- Ethereum bearish pressure strengthened following recent selling activity across long-term and short-term holders.

- Whales have been weathering the selling pressure after increasing their holdings by 410K ETH.

- ETH could decline toward the $3,000 psychological level if it breaches the $3,250 support.

Ethereum (ETH) is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Ethereum investors step up selling pressure, whales buy the dip

Ethereum has been witnessing a surge in bearish sentiment after experiencing double-digit losses last week.

ETH’s Weighted Sentiment, which measures the social volume of an asset and its overall sentiment, has remained below its neutral level, indicating high negative sentiment.

Ethereum Weighted Sentiment. Source: Santiment

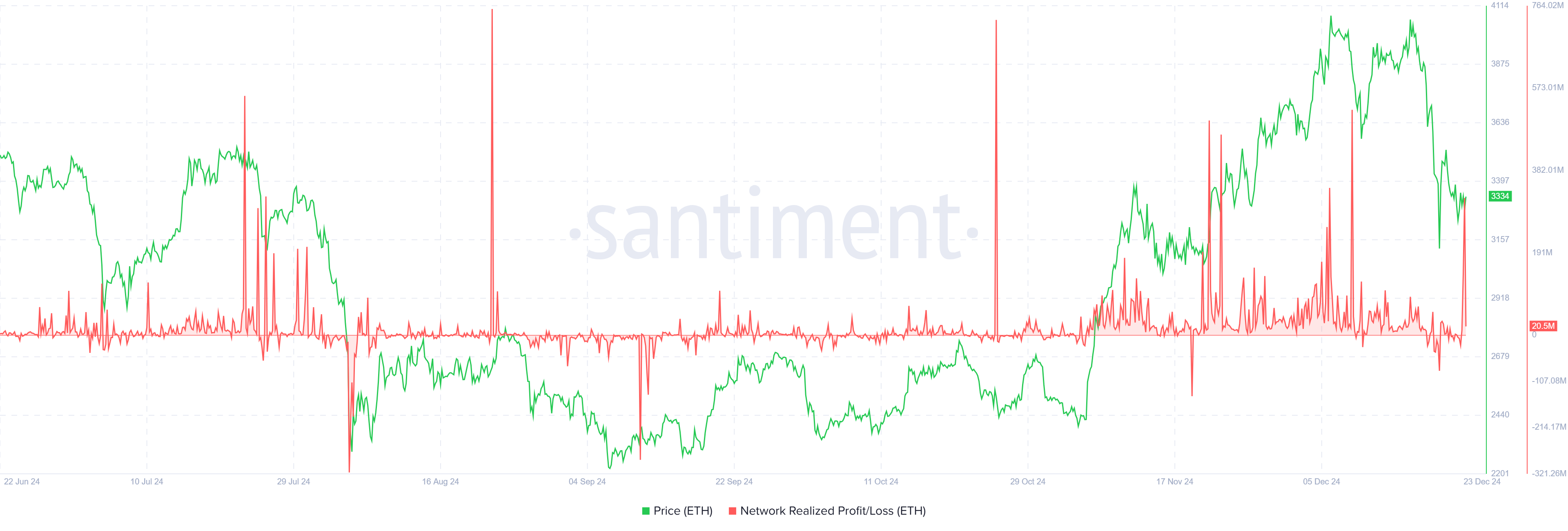

The bearish sentiment is also evident in the Network Realized Profit/Loss metric, which shows that most investors have been selling off their assets to book profits and losses in the past 24 hours. Notably, investors have realized over $340 million in profits and $30 million in losses.

