Binance’s operation in Africa’s biggest cryptocurrency market is under intense scrutiny, with Nigerian authorities accusing the crypto giant and a host of other exchanges of infractions including currency manipulation and facilitating transfers of illicit funds.

With one Binance executive in custody in Nigeria, and a second having fled the country after having been detained, Nigerian authorities have singled out the exchange for circumventing Nigerian laws and for tax evasion.

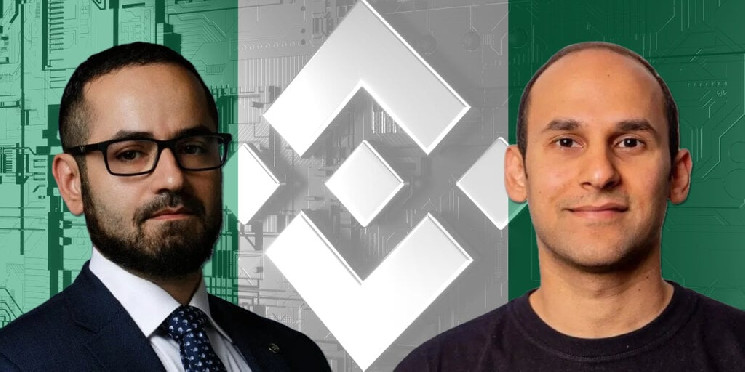

According to court papers shared with Decrypt, Nigerian authorities alleged Binance, along with its regional head for Africa Nadeem Anjarwalla and its Head of Financial Crime Compliance Tigran Gambaryan, “carried on specialised business of other financial institution without valid licence (sic).”

They were also accused of manipulating the forex market, concealing the “origin of the proceeds of your unlawful activities,” and the “origin of a cumulative sum of $35,400,000”.

‘Blackmail’

In February, Binance sent Gambaryan and Anjarwalla to Abuja, Nigeria’s capital, to meet with senior government officials as part of their investigation into crypto exchanges. As part of the investigation, Nigeria demanded that Binance provide it with information on its top 100 users in the country, along with their transaction history for the past six months.

The officials were detained on February 28th, on the order of the silent but hawkish national security adviser, Nuhu Ribadu, a retired policeman and former head of the country’s anti-corruption agency. No charges were initially brought against the pair, who were held by the Economic Financial Crimes Commission (EFCC) for 14 days under the terms of a court order, which was subsequently extended.

Binance regional manager for Africa Nadeem Anjarwalla. Image: Binance

On March 22nd, Anjarwalla, a British Kenyan, escaped custody, reportedly after he was allowed to visit a local mosque for prayers under guard. Per reports in local media, he is believed to have used a concealed passport to flee the country to an unknown destination. Nigeria is reportedly working with INTERPOL to return Anjarwalla to the country.

That same day, the FIRS filed charges of tax evasion against the exchange, as well as Anjarwalla and Gambaryan. On March 28th, the EFCC charged Binance, Anjarwalla and Gambaryan with money laundering.

Gambaryan, an American citizen, remains in custody and has sued the Nigerian government for unlawful detention. He was served with the charges during a court appearance yesterday, and did not take a plea; he will be formally arraigned for the money laundering charges on April 8th, and the tax evasion charges on April 19th, when his plea will be taken.

Binance head of financial crime compliance Tigran Gambaryan. Image: Binance

Nigeria’s EFCC has suggested that Gambaryan could face charges on the exchange’s behalf. His family said they are worried that the Binance official is being used as a pawn for Nigerian authorities to punish his employer.

“Simply put, my husband is being held as blackmail,” his wife Yuki said.

In a statement, Binance insisted that Gambaryan has not violated any Nigerian law and that he has no decision-making power in the company.

In Gambaryan’s suit against the Nigerian government, he alleges violations of his constitutional rights, and awaits arraignment with Binance and Anjarwalla in the Federal High Court in Abuja.

“The detentions will damage Nigeria’s reputation,” said Seyi Awojulugbe, a senior analyst at Lagos-based risk consultancy firm SBM Intelligence.

The CEO of a Nigerian peer-to-peer cryptocurrency marketplace dismissed as “rubbish” allegations that cryptocurrency exchanges are used for money laundering and terror financing. “There are smart people in government that know that the vast majority of any illegal activity is done with fiat, the traditional banking system and cash dollars,” Ray Youssef, CEO of NoOnes, told Decrypt.

Binance and Nigeria

Steering Binance away from controversies and regulatory grey areas is a priority for the company’s new CEO Richard Teng. He succeeded Binance’s founder Changpeng Zhao as CEO, after Zhao resigned from the company last November as part of a settlement in a $4.3 billion money laundering case in the United States.

“Over the course of the past two years, Binance has systematically worked to address its past compliance issues through a series of significant efforts to recruit, hire, and retain the right personnel to strengthen Binance’s compliance program and culture,” Teng said days after succeeding Zhao in November 2023.

