-

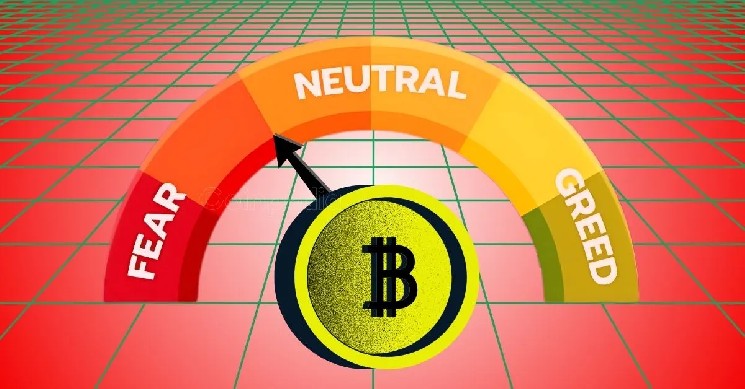

Fear & Greed Index drops to 55, showing a neutral shift after recent Greed levels.

-

BTC dominates short liquidations post-ETF, signaling bullish pressure.

-

Altcoins face $1B+ long liquidations, triggering investors.

It’s no wonder that investors and traders in the crypto market remain puzzled, as sentiments in the business continue to swing rapidly. The swift moments in the Fear & Greed Index’s metrics are catalyzed heavily by liquidation. As of today, the Crypto Fear & Greed Index stands at 55, signaling a neutral sentiment in the market. This marks a retreat from last week’s “Greed” level of 65, and slightly above last month’s neutral reading of 49.

At the same time, the Bitcoin ETF approval has fundamentally changed the landscape of liquidation behavior across the market. While Bitcoin rallied, triggering a $190 million short liquidation wave, altcoins faced the brunt, with over $1 billion in long positions liquidated. This imbalance unveils two drastically different trader expectations — and outcomes — across the crypto spectrum.

Liquidation Map and Sentiment Trends

Bitcoin’s steady rise, shown in the chart, has been marked by spikes in short liquidations. This classic short squeeze phenomenon reflects high-leverage traders betting against BTC’s rally, only to be liquidated as BTC crossed $100k+, driven by institutional momentum from the ETF narrative.

On the contrary, altcoins showed the opposite pattern. Leverage-fueled long positions were consistently wiped out, hinting at aggressive bets on an “altseason” that never came. Since December 2024, this asymmetry has only widened, reflecting intensifying risk aversion towards altcoins.

Overlaying this with the Fear & Greed Index, we observe a clear correlation: when the index was in Extreme Greed (90–100) territory in early 2025, traders overexposed to altcoins suffered the most. As sentiment cooled to neutral, BTC stabilized, while altcoins continued to experience high leverage flush-outs.

Read our Ethereum (ETH) Price Prediction 2025, 2026-2030, to know where the largest altcoin is heading!

FAQs

It reflects neutral sentiment, meaning the market is currently balanced between caution and optimism.

Many traders anticipated a broad altcoin rally post-BTC ETF approval. However, this didn’t materialize, leading to overleveraged long positions being liquidated.

Monitoring sentiment trends and liquidation maps helps identify overleveraged zones.

Read the full article here