Highlights

- Bitcoin price fell 5.2% to a low of $100,345 yesterday due to leveraged trade liquidations and geopolitical tensions.

- Whale James Wynn had long positions worth $16.14 million liquidated, closing all running positions.

- Despite the downturn, on June 6th, Bitcoin showed a 3% rise, as trade talks between the U.S. and China are set to resume.

The crypto market crash gained steam overnight as its top crypto, “Bitcoin price,” fell 5.2% to a low of $100,345. This fall was seen due to the liquidation of leveraged trades, geopolitics, and the Elon Musk-Donald Trump feud.

Keep reading, as this article will shed light on the main reasons for the overnight crash and whether the bull run in BTC is over or not.

Aggregated Reasons For Yesterday’s Bitcoin Price Decline

The primary reason for the decline was Trump signing a new executive order, which has fueled volatility in major financial instruments, and that has affected BTC’s sentiment too. His EO this time has throwed lightning on steel and aluminium tariffs, which have jumped by 50%, to promote American in-house factories’ production to scale up.

Similarly, arguments with China have once again started to heat up, and no resolution has been worked out between China and the US yet. As a result of these global pessimistic factors, the crypto market went into bearish mode last night, the growing uncertainty is creating delays in major technological advancements, too.

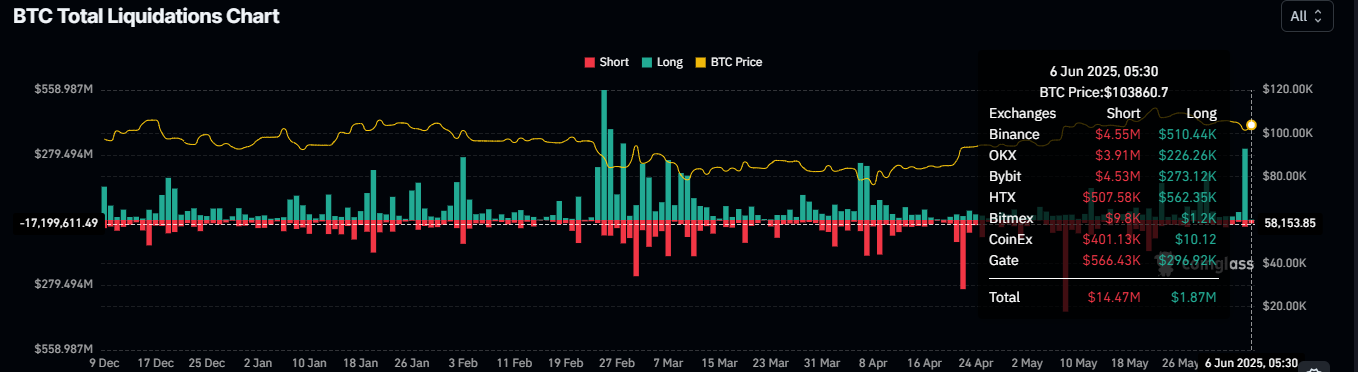

The result of the bearish mode caused liquidations of 215,593 traders in the past 24 hours, and the total liquidations come in at $967.63 million, per Coinglass. It said the largest single liquidation order happened on Bitmex – XBTUSD, valued at $10.00 million.

Meanwhile, a popular whale, James Wynn, had long positions worth $16.14 million liquidated. As a result, he had to close all his running long positions, as reported by Lookonchain.

Joining the bearish facts, the fallout between Trump and his ex-best buddy, Elon Musk, is also adding bearish pressure on the market. This feud is caused by “big, beautiful bill”, Musk asked that it end EV subsidies and advance debt on the country.

This combination of factors is having a strong impact on the crypto market, as Donald Trump and Elon Musk are known among the top crypto advocates for the crypto space, and the feud between them is affecting investors ‘ sentiment.

Should We Be Concerned About Bitcoin Price?

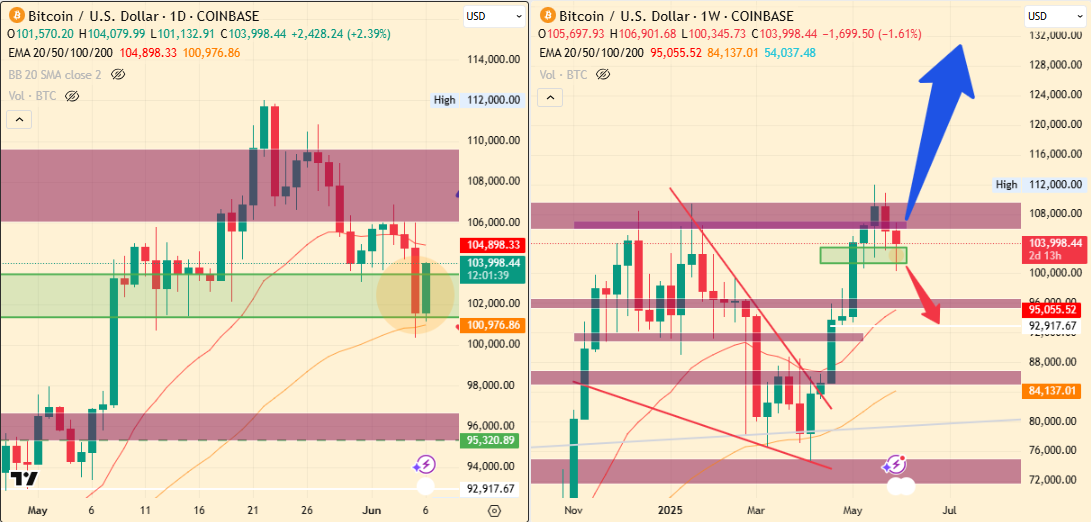

After the catastrophic last night for top crypto and altcoins, June 6th has shown a 3% rise to $103,976, also the recent 12-hour Rekt shows rising short liquidation compared to longs.

This sudden optimism happened as the long-disputed and most argued trade talks between the US and China are set to restart, which has turned yesterday’s bearish situation, and kept the price of BTC above the previous month’s support zone.

As per price action, it appears on the daily chart that this daily move took market liquidity by hitting several stop losses, and this could be a trigger point for an upcoming move northwards.

Therefore, if things go south and pressure grows, then by June end the price could go as low as $92917. However, if things go north then this time $130K mark is the target for June-end.

Read the full article here