But the changes at the top of Binance don’t appear to have mollified Nigerian authorities.

In February, Nigeria’s central bank governor, Olayemi Cardoso, told journalists that $26 billion had passed through Binance Nigeria from unidentified sources in one year.

“We are concerned that certain practices go on that indicate illicit flows going through a number of these entities and suspicious flows at best,” Cardoso said.

At least $24.2 billion was received by illicit cryptocurrency addresses in 2023 globally, according to Chainalysis, a global cryptocurrency analysis firm. But it warned the figure could be higher.

In March, Bayo Onanuga, a spokesman for Nigeria’s President Bola Tinubu, insisted Binance operations were injurious to the country’s economy and blamed the crypto giant for weakening the local currency naira.

Binance denied any wrongdoing but announced the stoppage of all its naira-denominated services in March.

The country’s Federal Inland Revenue Services (FIRS) last month slapped four counts of tax evasion on the cryptocurrency exchange. The tax agency said the company helped its Nigerian users to evade taxes.

“One of the counts in the lawsuit pertains to Binance’s alleged failure to collect and remit various categories of taxes to the federation as stipulated by Section 40 of the FIRS Establishment Act 2007 as amended,” FIRS said.

Section 40 of the Act explicitly addresses the non-deduction and non-remittance of taxes, prescribing penalties and potential imprisonment for defaulting entities.

Binance was also accused of not paying value-added tax and company income tax, and not complying with tax return filing obligations.

Nigeria and cryptocurrency

The Binance case highlights Nigeria’s troubled relationship with cryptocurrency.

In May 2023, former Nigerian President Muhammadu Buhari signed the 2023 Finance Act. The law introduced sweeping changes to the nation’s revenue drive, including a 10% capital gains tax on profits made in the disposal of digital assets from May 1, 2023.

The country also launched a national policy to drive its blockchain adoption in the same month.

The policy document explains that the National Blockchain Policy will provide a “framework for the use of cryptocurrencies, among others, which can help to mitigate risks such as money laundering and fraud. This can help to build trust in cryptocurrency and make it more accessible to businesses and individuals in Nigeria.”

The feeling at the time was that the crypto-crazy country was slowly walking towards officially recognising cryptocurrency.

Months before the Finance Act and the policy document were unveiled, President Bola Tinubu had promised to provide an enabling regulatory environment for trading digital assets, including cryptocurrency, when he was campaigning for election.

About six months after he took power, the country lifted the ban on banks’ facilitating trading of digital assets. It began a more intense clampdown on cryptocurrency exchanges less than three months later.

The Central Bank of Nigeria (CBN) order prohibiting banks from enabling crypto transactions was in place when the Finance Act was signed, as well as when Tinubu made his campaign promise.

CBN had ordered the closure of all accounts linked to cryptocurrency exchanges in 2021, fearing that pseudo-anonymous crypto accounts could foster money laundering and terror financing.

Although the Nigerian government is still keen on allowing crypto exchanges to register, new entrants would have to pay stiffer registration and operation fees. A new set of anti-money laundering regulations for digital asset operators has also been introduced by the Securities and Exchange Commission (SEC).

The SEC itself has consistently warned that cryptocurrencies are a risky venture.

“Nigerian investors are hereby warned that investing in crypto-assets is extremely risky and may result in total loss of their investment,” said the SEC in a June 2023 circular.

Experts argued that Nigeria’s forex crisis is tied to reckless spending and not cryptocurrency trading.

“Despite the government’s tendency to blame external factors, such as cryptocurrency trading, the root causes of Nigeria’s forex rate challenges lie in irresponsible government spending, oil theft, and low export income levels—for which the government bears significant responsibility,” Awojulugbe said.

Binance responds

The crackdown on Binance began months after Bureau de Change operators called for a ban on the crypto giant.

“So, we have to do something that can stop Binance. It’s a competition; we need to ban Binance, and the only way to do so is if you have liquidity,” Aminu Gwadebe, who heads the Association of Bureaux De Change Operators of Nigeria (ABCON), told a government-owned news agency in August.

Despite the mounting legal challenges and allegations leveled against it in Nigeria, Binance has remained resolute in its response. The cryptocurrency exchange has categorically denied any wrongdoing, emphasizing its commitment to compliance with regulations in all jurisdictions in which it operates.

Binance’s chief strategy officer Bradley Jaffe did not immediately respond to Decrypt‘s request for comment. But in a blog post in March, the company said, in response to the allegations of tax evasion and illegal operations in Nigeria, that it will cooperate fully with authorities while vigorously defending itself against the charges.

In an April blog post, Binance added that discussions are ongoing between the company and Nigerian government officials regarding Gambaryan’s detention.

Read the full article here