While the increasing anticipation for a potential crypto bull run, CryptoQuant has analyzed the leverage levels on diverse centralized crypto exchanges. CryptoQuant’s analysis dealing with the CEX leverage levels highlights default risk, liquidity, and the extent of support that the crypto reserves support for the trading of perpetual futures amidst the approach bull run. In its recent social media post, the on-chain analytics provider examined this market scenario.

Centralized Exchange Leverage Risk on the Midst of the Upcoming Bull Run

We assess the leverage levels of various crypto exchanges to evaluate their liquidity, default risk, and the extent to which their perpetual futures trading activity is backed by their crypto reserves.

Our… pic.twitter.com/NAadJSAlVT

— CryptoQuant.com (@cryptoquant_com) December 21, 2024

Binance Takes Prominent Position among CEXs for Maintaining Resilient Reserves

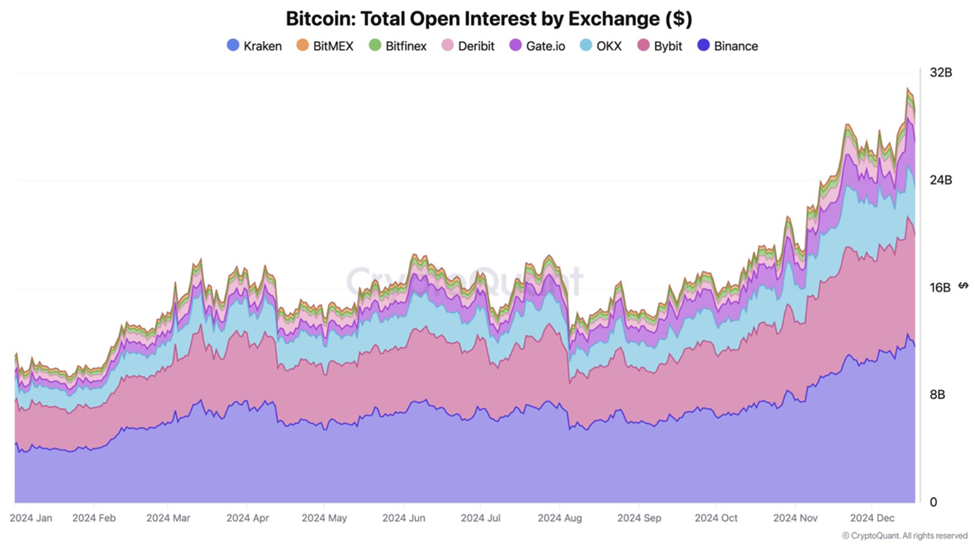

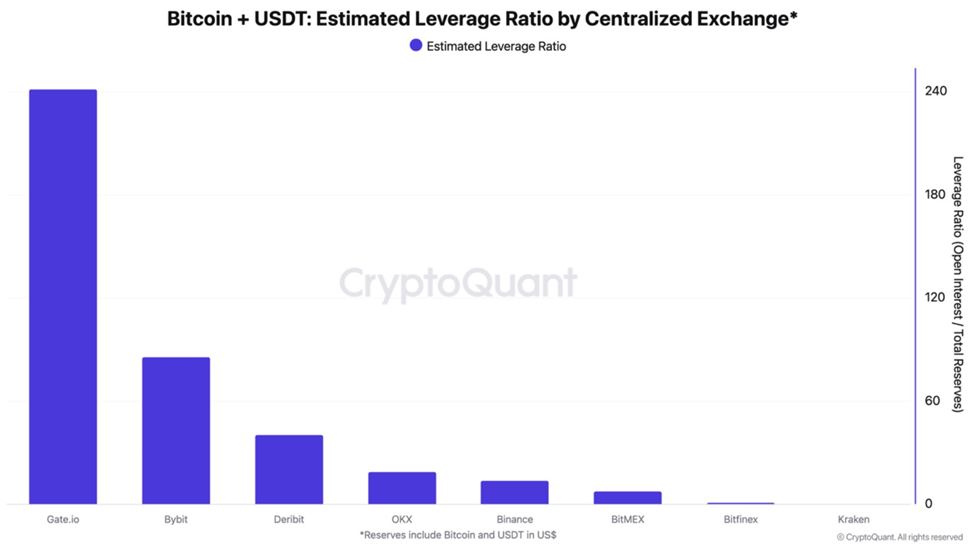

CryptoQuant mentioned that its analysis takes into account the leverage ratio to measure the leverage that the traders employ. In addition to this, it also gauges the each crypto exchange’s financial health. In this respect, an increased leverage ratio potentially denotes likely liquidity risks. Binance dominates the major exchanges for maintaining resilient reserves irrespective of the massive growth in open interest during 2024.

Additionally, Binance’s reserves in $BTC, $ETH, and $USDT conveniently surpassed the open interest thereof. The crypto exchange additionally reported the least as well as most steady leverage ratio in comparison with the top exchanges. In December last year, it saw a ratio of up to 12.8 which reportedly increased to 13.5 this December. This stability combines with a notable 2.6x enhancement in Bitcoin’s open interest that rose to $11.64B from just $4.45B. Hence, this overall combination underscores the crypto exchange’s potential to tackle market liquidity along with the following liquidations.

Deribit, Bybit, and Gate.io’s Open Interest Surpasses or Approaches the Reserves

On the other hand, Deribit, Bybit, Gate.io, and other such exchanges have the peak leverage ratios at 32, 86, and 106, respectively. The respective figures display the open interest surpasses or nears the reserves with analogous patterns recorded for Ethereum. Keeping this in view, CryptoQuant deems observing exchange leverage crucial based on the key role of high leverage in the FTX crash in 2022’s November.

Read the full article here