A CoinLedger study discovered that cryptocurrency portfolios increased in value by an average of $2,804 this year as the industry raced toward its previous 2021 peak.

The crypto tax and portfolio management software provider analyzed a database of over 500,000 investors to map out popular tokens and solutions being leveraged amid a bull run underpinned by institutional interest and retail demand.

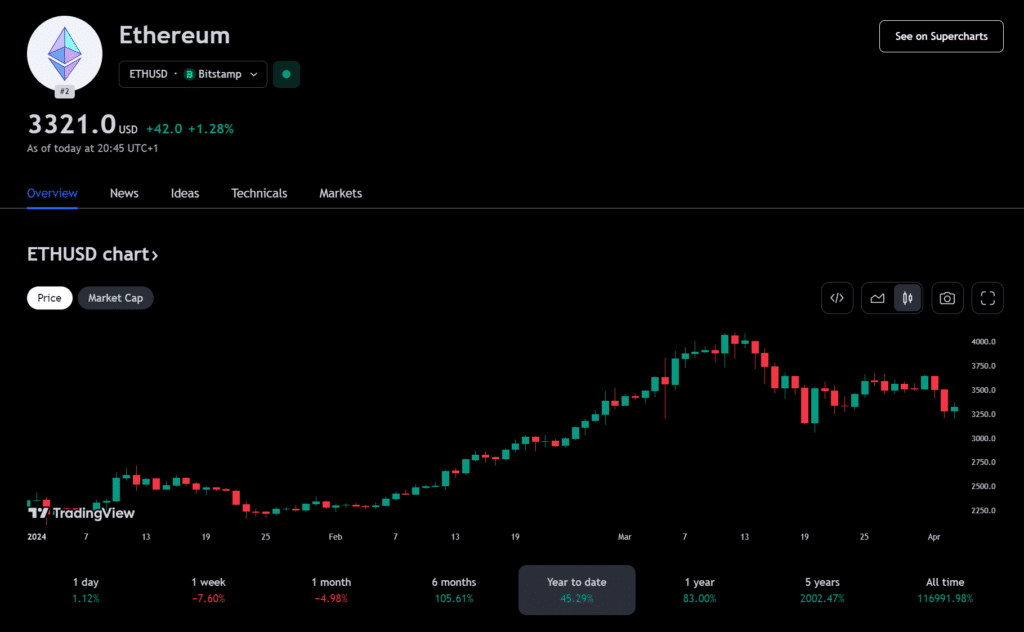

According to CoinLedger, users hold the most unrealized gains primarily in crypto’s top two digital assets: Bitcoin (BTC) and Ethereum (ETH). The two tokens have grown over 57% and 45% year-to-date (YTD) per TradingView.

BTC YTD chart | Source: TradingView

ETH YTD chart | Source: TradingView

Cryptocurrencies like Solana (SOL), Cardano (ADA), Polygon (MATIC), and BNB also ranked among the top six tokens for unrealized gains in 2024. SOL has recently enjoyed a renaissance thanks to liquidity flowing into meme coins on Solana’s ecosystem. BTC, ETH, and BNB are also the longest-held cryptocurrencies by investors.

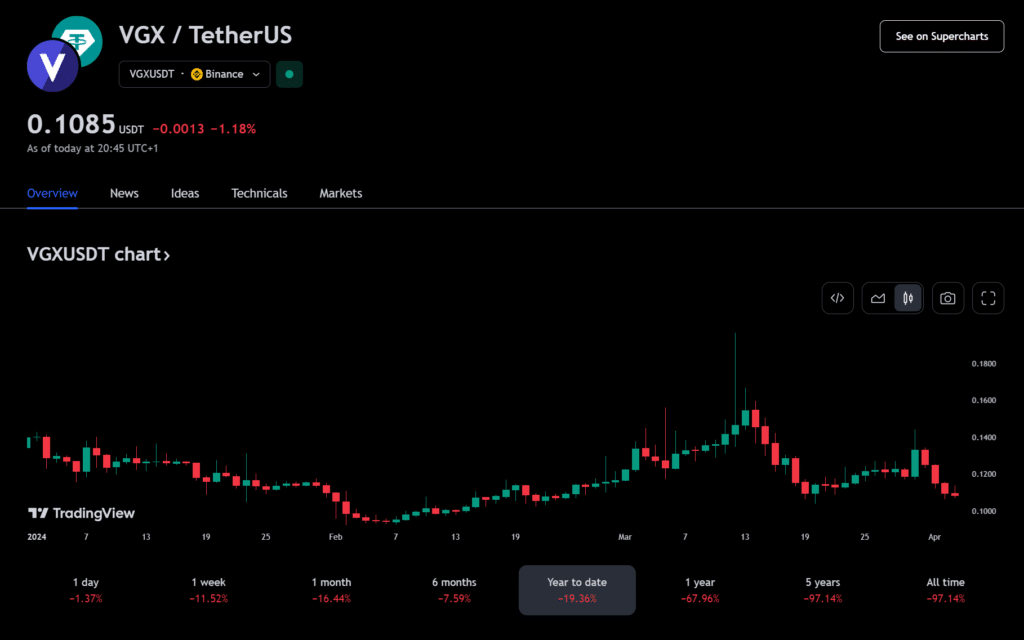

The native token of the bankrupt Voyager exchange (VGX) held the top spot for crypto’s largest losses. VGX has lost over 19% YTD. CoinLedger analysts added that other digital currencies with considerable losses in 2024 include Chainlink (LINK), Luna (LUNC), Hedera (HBAR), and Tezos (XTZ).

VGX YTD chart | Source: TradingView

You might also like: The Bitcoin Ponzi scheme: unveiling the truth

Most popular exchanges, wallets

In crypto, exchanges, and wallets are standard tools that nearly every user interacts with at some point. Whether centralized or decentralized exchanges, custodial or non-custodial wallets, these solutions allow participants to trade digital assets.

CoinLedger’s reports focused on centralized exchanges and non-custodial wallets, revealing that Binance was the most used trading venue and users mostly preferred MetaMask for crypto storage.

Ledger wallet, Coinbase wallet, Trust wallet, and Phantom were popular options for safeguarding digital assets, while Coinbase, KuCoin, Crypto.com, and Kraken ranked after Binance.

CoinLedger CEO David Kemmerer said the year has ushered in renewed interest in Bitcoin and cryptocurrencies after the industry weathered heightened skepticism following marquee crashes in 2022.

Though the bankruptcies of exchanges like FTX and Voyager were major setbacks, investors have seen considerable gains in 2024 due to the resurgence of cryptocurrencies like Bitcoin and Ethereum. The cryptocurrency market is thriving once again.

David Kemmerer, CoinLedger CEO

Read more: The safest ways to buy crypto

Read the full article here