A sharp rise in stablecoin supply across major blockchain networks has been recorded over the past week. Market sentiment is signaling heightened liquidity and trading activity. Data from market tracking platforms shows that Ethereum and Tron saw a combined $4.5b increase in USDT and USDC stablecoins.

According to blockchain analytics firm Lookonchain, the Ethereum network saw an inflow of $2.43B in USDC and USDT from Feb 3rd to 10th. On the other hand, Tron recorded a $2.08B increase in the same period. Solana and Avalanche also recorded $598M and $411M in inflows.

Solana’s stablecoin supply had risen by $640M during that period.

Stablecoin supply record highs continue

On Ethereum, the trading volume for ETH/USDT pairs surged by 16% over the past week, with an average daily trading volume of over $1 billion as of February 10, 2025, according to CoinGecko. Similarly, Tron’s TRX/USDT pair saw a 13.4% increase in trading volume, reaching an average daily volume of $800 million on the same date.

This surge in stablecoin supply has contributed to lower slippage for large trades, making the market more attractive to institutional investors. Additionally, the growing stablecoin capitalization has coincided with reduced volatility in major cryptocurrencies.

A research from CCData released in late January noted that the total market capitalization of all stablecoins has now surpassed $200 billion, reflecting an increase of $37 billion since Donald Trump’s victory in the US presidential election in November 2024.

Despite the rising market cap, the dominance of Tether’s USDT has slightly decreased. CCData also shows that USDT’s market share fell from 67.5% to 64.9% last month. This marks its lowest level since May 2023.

Tether has been having regulatory troubles since the start of the year, and many exchanges in the EU have delisted USDT from their trading pairs to comply with the Markets in Crypto Assets law (MiCA).

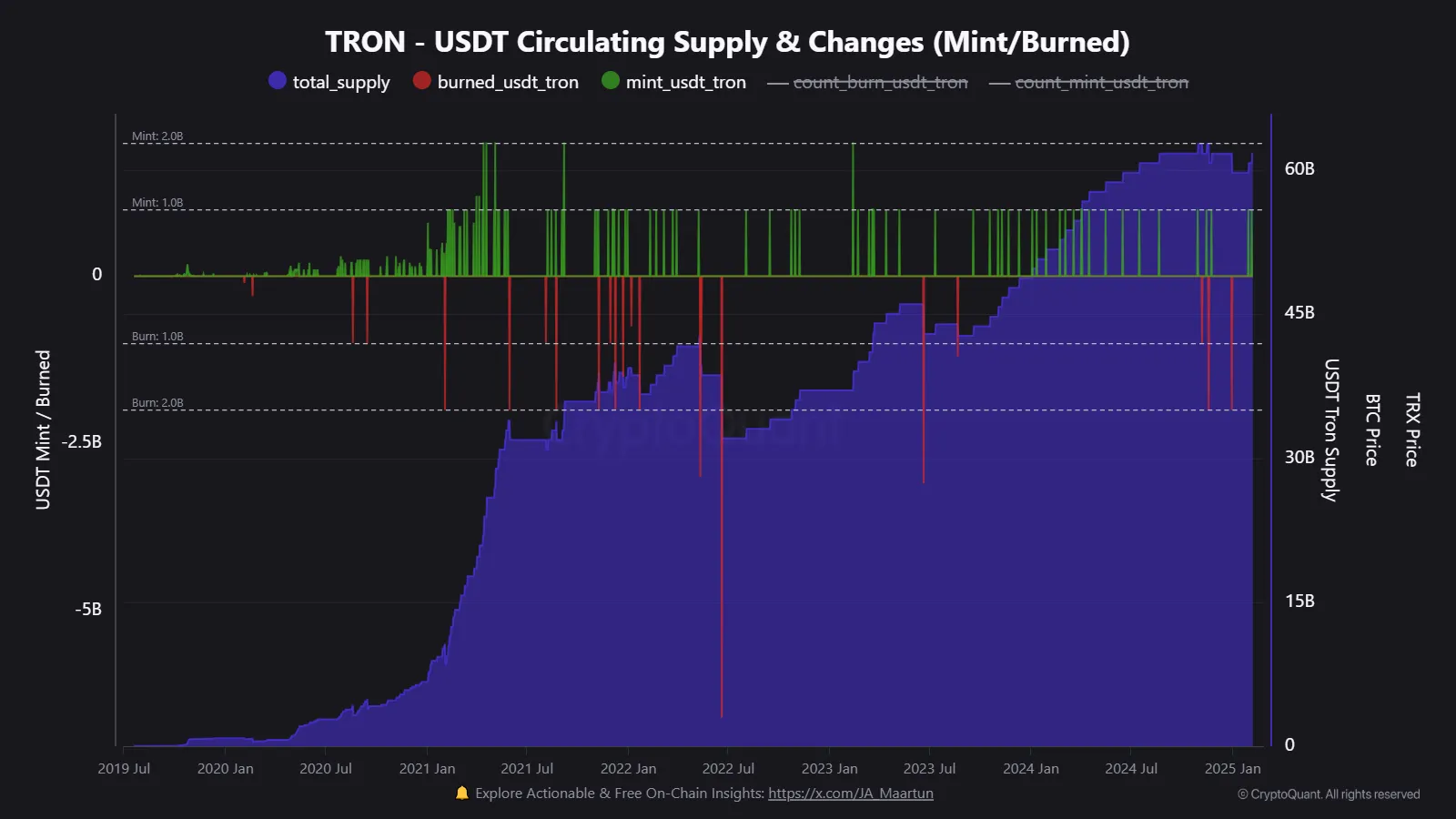

USDT nears all-time high supply on Tron

Last Friday, a CryptoQuant contributor noted that USDT balances on the Tron network are nearing an all-time high following two separate $1 billion mints in the past week. In the chart shared by the analyst, Tron’s total USDT supply had reached $61.7 billion.

The surge in USDT supply on Tron points to increasing demand, either for stablecoin usage or as broader market liquidity. Large mints of this scale are often associated with heightened trading activity and increased participation from institutional investors.

Read the full article here