Ethereum has recently displayed notable volatility, witnessing a 10% surge attributed to increased market activity surrounding President Trump’s inauguration.

Nevertheless, the asset faces a pivotal resistance at $3.5K, and the upcoming price action will likely define its next trend.

Technical Analysis

By Shayan

The Daily Chart

ETH encountered significant buying interest near the 100-day moving average at the $3.2K mark, propelling the price upward by 10%. This heightened buying pressure has brought the asset closer to a critical resistance region at $3.5K, which aligns with the bullish flag’s upper boundary.

If this momentum persists, Ethereum is likely to break above the $3.5K threshold, paving the way for a fresh surge toward the $4K resistance zone. However, the short-term price action will be critical in determining the market’s direction, with elevated volatility expected.

The 4-Hour Chart

On the 4-hour timeframe, ETH’s volatility is evident as the price fluctuates near the 0.5-0.618 Fibonacci retracement levels. This range, bounded by $3.2K as support and $3.5K as resistance, highlights the ongoing battle between buyers and sellers. The current market structure shows optimism, with the potential for a bullish breakout gaining momentum.

If buyers succeed, Ethereum could embark on a sustained rally toward $4K. However, the increased volatility and potential liquidations necessitate careful risk management, as a rejection at $3.5K could lead to short-term retracements.

Onchain Analysis

By Shayan

While Ethereum has been consolidating within a tight range of $3.2K-$3.5K, market participants are considering the likelihood of a bullish breakout following President Trump’s inauguration.

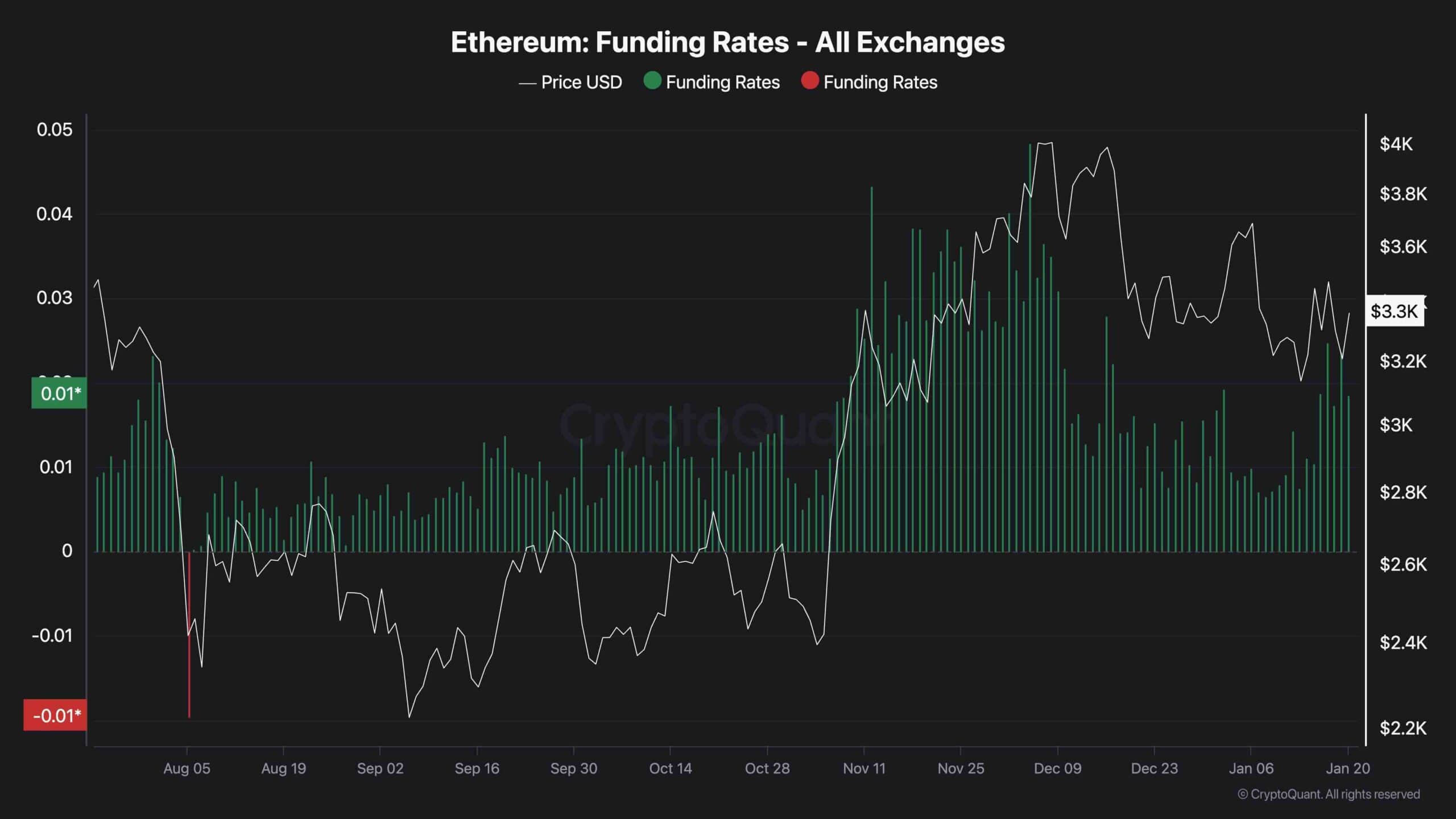

The funding rates metric, a key indicator of market sentiment, has shown declining values recently, suggesting a reduction in long positions and fading bullish sentiment. However, the metric has sharply increased most recently, hinting at growing bullish momentum in the perpetual markets.

As Ethereum approaches the $3.5K resistance level, the presence of notable supply at this juncture underscores the necessity of sustained bullish momentum. For a decisive breakout to occur, the funding rates metric must rise further, reflecting heightened market optimism and increased long positions.

A break above $3.5K remains contingent on stronger bullish sentiment in the futures market. The funding rates metric will play a pivotal role in determining whether Ethereum can overcome the $3.5K threshold, making the upcoming market action crucial.

Read the full article here