Ethereum is still struggling to reach its March high of $4,000, let alone the all-time high of $4,891 in November 2021.

Ethereum’s (ETH) on-chain movements along with its decentralized finance sector have remained strong while the leading altcoin is seeing high price volatility amid market turbulence.

ETH briefly touched a four-month high of $3,444 on Tuesday, Nov. 12. Following the price drop from its local high, the king altcoin has been consolidating between $3,120 and $3,290 over the last two days.

ETH price | Source: crypto.news

While Ethereum is still down by 34% from its ATH, its fundamentals remain strong.

ETF inflows

Spot ETH exchange-traded funds in the U.S. have been registering consecutive inflows since the U.S. elections last week.

The investment products started the week with a record net inflow of $295.5 million led by Fidelity’s FETH and BlackRock’s ETHA funds — worth $115.5 million and $101.1 million, respectively.

On Wednesday, spot ETH ETFs had a net inflow of $146.9 million, taking the total inflows to $241.7 million.

This is the first time these ETH-based investment products have seen strong demand since their launch in July.

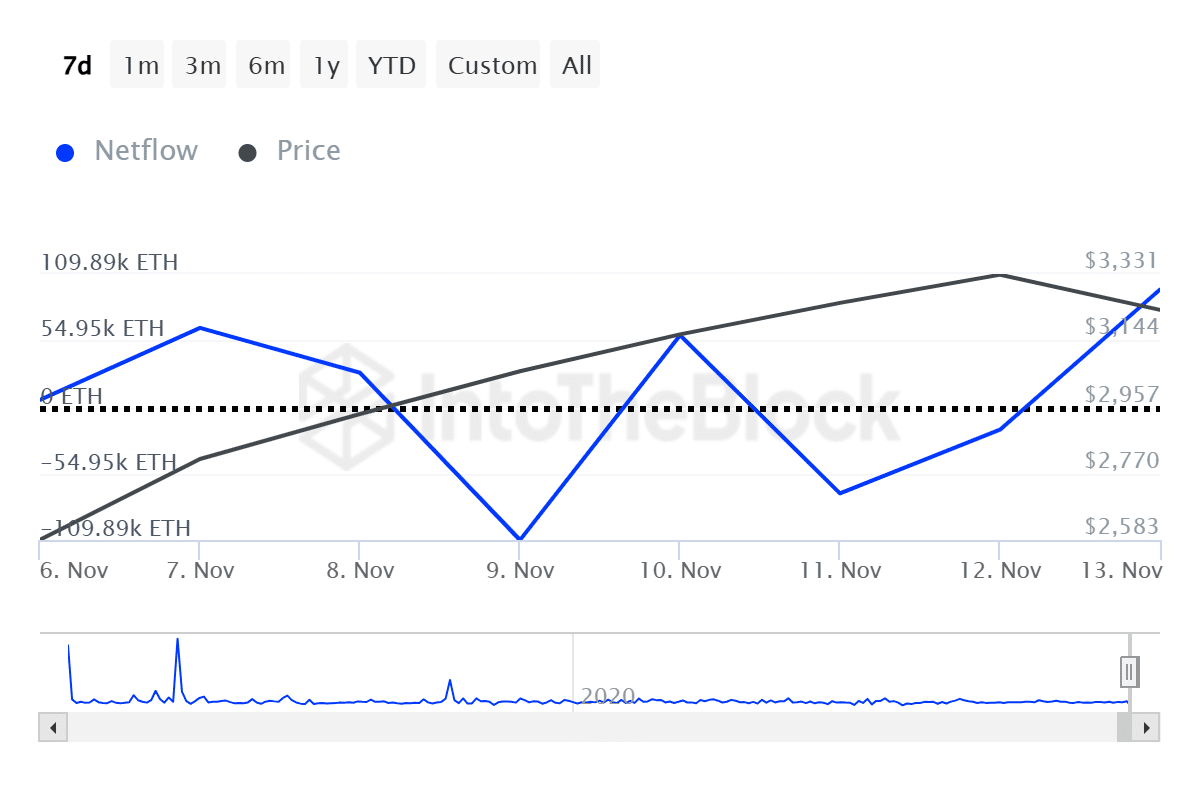

Whale accumulation

Ethereum is also seeing increased whale accumulation as the market participants wander in greedy conditions.

Large holders saw a net inflow of over 97,000 ETH, worth roughly $310 million, yesterday, according to data provided by IntoTheBlock.

ETH whale net flow | Source: IntoTheBlock

Whale accumulation often triggers the fear of missing out among retail investors. This usually leads to high price volatility before gaining steady upward momentum.