Ethereum Network Realized Profit/Loss. Source: Santiment

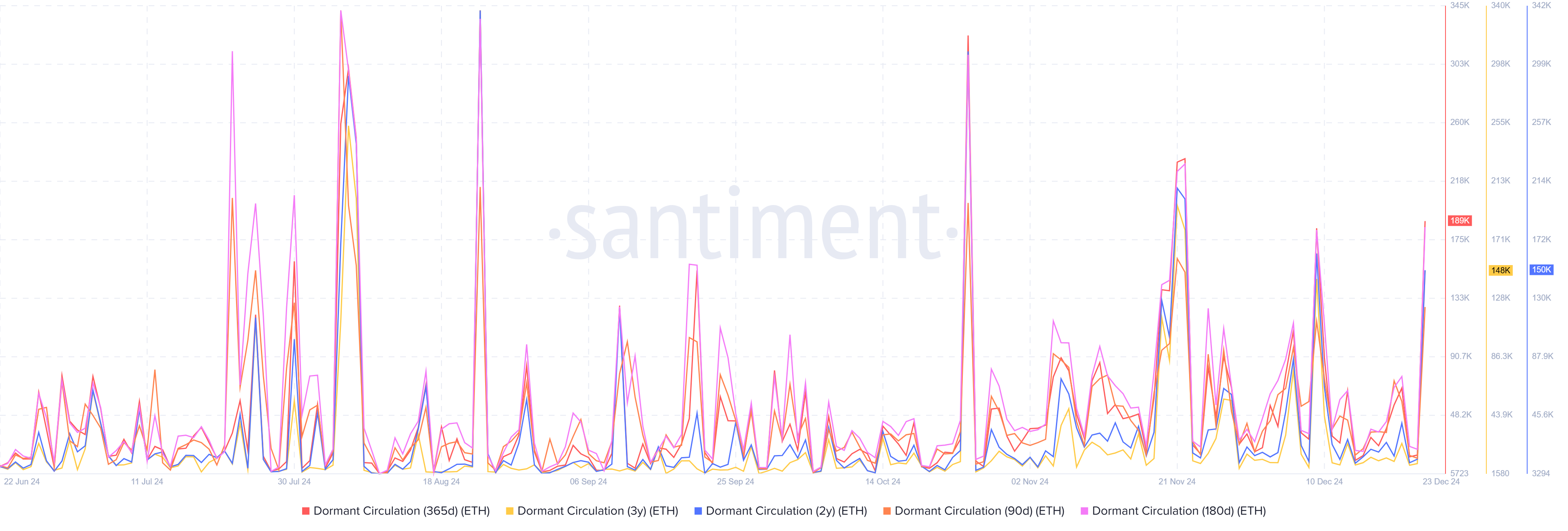

The Dormant Circulation metric reveals the recent selling activity is from both long-term and short-term holders, as evidenced by spikes in the chart below. This indicates that the bearish trend is gradually gaining strength.

Ethereum Dormant Circulation. Source: Santiment

Despite the selling activity, Ethereum exchange reserve has maintained a downtrend, with investors withdrawing.

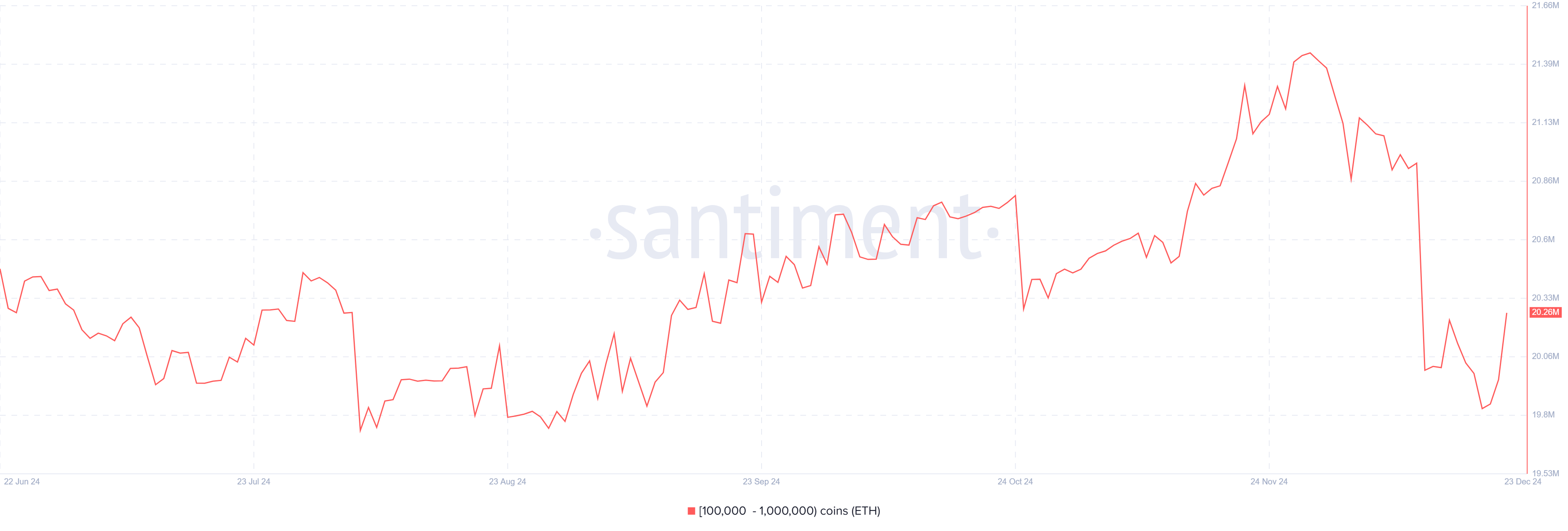

Most of these withdrawals came from whales holding between 100K to 1M ETH. This class of whales ended a two-week consistent selling activity after they increased their holdings by 410K ETH in the past two days. The move signifies confidence in a potential uptrend resumption after the holidays.

ETH Whale Holdings (100K to 1M ETH). Source: Santiment

Meanwhile, US spot Ethereum ETFs managed to maintain their weekly net inflow streak even after seeing outflows on Thursday and Friday. The products recorded net inflows of $62.7 million last week, stretching their inflow streak to four consecutive weeks, per Coinglass data.

Ethereum Price Forecast: ETH could find support at $3,000 psychological level if it declines below $3,250

After extending its decline below the 50-day Simple Moving Average (SMA), ETH hovered within the $3,250 support and $3,423 resistance levels over the weekend as prices appear to be stabilizing due to the holiday season.

ETH/USDT daily chart

The $3,250 level is crucial even as prices move range bound. ETH could decline toward the $3,000 psychological level if it breaks the $3,250 support.

The $3,000 target is obtained by measuring the height of a double top pattern that ETH posted within the first two weeks of December, down to its neckline support level. The 100-day and 200-day SMAs could strengthen the $3,000 psychological level as a key support zone.

However, a further breach of the $3,000 support level will validate a rounding top pattern that could send ETH toward the $2,000 psychological level. The $2,817 key support level could help cushion such a decline.

On the way up, ETH has to recover the $3,550 support level with a high volume move to resume its uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) indicators are below their neutral levels, indicating the market is tilted toward bearish momentum.

A daily candlestick close above $4,093 will invalidate the bearish thesis.

Read the full article here