This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

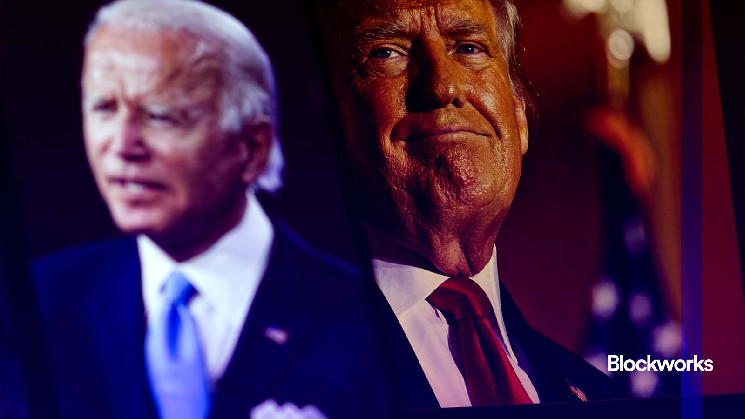

President Trump yesterday issued his first crypto executive order.

The news and ensuing chaos on Crypto Twitter reminded me of Biden’s crypto executive order, published in March 2022.

Let’s take a trip down memory lane. Here’s what Trump’s report says, and how it differs from Biden’s plans:

On CBDCs

Trump’s order prohibits federal agencies from establishing, issuing or promoting central bank digital currencies. It calls for any ongoing projects creating a CBDC to be “immediately terminated.”

CBDCs “threaten the stability of the financial system, individual privacy and the sovereignty of the United States,” Trump’s order reads.

Biden was less resolute on the topic. His administration struck a bit of a middle ground, saying they saw “merit” to a US CBDC but also acknowledged “potential risks and downsides to consider.” In the end, Biden directed agencies to create a report on the future of money and payment systems.

We eventually got this report, which, like Biden’s executive order, said little definitively. The Treasury recommended “advancing” work on a CBDC and “prioritizing” improvements to cross-border payments. Spoiler alert, a CBDC was never developed.

On “protection”

When it comes to security, Biden and Trump hold very different views on how to approach digital assets.

Biden’s order focused on protecting consumers from the risks associated with investing and engaging with crypto. He also highlighted national security concerns, calling digital assets a threat to financial stability and a tool ripe for abuse from illicit actors.

Trump’s EO also includes the term “protection,” but his administration is concerned with maintaining US dollar dominance and shielding citizens from the dangers of CBDCs.

The Working Group

Trump’s order established a Working Group on Digital Asset Markets, to be led by “crypto czar” David Sacks.

Included in this group are the chairs of the CFTC and SEC, attorney general and secretaries of the Treasury and Homeland Security, among other cabinet members.

Trump’s Working Group “shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the federal government through its law enforcement efforts.”

As one source on the Hill told me last night, this is a long way of saying the “strategic bitcoin reserve is going to live in bureaucratic purgatory for a long time, maybe forever.”

Biden did not create any such working group, or any crypto-specific advisory council. But he did task the President’s Working Group on Financial Markets to create a report outlining the various risks of digital assets.

This report noted that crypto can pose a threat to financial stability, and it recommended Congress pass legislation designating rulemaking authority to appropriate agencies (something like a market structure bill, for example.)

Spoiler: This, too, has lived in political limbo for years.

Only time will tell if this latest crypto executive order inspires more progress than Biden’s.

But it’s worth noting that the industry excitement around Trump’s EO bodes well. Never underestimate what some well-funded lobbyists can get done on Capitol Hill.

Read the full article here