Aura (AURA), a culture token built on the Solana (SOL) blockchain, has skyrocketed by over 3,500% in the past 24 hours, marking an extraordinary price surge.

This dramatic spike has enabled numerous investors to secure significant profits. Yet, market analysts caution that the rally may be part of a larger rug-pull scheme.

Why is Aura Token’s Price Surging?

According to the latest data, AURA pumped from a low of $0.001 to $0.037 at press time. This marked an appreciation of 3,538% over the past day. In addition, the market capitalization has climbed from around $1.1 million to $34.4 million.

AURA Token Price Performance. Source: TradingView

The trading volume also soared 106,684.40% to $38 million, indicating significant investor interest and activity. AURA has claimed the top spot as the highest daily gainer on CoinGecko and is currently the most trending cryptocurrency on the platform.

Lookonchain data highlighted that AURA’s rally allowed a whale to book a $104,000 profit.

“5 months ago, trader FvaBFc spent $24,000 to buy 2.87 million Aura, only to see it crash over 90%. But today, Aura suddenly surged 35x. He sold all 2.87 million Aura for $128,000—more than recouping his losses and walking away with a $104,000 gain,” Lookonchain posted.

Another trader also shared an unrealized profit of $698,154 on his AURA holdings in an X (formerly Twitter) post. However, the rally has raised red flags among market watchers.

“Aura one year old coin pumped out of nowhere. Don’t fall for it. They rug the crypto sector. Buy high conviction with organic chart. This will not end well,” a user said.

Meanwhile, David, a user specializing in monitoring and reporting cryptocurrency scams, flagged AURA as a “Level 3 – Expert SCAM.” According to David’s post, AURA lacks clear utility.

He noted that the token was created on May 30, 2024. Its market capitalization reached over $70 million as AURA hit an all-time high (ATH). Nonetheless, it quickly dropped to around $600,000.

“It’s designed for a Rug Pull! They got lucky because I didn’t start this work at that time,” the post read.

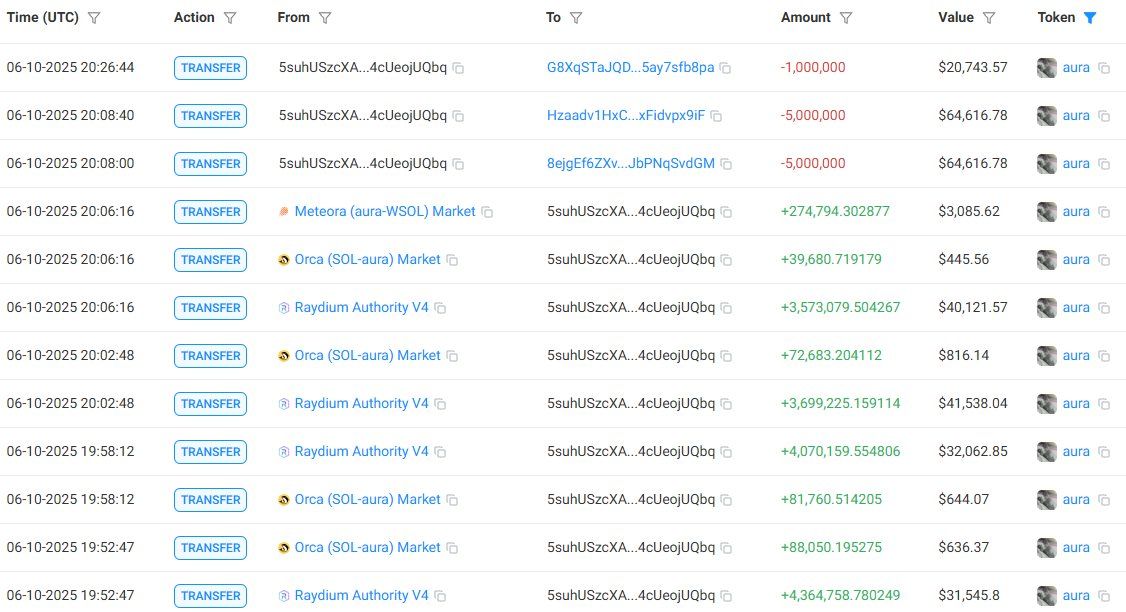

Moreover, David raised concerns about the recent price pump. He stressed that it lacks any clear explanation, such as a partnership or utility behind the token. He said the on-chain buying activity surged abruptly around 6 PM UTC on June 10.

However, it’s unclear whether this increase in activity was organic or artificially driven. Additionally, the thread pointed out that the token supply is tightly controlled.

David highlighted that many top AURA holders have large “bundles” of tokens. Notably, these “bundles” are not long-term holdings but are new.

AURA Token Holders: Source: X/David Crypto Scam Hunter

Additionally, he pointed out that many top holders never actually bought the tokens. Instead, they received them through transfers or splits from other wallets.

This further fuels suspicions of manipulation or coordinated efforts to artificially inflate the token’s price. Thus, while the latest rally has led to massive gains for some, its sustainability remains a topic of debate.

Read the full article here