ETH price movement in the 2-week chart showed an inverse head and shoulders pattern, suggesting a potential bullish reversal.

Starting from the low of around $1,985, Ethereum’s price formed the “head” of the pattern in October, rallying to the neckline near $4,000 before pulling back to form the “right shoulder” at a higher low, indicating increasing market confidence.

ETH Price Action Intensifies

The price oscillated around $3,960, approaching the critical neckline.

This pattern was significant because a breakout above the neckline at $4K could confirm the pattern, potentially propelling Ethereum towards $7,250.

This scenario remains conditional on continued buying pressure and favorable market conditions.

ETHUSD weekly chart | Source: Trader Tardigrade/X

The expected bullish outcome, however, must consider the $7,250 target as a pivotal resistance level, where a convergence of historical sell-offs could challenge further gains.

– Advertisement –

If ETH sustains above this neckline, it could signal a strong buyer-dominated market phase, supporting the climb to the projected high.

This analysis positions Ethereum advantageously if the market maintains its current dynamics, aligning with broader bullish sentiment in the crypto market.

ETH/BTC was also breaking out on the intraday timeframe marking a potential onset of an explosive Altseason.

This could propel ETH toward and potentially beyond $7K. Ethereum’s price breaking out of a consolidation pattern could be a bullish signal for its next price targets.

With RSI on the rise, currently positioned above the midline, it suggested increasing buying momentum.

ETHBTC 8-hour chart | Source: Trading View

The resistance levels to watch were around 0.03800 BTC, with a strong support established near 0.03285 BTC.

These movements indicate a shift from bearish to bullish sentiment, possibly leading Ethereum to reach new heights against Bitcoin.

This scenario was supported by the price action where ETH has shown resilience and strength against BTC, hinting at a larger market shift favoring altcoins.

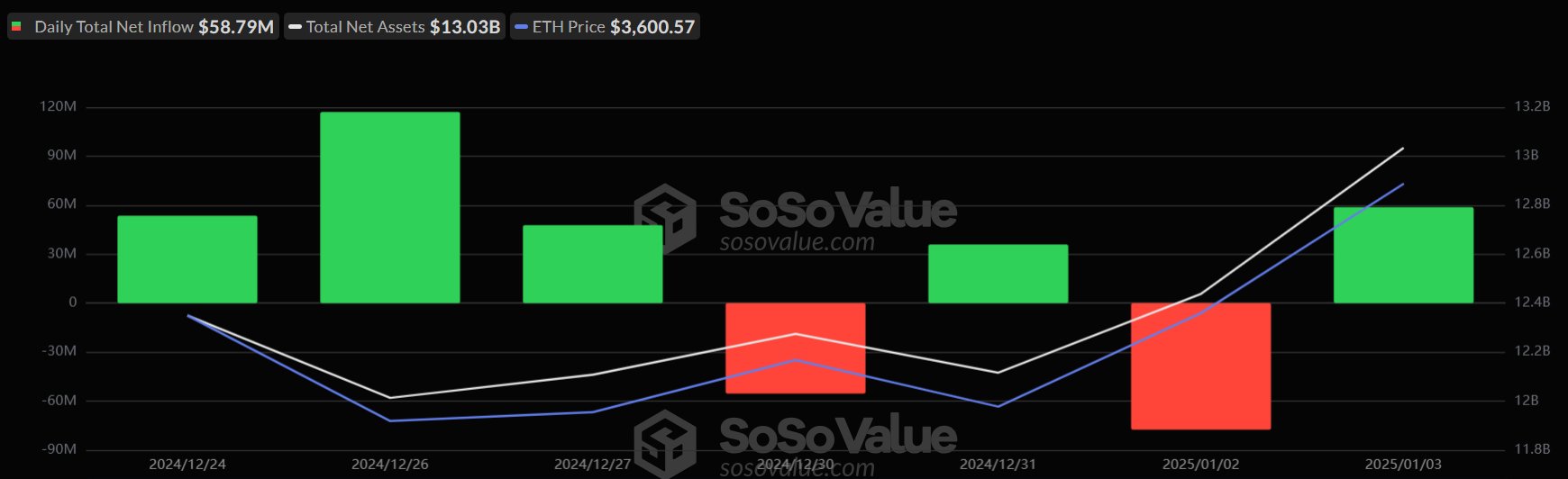

Total Net Inflow of Ethereum Spot ETF

A look into Ethereum ETF showed significant net inflows on January 3, totaling $58.79 million.

