Ethereum (ETH) price has struggled to keep pace with other major cryptocurrencies this cycle. While ETH is up 32% year-to-date, its performance lags significantly behind Bitcoin’s 112% and Solana’s 115% gains. Among the top 10 coins, Ethereum has seen the least growth, outperforming only Avalanche.

This lackluster performance highlights growing uncertainty around ETH, as key metrics like whale activity and net exchange flows suggest investors are cautious about betting on Ethereum.

ETH Net Transfer Volume Was Positive for 6 Consecutive Days

Ethereum’s Net Flow From/To Exchanges has shown notable fluctuations in recent weeks. Between November 13 and November 18, the net flow was consistently positive, peaking at 83,500 on November 18.

Earlier in the month, it hit its highest value in two weeks, reaching 128,000 on November 10. However, on November 19, the trend reversed, with the flow turning negative at -33,400.

ETH Net Transfer Volume from/to Exchanges. Source: Glassnode

A high volume of ETH being sent to exchanges often indicates a bearish sentiment, as users may be preparing to sell. Conversely, ETH being withdrawn from exchanges can signal a bullish outlook, as holders typically store assets in private wallets with long-term intentions.

Despite the net outflow on November 19, it followed six consecutive days of positive flows. This suggests that while the recent withdrawal is a promising sign, sustained negative flows are necessary for the signal to turn decisively bullish for ETH price trajectory.

Ethereum Whales Appear To Be Hesitant

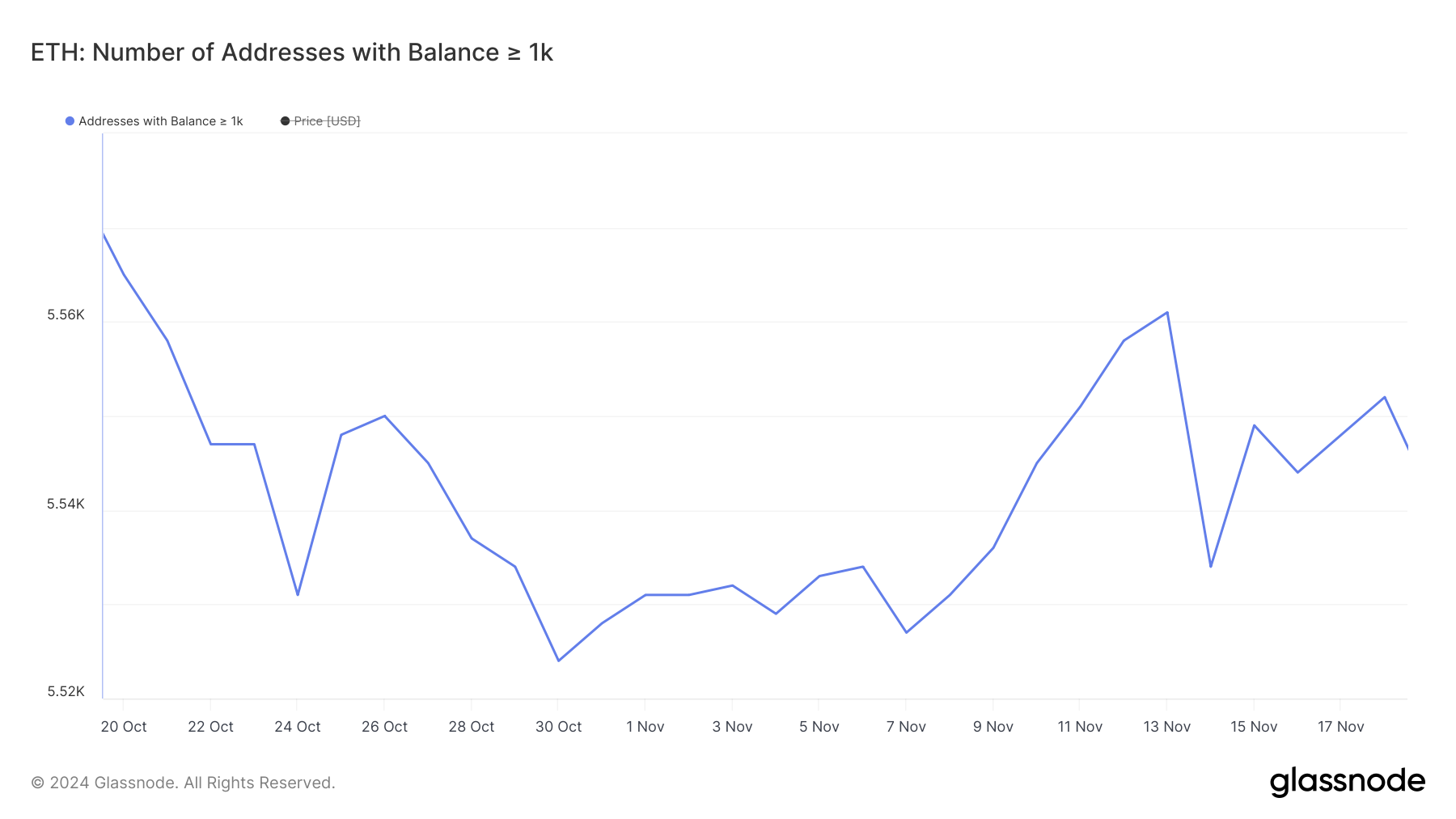

The number of Ethereum whales holding at least 1,000 ETH surged significantly between November 7 and November 13, increasing from 5,527 to 5,561. This marked a strong period of accumulation by large holders, suggesting heightened interest during that timeframe.

Addresses with Balance >= 1,000 ETH. Source: Glassnode

However, the number dropped sharply on November 14 to 5,534 and has struggled to recover since then. Currently sitting at 5,542, the metric’s ups and downs indicate lingering uncertainty among whales. Their hesitance suggests that they are unsure of ETH price potential for sustained surges in the near term.

ETH Price Prediction: A Correction or a 15% Upside?

Ethereum’s short-term EMA lines remain above the long-term ones, but the gap between them is narrowing. If the short-term line crosses below the long-term line, it would form a death cross, a bearish signal that could indicate a stronger downtrend ahead.

ETH Price Analysis. Source: TradingView

If Ethereum enters a downtrend, it may test its nearest support at $2,990. A break below this level could lead to further declines, with the price potentially falling to $2,570.

On the other hand, renewed confidence from whales could push ETH price higher. In this scenario, the price might first test resistance at $3,219 and then climb to $3,448, offering a potential upside of around 15%.

Read the full article here