According to recent data from CryptoQuant, Ethereum (ETH) reserves on centralized cryptocurrency exchanges have dropped to a nine-year low. Experts suggest that this dwindling ETH supply could indicate an impending ‘supply shock,’ potentially fuelling a significant rally in the cryptocurrency.

Ethereum Reserves At 9-Year Low

Ethereum, the second-largest cryptocurrency by market cap, continues to trade within the mid-$2,000 range, sitting at $2,721 at the time of writing. Unlike Bitcoin (BTC), ETH has had a relatively quiet 2024, struggling to break past its all-time high (ATH) of $4,878, recorded in November 2021.

This lackluster price action has contributed to waning investor confidence in ETH. However, the digital asset recently managed to defend the critical $2,380-$2,460 demand zone, rekindling bullish hopes for a potential breakout above the stubborn $3,000 resistance level.

More notably, ETH reserves on centralized exchanges continue to plummet, which could lead to a supply shock – a scenario where demand for the asset surpasses its liquid supply. If this materializes, ETH may experience rapid price appreciation.

For the uninitiated, a supply shock in the crypto industry occurs when the demand for the underlying digital asset exceeds its liquid supply. As a result, the underlying asset – ETH, in this case – may experience sharp price appreciation in a short time.

As of today, ETH reserves on centralized crypto exchanges have fallen to 18.95 million, a level last seen in July 2016. Notably, ETH was trading at $14 at the time.

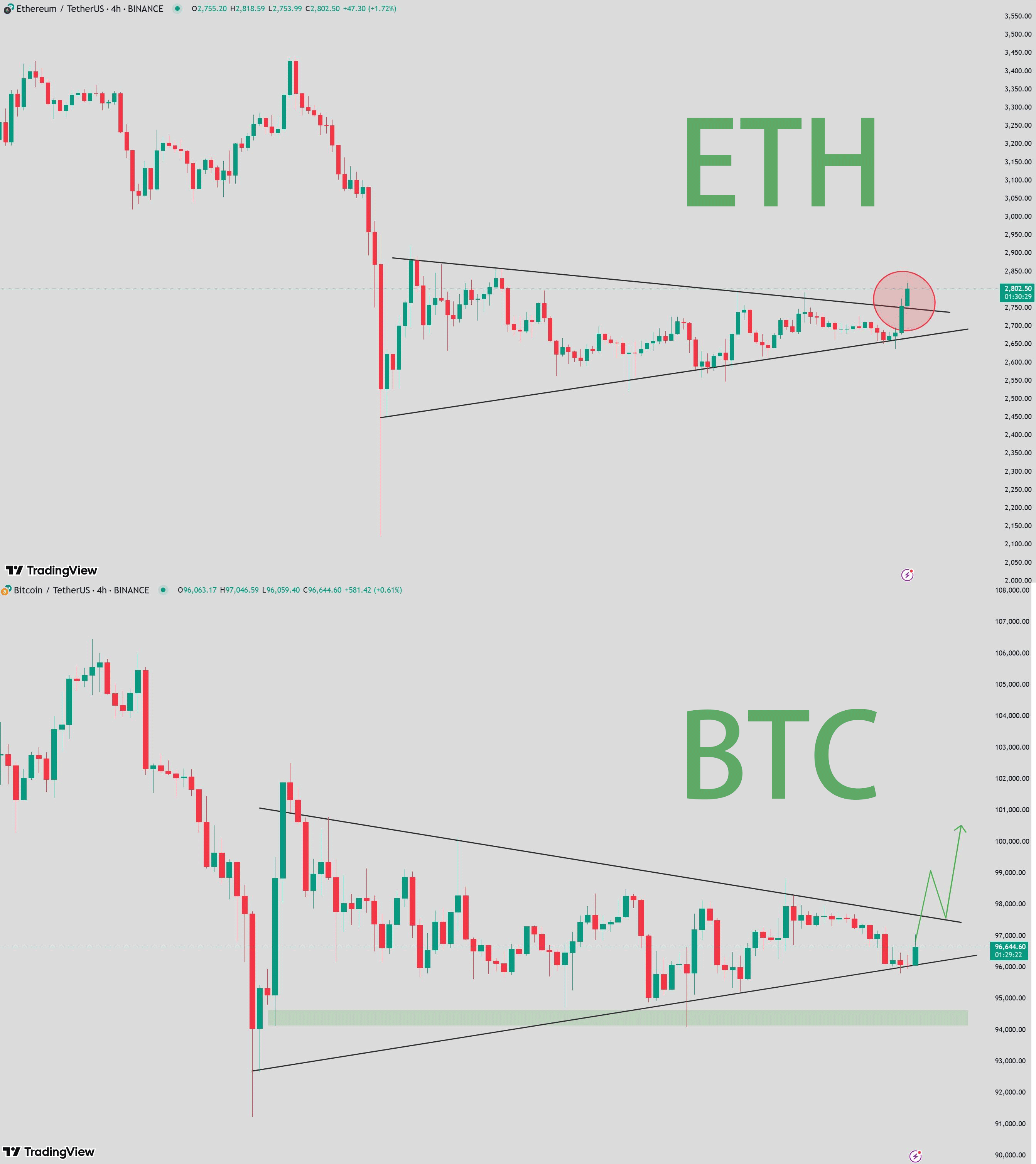

Recent analysis from seasoned crypto analyst Crypto Buddha suggests that ETH may be on the verge of a major price move. The analyst highlights how ETH has broken through a diagonal resistance level, signalling a potential bullish breakout.

Furthermore, Bitcoin (BTC) is exhibiting similar price behavior. A successful BTC breakout could spark a broader crypto market rally, driving significant gains across various digital assets. Crypto Buddha noted:

Bitcoin‘s price action is following a similar pattern with a triangular convergence, raising the question of whether it can break through successfully like Ethereum. Since the low of $91,000, Bitcoin has been consolidating for 10 days. The market is at a crucial juncture, and it’s time to pick a direction.

Will ETH Investors Finally Have Their Time?

Unlike competitors such as Solana (SOL), SUI, and XRP, which have all seen significant price appreciation over the past year, ETH has struggled to capitalize on bullish momentum. Bearish sentiment surrounding ETH has been on unprecedented levels.

However, analysts are confident that ETH may soon surprise the market. Recent analysis by Titan of Crypto emphasizes that ETH may soon enter its ‘most hated rally,’ leading to major price appreciation.

That said, concerns about the Ethereum Foundation selling copious amounts of ETH continue to haunt the holders. At press time, ETH trades at $2,721, down 4.7% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com

Read the full article here