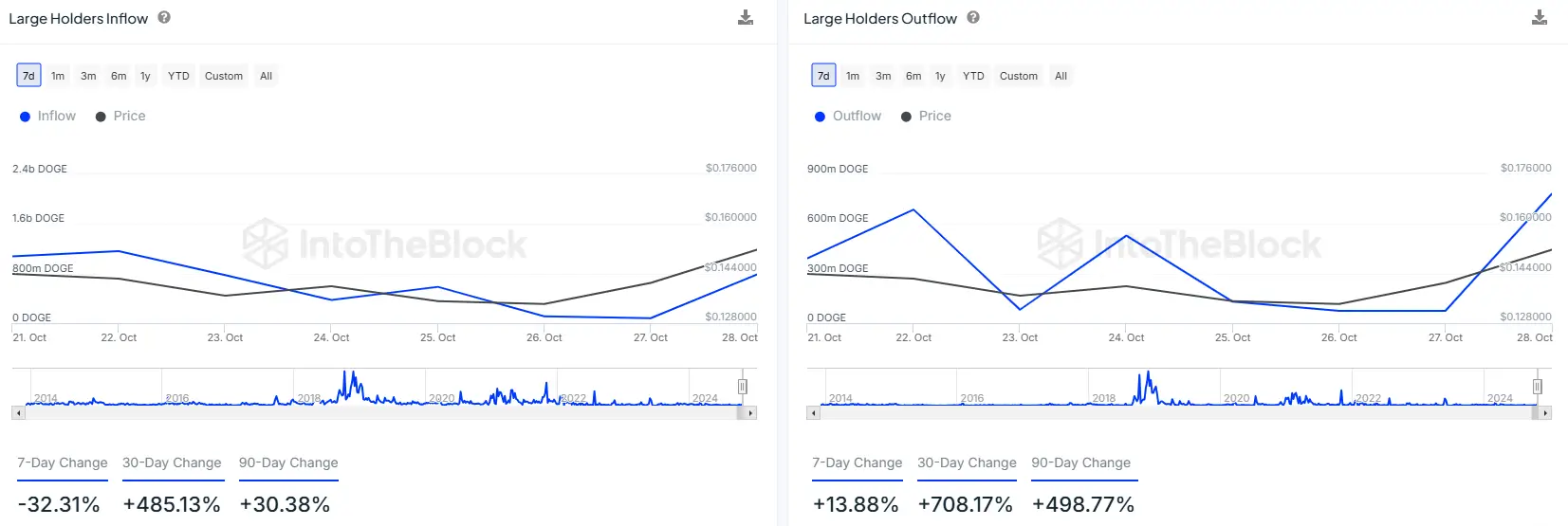

Inflow-Outflow Divergence Signals DOGE Volatility Ahead

In addition to the technical data, on-chain data reveals notable activity among large Dogecoin holders. Over the past week, large holder inflows have dropped by 32.31%, while outflows have increased by 13.88%, suggesting some are taking profits as the DOGE token rallies. The 30-day data shows even larger moves, with inflows up by 485.13% and outflows by 708.17%, indicating high turnover among major holders.

This mixed activity hints at bullish interest and short-term repositioning, which could add volatility. If large holders continue to support the DOGE token with strong inflows, it may reinforce the current uptrend and pave the way for the next Fibonacci levels at $0.1832 and $0.2292. However, if outflows begin to dominate, the altcoin might face short-term pressure, offering new entry points as it navigates this bullish but cautious phase

Read the full article here