This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

FIFA, Maplestory, Off the Grid, Inversion.

These are among the few high-profile names to have launched (or plan to launch) chains on Avalanche’s tech stack lately.

Why Avalanche and not Ethereum?

The answer starts with Avalanche9000, the network’s largest upgrade that went into effect last December. It was Avalanche’s own version of “The Merge,” which radically overhauled validator economics.

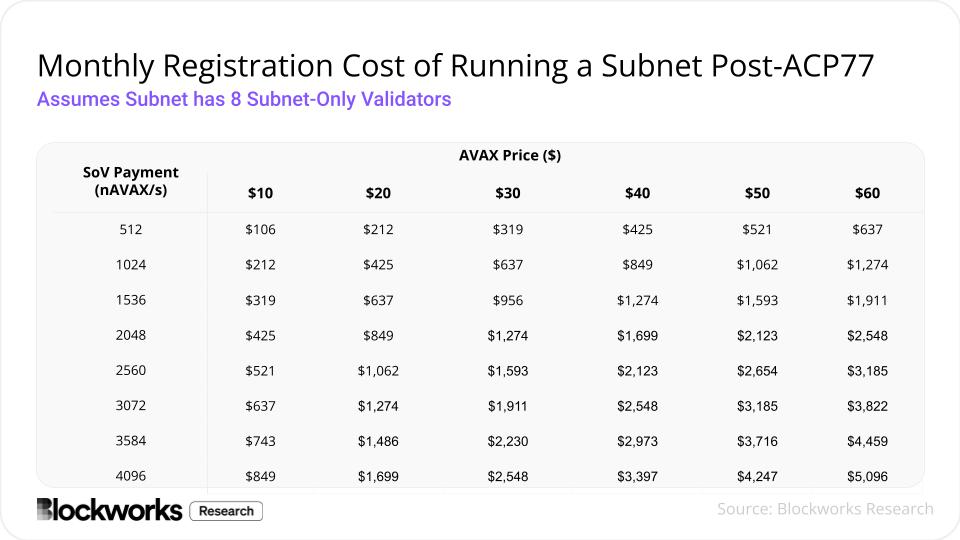

As part of ACP-77, Avalanche validator’s high fixed stake cost requirements (2000 AVAX) were replaced with a low-cost, pay-as-you-go model.

Reduced upfront costs have made it attractive to launch a sovereign Avalanche L1 chain — it’s possibly even cheaper than a Celestia rollup or Cosmos Appchain, based on estimates by Blockworks Research’s EffortCapital.

The cost savings go further.

Teams bootstrapping an Avalanche L1 can leverage what the C-Chain — Avalanche’s liquidity hub — has already built out.

For instance, Avalanche L1s can offer users the convenience of a CEX ramp via the C-Chain without having to pay a hefty percentage of their token supply to integrate directly.

“That’s one of the core value propositions at Avalanche,” Ava Labs chief strategy officer Luigi D’Onorio DeMeo told me. “From a go-to-market perspective, it saves teams a lot of time and millions of dollars in integration fees.”

This goes for most standard chain infrastructure that the C-Chain already has, such as oracles, RPCs, indexers, explorers, NFT marketplaces, etc. — all of which can cost up to an estimated $13 million for an independent L1 to bootstrap themselves.

