The Financial Services and Markets Authority (FSMA) publishes a dashboard providing statistics and trends on investment fraud. The second semester of 2024 report highlights that cryptocurrency scams and fraudulent trading platforms continue to account for about half of all reported fraud cases.

FSMA Receives 2,621 Fraud Reports in 2024

In the second half of 2024, Belgian consumers reported losses of €15.9 million due to fraud, with over €12.5 million attributed to fraudulent trading platforms, primarily related to cryptocurrency investments. Another €1.6 million was lost to fraudulent portfolio management offers.

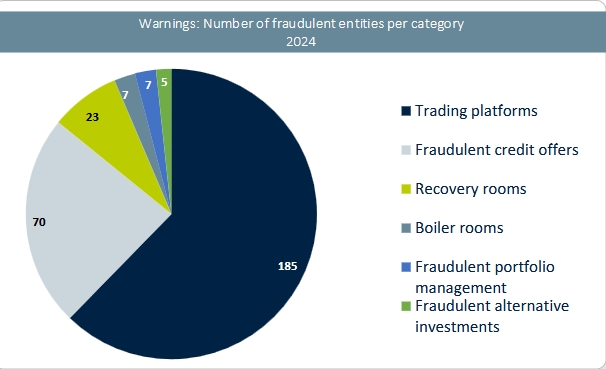

In 2024, the FSMA received 2,621 reports of unauthorized activities, a 20% increase compared to 2023. The FSMA also issued 16 warnings concerning 297 fraudulent entities and 396 websites throughout the year.

FSMA Warns Against Recovery Room Fraud

A rising concern is “recovery room” fraud, where victims of initial investment fraud are targeted again. Fraudsters contact these victims offering services to recover lost funds, often asking for upfront payments. The FSMA warns against paying any fees to recover funds, sharing personal information, or granting remote access to devices.

These fraudsters may operate under the guise of law firms or financial authorities and often use fake documents, websites, and email addresses to deceive victims. The FSMA reported 25 such scams in the last six months, noting a 57% increase in recovery room fraud cases from 2023 to 2024. The FSMA has alerted the public and worked with judicial authorities and web hosts to combat these scams.

Prop Trading Firms Target Consumers, FSMA Warns

Meanwhile, the FSMA has issued a warning about the risks of prop trading firms, which engage in proprietary trading and may exploit consumers’ financial naivety, as reported by Finance Magnates.

These firms offer consumers the opportunity to trade various financial products, including shares, commodities, and forex, without using their own capital. However, the firms often require consumers to pay for expensive courses, designed to filter out less committed participants while generating revenue.

Many consumers pay for multiple courses without accessing real trading opportunities. Upon completion, consumers receive a certificate and engage in simulated trading on demo accounts, with no control over actual trades or potential earnings.

Read the full article here