This spike, largely due to BlackRock’s ETF ETHA, which alone contributed $33.88 million, elevated the ETHA’s cumulative inflow to $3.559 billion.

This influx likely enhanced Ethereum’s market strength, pushing its price to $3,600.57 on that day.

ETH daily total net inflow | Source: Soso Value

This could signal growing institutional interest in Ethereum, potentially stabilizing and driving the price further.

Future implications hinge on sustained inflow levels; if they remain robust, Ethereum could see continued upward momentum.

However, any reversal in these inflows might undermine this bullish outlook, indicating a need for cautious optimism in trading strategies.

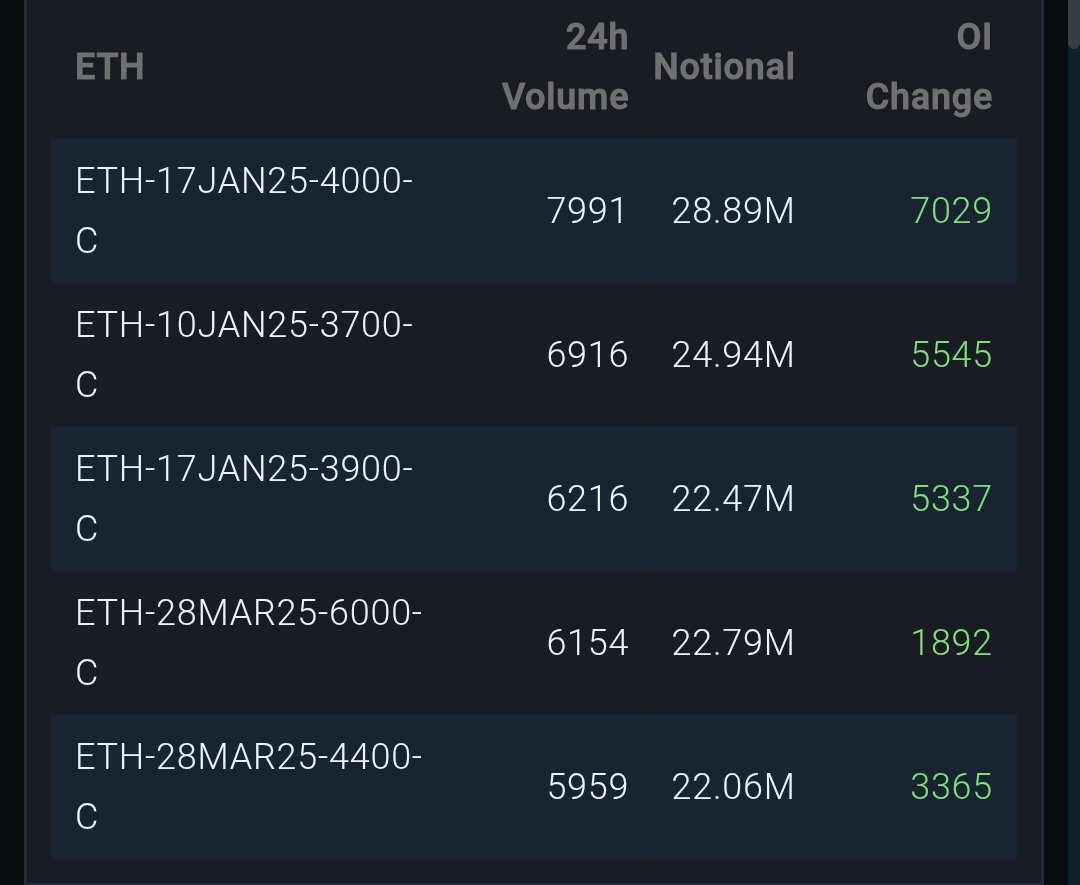

Ethereum Options Market Update

The ETH options market exhibited strong bullish sentiment, especially in the call positions at the $3,700 and $4,000 strike prices, reflecting short-term confidence.

The trading volume and open interest suggested a significant anticipation of price movement beyond these levels.

Notably, call positions for $6K strike price for late March indicated that some investors were positioning for a substantial upward shift in ETH’s price in the longer term.

ETH 24-hour call options | Source: X

The potential for ETH to reach or even surpass $7,000 was supported by the underlying market dynamics.

Investors’ strategic placement in higher strike prices aligned with a broader expectation of bullish momentum driven by positive market influences.

This analysis suggested a strong foundation for growth, considering both current trading behaviors and historical responses to similar setups in the options market.

If this bullish trend continues, bolstered by consistent market inflows and trading patterns, ETH could see significant gains, aiming towards $7K.

Read the full article here