Mercurity Fintech Holding, a Nasdaq-listed digital fintech group building blockchain-based payment infrastructure, plans to raise $800 million to establish a Bitcoin treasury reserve as more companies adopt the cryptocurrency for strategic purposes.

Mercurity plans to raise $800 million to establish a “long-term” Bitcoin (BTC) treasury reserve, which will be integrated in its digital reserve framework through blockchain-native custody, staking integrations and tokenized treasury management services, the company said in a Wednesday announcement.

Mercurity said it will transition a portion of its treasury into a “yield-generating, blockchain-aligned reserve structure that reinforces long-duration asset exposure and balance sheet resilience.”

Through the establishment of its corporate Bitcoin treasury, the company aims to position itself to become a “key player in the evolving digital financial ecosystem,” said Shi Qiu, CEO of Mercurity Fintech, adding:

“We’re building this Bitcoin treasury reserve based on our belief that Bitcoin will become an essential component of the future financial infrastructure.”

Related: Bitcoin nears new high as Trump says US-China trade ‘deal is done’

The $800 million capital raise would enable the firm to purchase about 7,433 BTC at current prices.

This would make Mercurity the world’s 11th largest corporate Bitcoin holder after Galaxy Digital Holdings, surpassing GameStop’s 4,710 BTC, Bitbo data shows.

Related: ‘Apple should buy Bitcoin,’ Saylor says, as share buyback disappoints

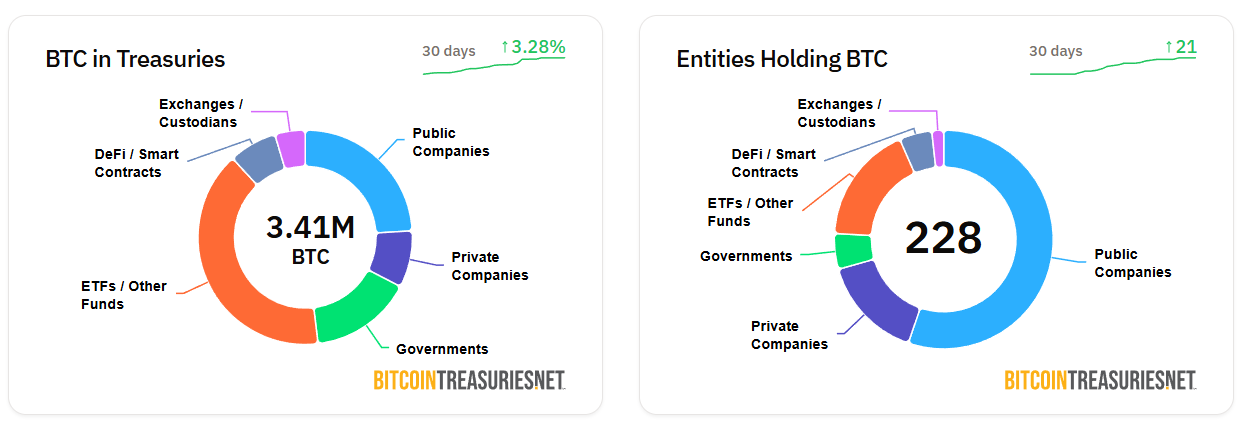

Corporate Bitcoin adoption on the rise, 223 companies hold BTC

Signaling growing institutional interest, at least 223 public companies are now holding Bitcoin as part of their corporate treasuries, up from just 124 firms on June 5, Cointelegraph reported.

Over 819,000 BTC, representing 3.9% of the total supply, is now held in public company treasuries, according to data from BitcoinTreasuries.NET.

A long-term investment perspective is driving the wave of corporate Bitcoin adoption, a Binance Research spokesperson told Cointelegraph, adding:

“Corporate BTC adoption is driven by long-term balance sheet strategy, treasury diversification and capital-raising activity.”

Altcoins are also benefiting from growing institutional interest. Interactive Strength, a Nasdaq-listed fitness equipment manufacturer, announced plans to raise up to $500 million to establish a Fetch.ai (FET) token treasury, Cointelegraph reported on Wednesday.

Magazine: Older investors are risking everything for a crypto-funded retirement

Read the full article here