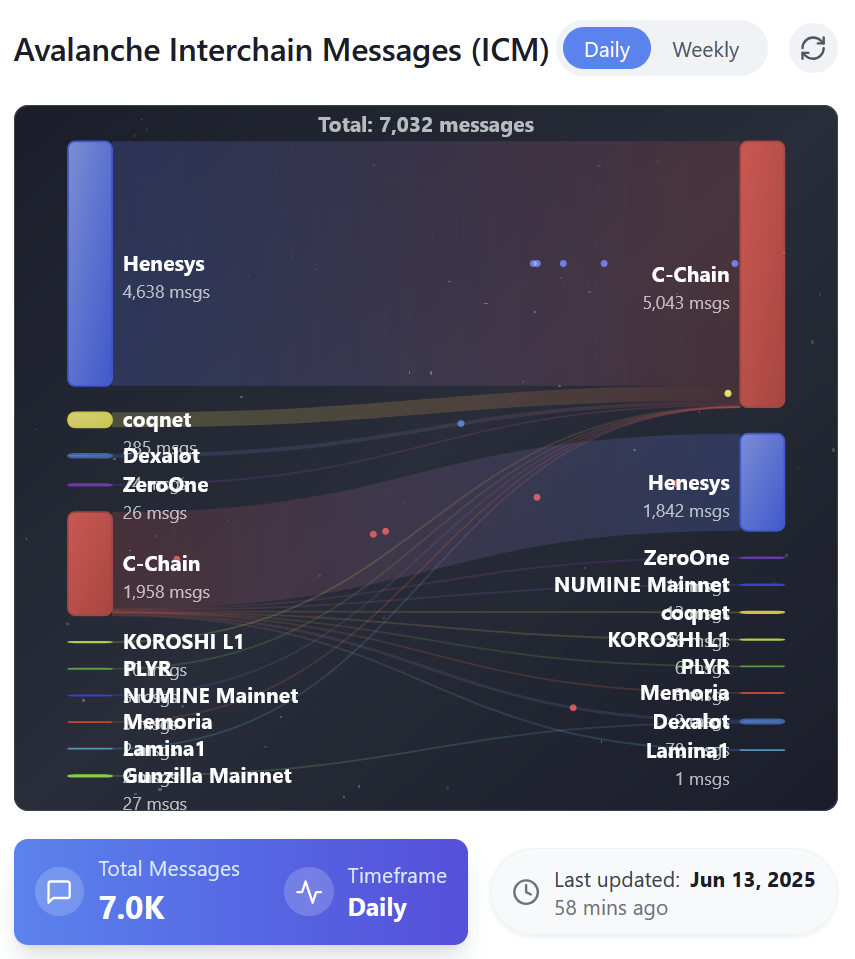

It all hinges on Avalanche’s “Interchain Messaging” (ICM) protocol, which Avalanche L1s use to easily move assets to and from the C-Chain to take advantage of the aforementioned features.

C-Chain to Henesys (Maplestory’s chain) is today the most active back-and-forth route on ICM, facilitating thousands of messages daily.

Source: L1beat.io

Value accrual is another major reason to launch an Avalanche L1.

Avalanche L1s can devise clear value accrual streams to their native tokens by bootstrapping their own validator sets and issuing block rewards (or using their own native token as gas).

Ethereum L2s cannot leverage the same levers and therefore have limited or no value accrual streams to their tokens, outside of governance (there are exceptions).

Finally, AvaCloud’s HyperSDK also grants a high degree of L1 customization, a stark advantage over the constraints L2s face building on today’s rollup tech stacks.

AVAX value accrual

Given the problems of value accrual that have plagued ETH and ATOM, it’s worth looking at how AVAX accrues value.

