Bitcoin (BTC) has been consolidating below the $100,000 psychological resistance since breaking out of a seven-month downtrend in November. Now, traders are cautiously looking at key levels that BTC needs to reclaim before trying a new price rally above $100k.

In particular, CrypNuevo has set a key price target to validate the upward momentum and a potential $100,000 breakout. According to a post on November 29, the trader is ready to open long positions if Bitcoin reclaims $98,300.

“If we want to see a push higher to $104k-$105k , then Bitcoin needs to get back above this key level: $98.3k. Reclaim that $98.3k level and I’m back in longs.”

– CrypNuevo

By his posting time, Bitcoin was trading at $95,312, still below an uptrend line BTC is facing as resistance. Reclaiming the uptrend and, then, the $98,300 level – which has significant selling pressure – is key to a continuation rally.

What’s next for Bitcoin after reclaiming this level?

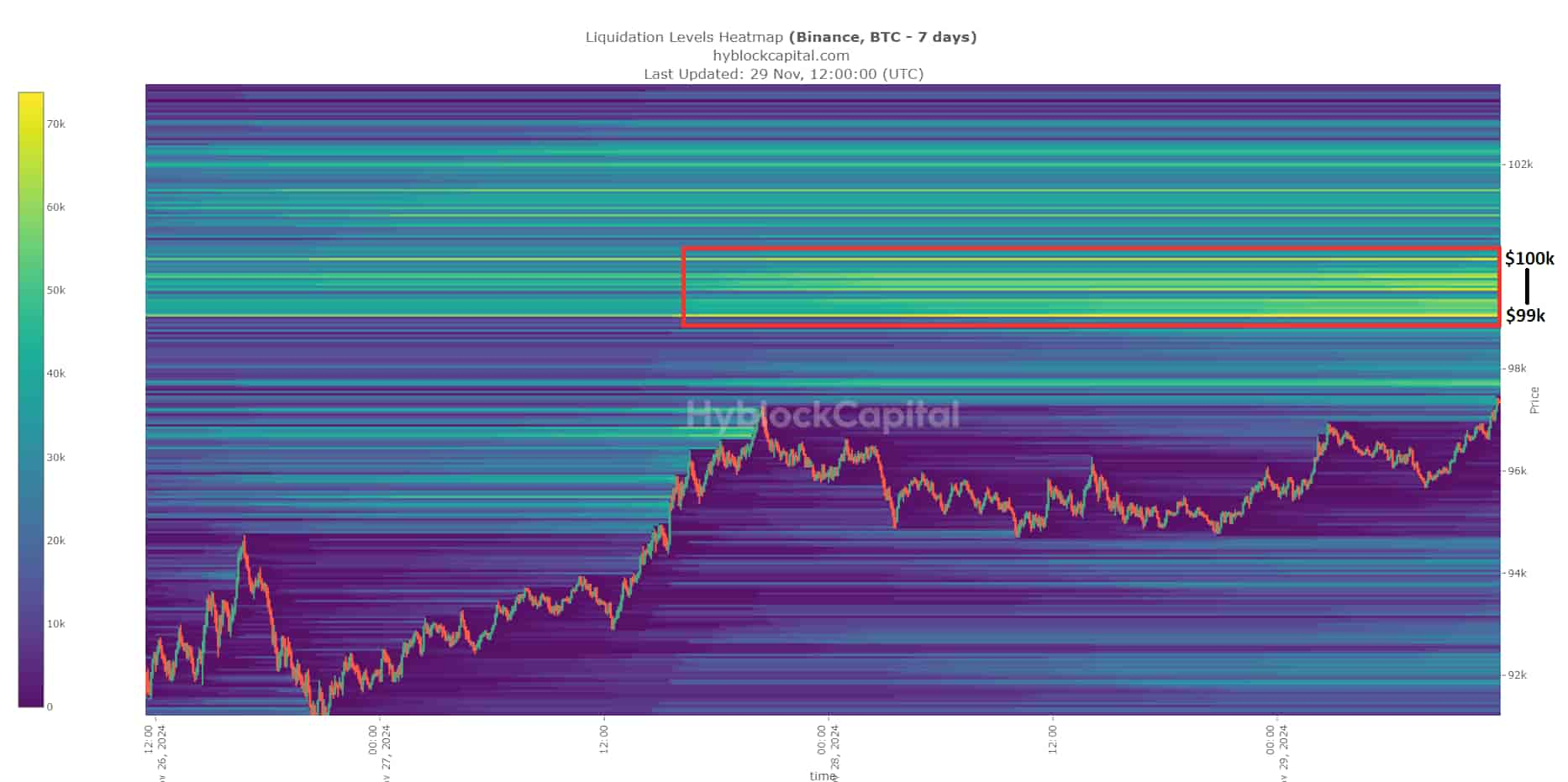

Following up with his analysis, CrypNuevo points out high liquidity pools between $99,000 and $100,000. This means that there are significant liquidations waiting for a trigger above the trader’s key level of $98,300.

Reclaiming and trading above that zone with strength could reach these liquidation targets and start a short squeeze. This would create a favorable scenario for Bitcoin bulls, eyeing the region above $100k and up to $105,000.

Ash Crypto, a one-million-followers account, celebrated Bitcoin reclaiming the $97,000 level, eyeing the $100,000 target.

Analysts have wondered what will happen after BTC reaches the long-awaited $100k target. Ideas vary from cautious outlooks foreseeing a quick break above $100,000 followed by a correction. Meanwhile, others are already setting their targets at $200,000 and beyond.

However, savvy traders have been warning for months about the value of profit realization and having a clear exit strategy. For example, Wolf has disclosed a plan to start offloading his BTC position above the $130,000 price level.

Featured image from Shutterstock.

Read the full article here