Ethereum’s Total Value Locked (TVL) has surged by an impressive $7.79 billion over the past week, marking it as the blockchain with the highest growth in TVL during this period. This significant development coincides with the temporary rise of the ETH price to $4,000, indicating renewed investor confidence in the cryptocurrency.

The blockchain is not the only one that has had notable growth. However, according to recent data, no other project has experienced Ethereum’s level of growth.

Confidence in Ethereum Reaches New Heights

On December 2, the Ethereum TVL was a little less than $70 billion. But today, the metric has grown to $77.15 billion. TVL is a crucial metric within the cryptocurrency and decentralized finance (DeFi) ecosystem.

It represents the total value of assets locked or staked in decentralized applications (dApps), smart contracts, or blockchain-based protocols. This metric serves as an indicator of the growth, adoption, and user confidence in DeFi platforms.

A higher TVL suggests that more users are engaging with these systems, signifying trust in their functionality and security. On the other hand, a decrease in the metric indicates dwindling liquidity, suggesting falling deposits on the blockchain

Therefore, the rise in Ethereum’s TVL indicates the cryptocurrency’s growing adoption and popularity among investors. This surge suggests heightened trust in Ethereum-based decentralized applications and protocols.

Ethereum Total Value Locked. Source: DeFiLlama

If this trend persists, it could potentially drive further appreciation for ETH price, as rising TVL often correlates with increased network activity and demand for the asset. It is also important to note that Tron’s and Solana’s TVL also increased by $900.23 million and $618.40 million.

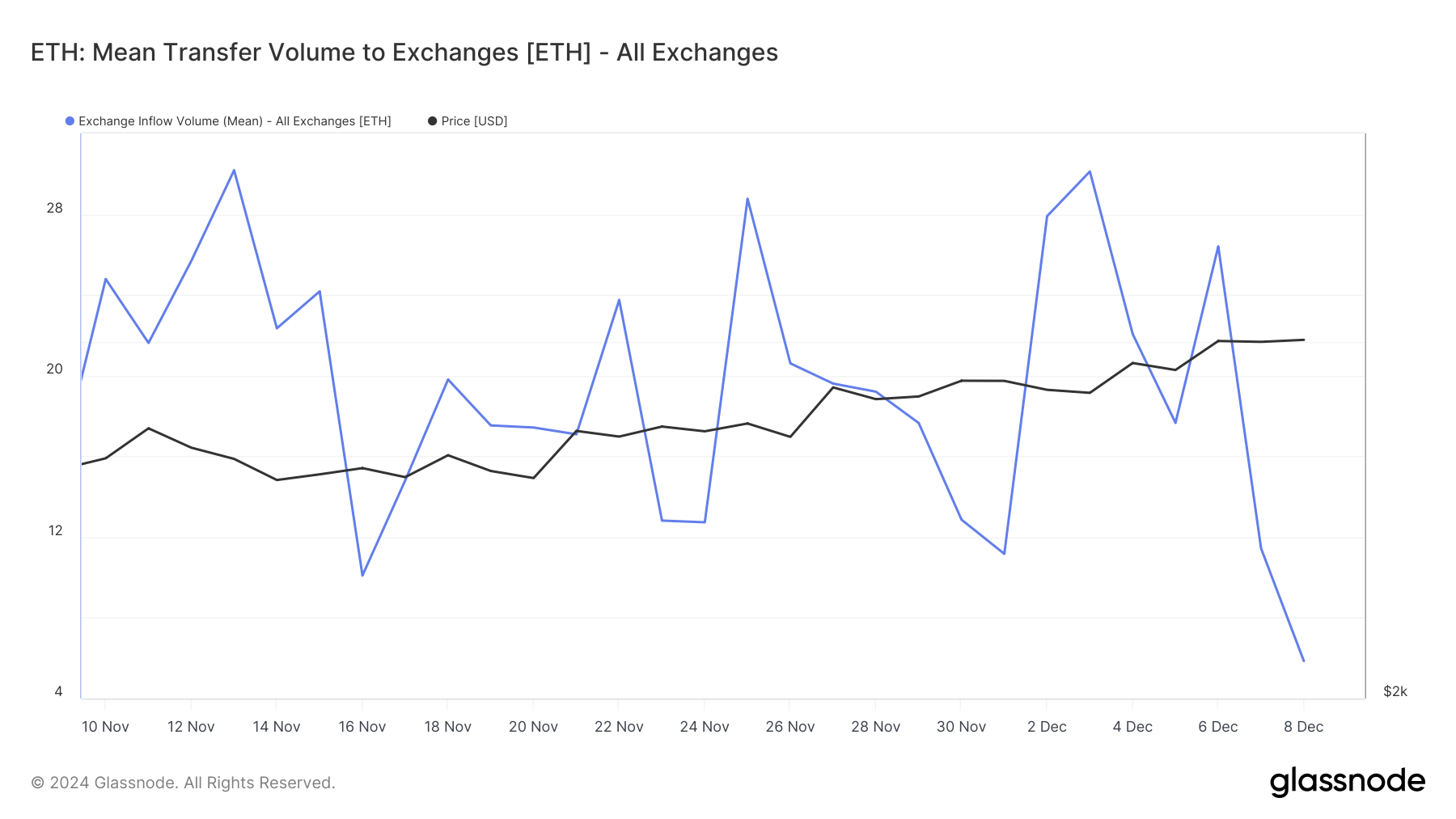

Beyond that, Glassnode data showed that Ethereum exchange inflow volume has dropped to the lowest level in over a month. When exchange inflow rises, it means holders are willing to sell.

However, since it decreased, it indicates that many ETH holders have decided not to liquidate their assets, which is bullish for the price.

Ethereum Exchange Inflow. Source: Glassnode

ETH Price Prediction: $4,200 Target Looms

The ETH/USD 3-day chart shows that the cryptocurrency traded within a descending triangle between June and November. A descending triangle is a commonly recognized bearish chart pattern defined by a falling trendline connecting a series of progressively lower highs and aflatter trendline forms along a consistent price level, acting as support as the asset price tests it multiple times.

The descending triangle typically signifies that sellers are gaining control, potentially leading to a breakdown below the support line. However, ETH’s price has broken out of this channel, suggesting that the cryptocurrency’s value might trade higher.

Ethereum 3-Day Analysis. Source: TradingView

If this trend continues, then Ethereum could climb above $4,096 and hit $4,200 in the short term. However, if selling pressure increases and the Ethereum TVL drops, this prediction might not come to pass. In that scenario, ETH might decrease to $3,175.

Read the full article here