As uncertainty dominated the digital assets landscape in the past week, Hedera demand plummeted significantly.

The $17M investor pullback has raised eyebrows about HBAR’s price action in the coming times.

The impending selling pressure threatens the key support zone at $0.20.

Losing this foothold might trigger a dip towards $0.17 – a nearly 25% dip from current prices of $0.2241.

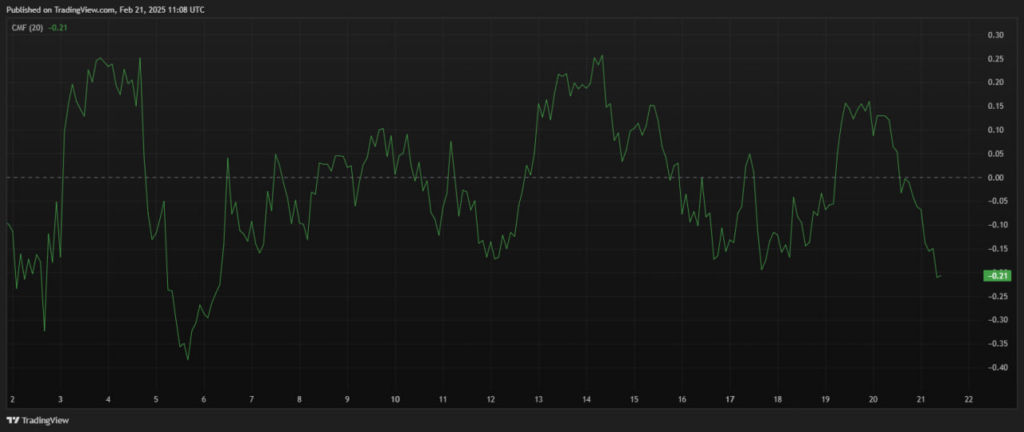

Hedera investors pull over $17M in a week

The Hedera ecosystem has seen a substantial investor exodus in the past seven days.

Coinglass data shows participants withdrew more than $17 million as bearish sentiments mounted.

Source: Coinglass

Hedera recorded only one inflow in the past week, $1.78 million on January 19.

These developments indicate investors cashing out their money from Hedera’s spot markets.

The investor exodus heralds selling activities as individuals dump their HBAR holdings for other assets.

Participants are losing interest in Hedera as the alt has underperformed since January 2025.

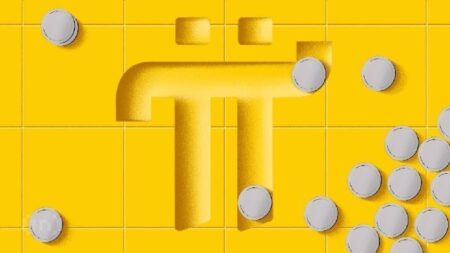

The Chaikin Money Flow confirms Hedera’s bearish sentiments.

The indicator has slumped from +0.16 over the past three days to -0.21 at press time.

Source: TradingView

That indicates cash flowing out of HBAR’s ecosystem.

On-chain data supports this outlook.

Santiment’s data shows the weighted sentiment remained negative over the past week.

Weighted sentiment measures social media chatter to gauge investor optimism.

Negative values indicate faded confidence about the asset’s future outlook.

HBAR price outlook: what’s next

The alt trades at $0.2241 with a modest 2.10% gain in the past day.

HBAR’s 24-hour gains reflect the broad market rallies, which saw Bitcoin surpassing $98K.

However, the 7D chart confirms significant bearishness after a more than 4% dip in the last seven days.

Chart by Coinmarketcap

HBAR has displayed bearish dominance since hitting a four-year peak on January 17, when it touched $0.40.

Hedera price has hovered beneath a falling trend line on the daily timeframe.

That highlights selling pressure eclipsing buyer momentum.

Bears threaten the $0.20 barrier, beneath which Hedera might crash to $0.17 – a 24.14% dip from current prices.

Nonetheless, broad market developments will influence Hedera’s near-term price action.

Digital assets trade in green today as Bitcoin holds above $98K.

The global crypto market capitalization increased by nearly 2% in the past 24 hours to $3.26 trillion (Coinmarketcap data).

A potential Bitcoin breakout and close above $100K would signal trend changes to bullish.

Altcoins will record significant recoveries amidst such developments.

Demand resurgence will stabilize HBAR price above $0.20 and trigger solid upswings.

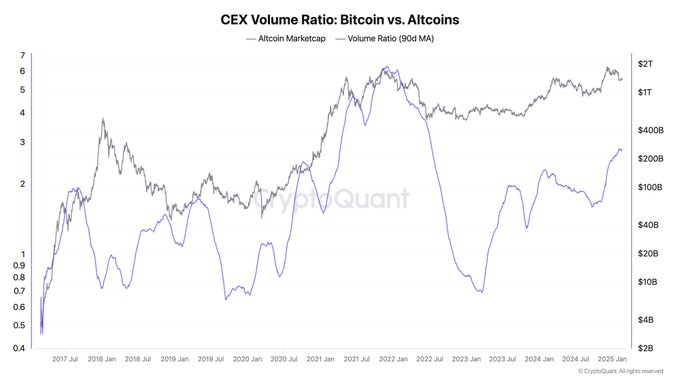

Moreover, the market exhibits a lucrative long-term trajectory.

While the market flashes rebound signals, CryptoQaunt CEO believes an “alt season has begun.”

Alt season has begun. No direct BTC-to-alt rotation, but stablecoin holders are favoring alts. Alt volume is 2.7x BTC. BTC Dominance no longer defines alt season—trading volume does. It’s a very selective alt season tho. DYOR.

6:58 AM · Feb 21, 2025

An altcoin season is a cycle where top alts outperform Bitcoin with significant margins.

The post HBAR price faces a 25% dip as Hedera sees $17M in outflows appeared first on Invezz

Read the full article here