The U.S. Securities and Exchange Commission took the first step toward allowing new crypto exchange-traded funds (ETFs) tracking the price of assets like Litecoin and Solana, as well as new ways of redeeming funds from existing crypto ETFs on Thursday, while companies took another step toward launching XRP ETFs in a further sign of the new crypto-friendlier administration at the agency.

Earlier Thursday, the SEC acknowledged a filing by Grayscale for a Solana (SOL) ETF, meaning that the Commission now has until October to approve or deny the application.

The SEC had previously refused to acknowledge several applications for ETFs tracking SOL and had told Cboe to take down its previously uploaded 19b-4s for those ETFs.

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence said the acknowledgement was “notable,” given that it’s the first time an ETF filing for a cryptocurrency that was previously deemed a “security” has been acknowledged by the SEC.

“We are now in new territory, albeit just a baby step, but seemingly the direct result of leadership change,” he wrote in a post on X.

The SEC also acknowledged a series of other crypto ETF-related applications on Thursday, including Grayscale’s filing for a Litecoin (LTC) ETF as well as BlackRock’s proposal to to allow for in-kind creations & redemptions on iShares Bitcoin ETF.

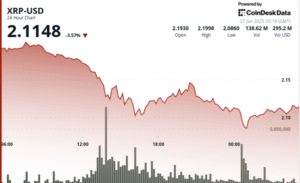

During U.S. evening hours, Cboe filed to list and trade shares of four separate ETFs looking to track the price of XRP (XRP).

The exchange filed four 19b-4 documents with the SEC on Thursday, for the prospective ETFs of Bitwise, 21Shares, Canary Capital, and WisdomTree.

All four issuers had previously filed S-1s, which are the first step in bringing an ETF on the market.

While Thursday’s actions don’t necessarily guarantee that the SEC will approve all of these products, they do show that companies feel more comfortable with expanding beyond just Bitcoin and Ether ETF products with the current SEC administration.

Read the full article here