Ethereum price today: $3,110

- Ethereum ETFs recorded six consecutive days of positive flows after posting net inflows of $146.9 million on Thursday.

- Investors have unstaked over $300 million worth of ETH in the past 48 hours.

- Ethereum could rally to $4,522 if the inverted head and shoulders pattern develops.

Ethereum (ETH) is down over 1% on Thursday following record net inflows across ETH exchange-traded funds (ETF) in the past six days. Despite the bullish market outlook, $300 million worth of unstaked ETH could hit the market and cause downward pressure on prices.

Ethereum investors display mixed on-chain behavior

Ethereum ETFs are on track to record their best week since launch after posting net inflows of $146.9 million on Wednesday, per Coinglass data. This marks a sixth consecutive day of positive flows for the products, stretching their six-day flows to $796.2 million.

Notably, the recent inflows have sent ETH ETF total net flows to $241.7 million — positive for the first time since launch.

This aligns with on-chain data which reveals that Ethereum whales have been dominating the market this week, with the daily count of large transactions — higher than $100,000 — surpassing 10,000 for the first time since August.

ETH Total Number of Large Transactions | IntoTheBlock

However, investors need to be cautious of ETH’s exchange reserve, which has been trending upward. A rising exchange reserve indicates a potential increase in selling pressure.

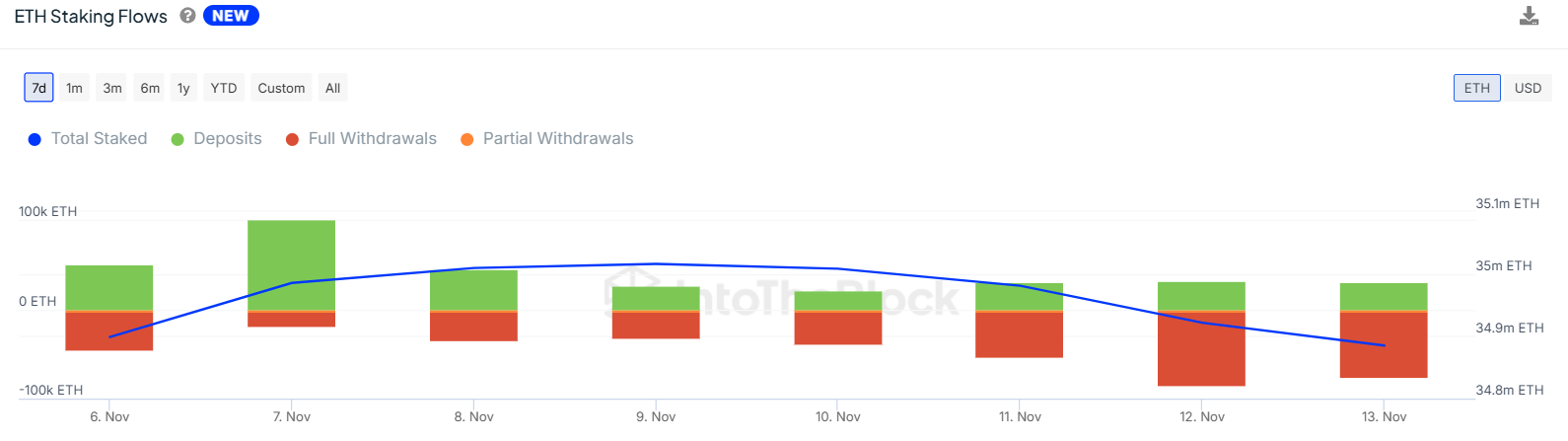

Additionally, ETH staking flows show a net outflow of 94.4K ETH worth over $300 million in the past 48 hours, per IntoTheBlock’s data. ETH could see a decline if the supply pressure from the staking outflows hit the market.

ETH Staking Flows | IntoTheBlock

Meanwhile, asset manager Franklin Templeton extended its US Government Money Fund (FOBXX) to the Ethereum blockchain on Thursday. FOBXX enables investors to buy shares of government securities and repurchase agreements, and hold them in crypto wallets via Franklin’s Benji investment app.

Ethereum Price Forecast: ETH could rally to $4,522

Ethereum is trading near $3,110 following $57.34 million in liquidations in the past 24 hours, per Coinglass data. Liquidated long and short positions accounted for $34.13 million and $23.20 million, respectively.

ETH bounced off the 14-day Exponential Moving Average (EMA) in blue after selling pressure near the $3,400 level extended its decline to a third consecutive day.

ETH/USDT daily chart

Since the bounce off the EMA, the top altcoin appears to be on the verge of posting an inverted head-and-shoulders pattern. If ETH follows this pattern, it could flip its yearly high resistance of $4,093 and rally toward $4,522.

The 14-day Relative Strength Index (RSI) is trending downward and looking to cross below its yellow moving average line. If it completes this move, ETH could decline toward $2,817.

A daily candlestick close below $2,817 will invalidate the bullish thesis.

Read the full article here