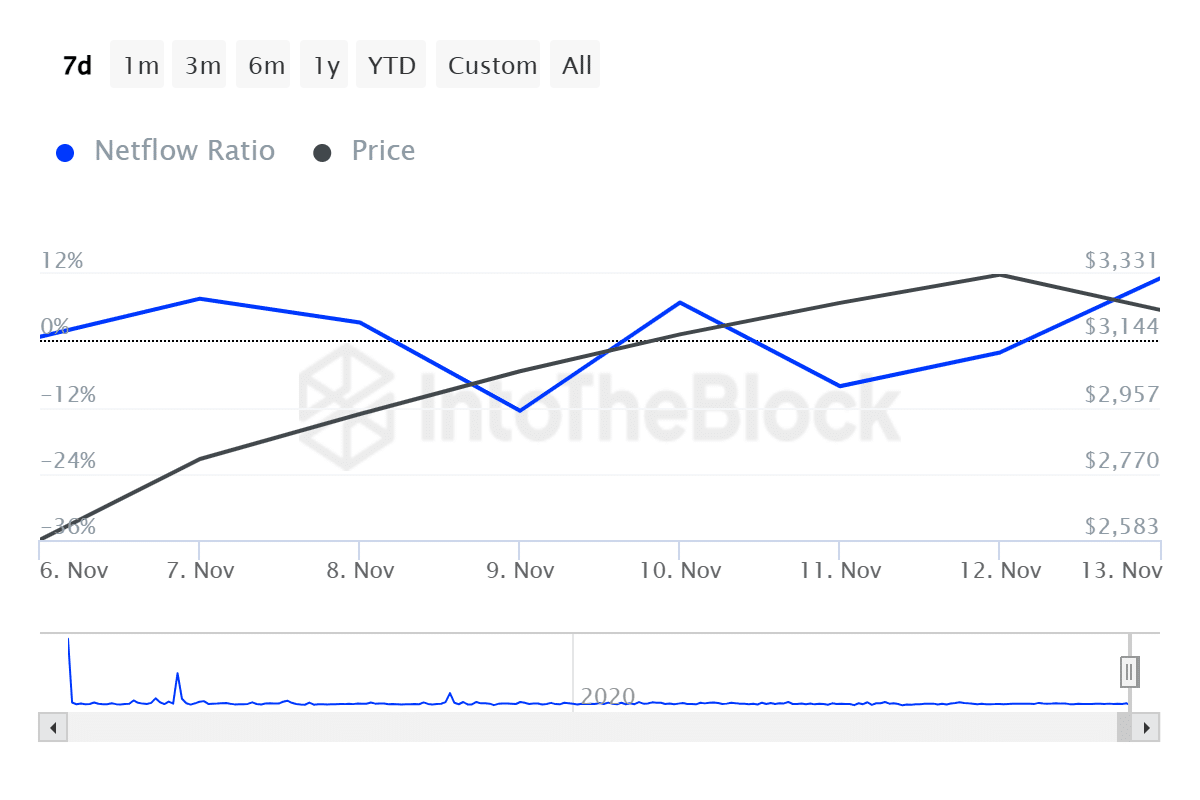

Exchange outflows

In addition to whales, retail investors have also been busy accumulating Ethereum.

ETH recorded an exchange net outflow of $1.12 billion over the past week, data from ITB shows. The large holder-to-exchange net flow ratio suggests strong retail accumulation on Nov. 9, 11 and 12.

ETH large holder-to-exchange net flow | Source: IntoTheBlock

Exchange outflows usually lead to long-term holding which would ultimately pave the way to a steady growth.

DeFi growth

Ethereum’s DeFi sector has also been surging.

The total value locked in Ethereum-based protocols increased by roughly $10 billion after the crypto market gained bullish momentum on Donald Trump’s win in the U.S. presidential election, according to data provided by Defi Llama.

Moreover, the total fees collected by DeFi platforms on the Ethereum network tripled over the past seven days to $18 million. These protocols generated a total revenue of $15.5 million over the past day.

Hitting $4k before 2025?

Amberdata, a market analysis firm, claims that there is an 18% chance of Ethereum reaching the $4,000 mark by the end of the year.

18% chance that Ethereum can hit $4000k by EOY being priced in for the Dec 27 expiration

We’re still a long way from ETH’s all-time high. Which makes us think we may have some room to run. NFA

New SVI Calibrated PDF/CDF charts built by AD Derivatives @genesisvol

Check out the… pic.twitter.com/csb7AZyeCy— Amberdata (@Amberdataio) November 12, 2024

“We’re still a long way from ETH’s all-time high. Which makes us think we may have some room to run.”

Amberdata wrote in an X post.

The strong growth in ETH ETFs and the increasing whale accumulation could add to the positive Ethereum price momentum.

However, it’s important to note that macro events could potentially shift the market’s focus to the other way despite bullish on-chain signals.

Read more: Bitwise acquires Ethereum staking provider Attestant with $3.7b in AUM

Read the full article here