The cryptocurrency market once again demonstrated its heightened volatility, with a sharp 7.9% decline in the last 24 hours, bringing the global market cap to $3.51 trillion.

This selloff was triggered by the emergence of the startup DeepSeek and its free AI offering, combined with growing unease ahead of this week’s Federal Reserve meeting.

Despite the prevailing bearish sentiment, a select group of altcoins is leveraging strong fundamentals and market momentum to position themselves as potential contenders to surpass the $5 billion market cap threshold in the first quarter of 2025.

APTOS

Aptos (APT), currently trading at $7.33 with a market cap of $4.2 billion, would need to climb to approximately $8.73 to reach a $5 billion valuation, representing a 19% increase.

Despite recent challenges, including a 10.72% drop in the past 24 hours and a 14% decline over the last week, Aptos continues to showcase remarkable ecosystem growth.

Active addresses have surged from fewer than 100,000 to over 1.3 million within a year, according to data from The Block, highlighting the platform’s increasing adoption.

The derivatives market data highlights a surge in trading volume, up 185.59% to $470.12 million, though open interest fell by 7.43% to $195.63 million.

Notably, the Binance APT/USDT long/short ratio (accounts) stands at 3.1999, signaling strong long interest, while top trader positions show a 1.5053 long/short ratio. However, liquidation data indicates $4.65 million in 24-hour rekt positions, with $4.56 million attributed to longs, reflecting heightened volatility.

Technically, Aptos faces headwinds as it appears to be forming a head-and-shoulders pattern, which could lead to a downside target of $4.30 if bearish momentum persists. However, a sustained close above $10.50 could invalidate this bearish outlook and pave the way for further growth.

If Aptos continues to expand its active user base, increase TVL, and attract developer interest while overcoming its current bearish technical signals, a $5 billion market cap in the near term remains a realistic target.

KASPA

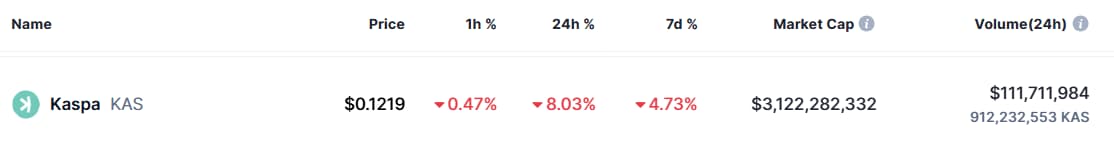

Kaspa (KAS), trading at $0.1219 with a market cap of $3.12 billion, has been consolidating between $0.12 and $0.16 for over a month, with a significant breakout anticipated if it surpasses $0.19.

Despite recent declines of 8.03% in the past 24 hours and 4.73% over the week, market data highlights growing interest and bullish momentum around the cryptocurrency.

Derivatives trading data reinforces this optimistic outlook, with trading volume surging by 269.79% to $103.72 million, signaling heightened trader activity.

The Binance KAS/USDT long/short ratio of 3.9603 reflects strong confidence in long positions, while the top trader long/short ratio stands at 3.8833 for accounts and 1.2758 for positions.

Even with a 5.70% dip in open interest to $175.84 million, minimal short liquidations point to sustained confidence among traders betting on an upward trajectory.

With its growing momentum and derivatives-driven speculation, Kaspa is well-positioned to achieve a $5 billion market cap by 2025.

Monitoring key price levels, trading volumes, and ecosystem developments for both assets will be critical for maximizing gains as they position themselves for their next phase of growth in the volatile digital asset space.

Featured image via Shutterstock

Read the full article here