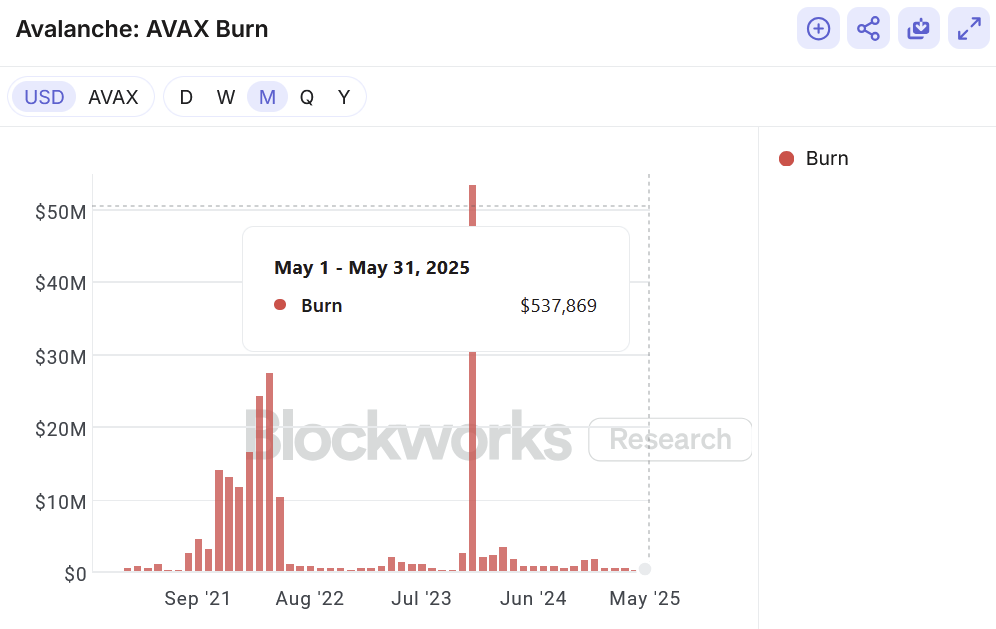

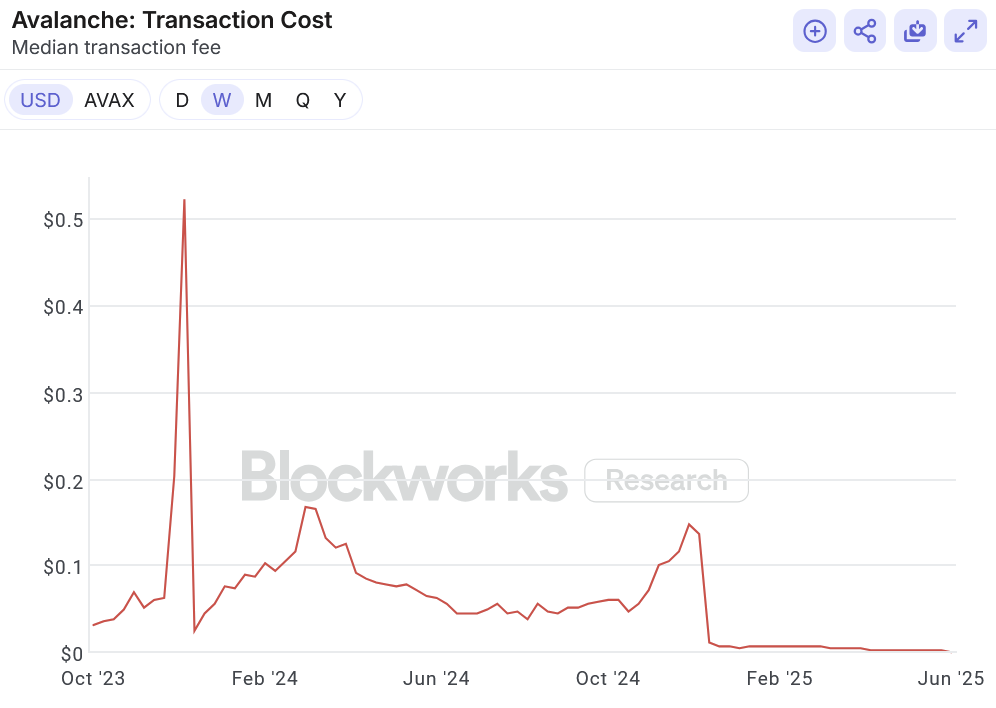

First, 100% of all C-Chain fees are burned, compared to partial burns for Solana or Ethereum. AVAX burn had a monthly average of about $453k in 2025.

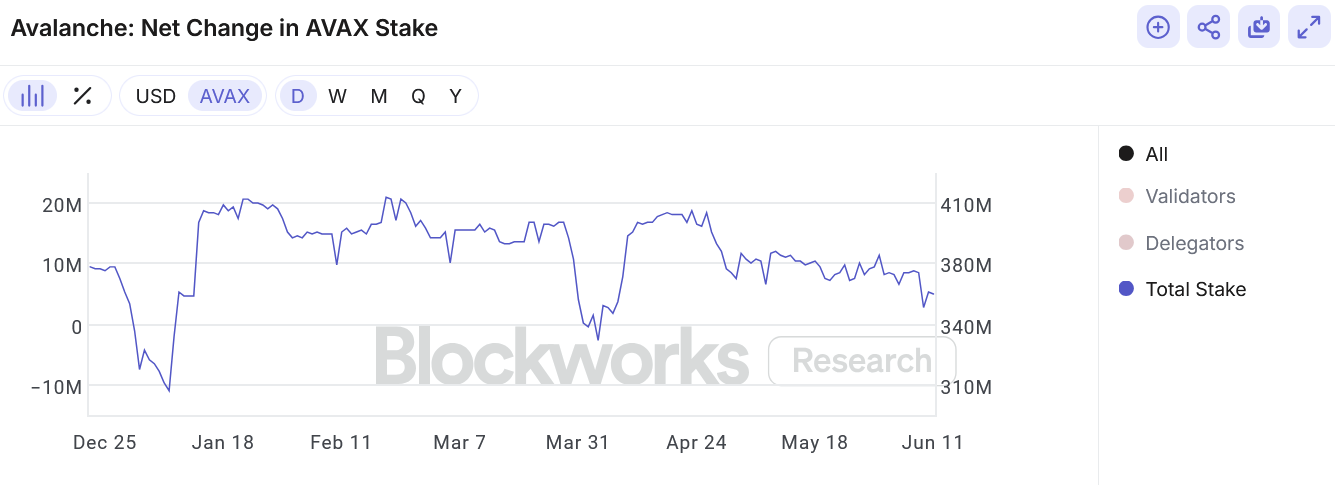

Secondly, validators continue to stake AVAX to validate the primary networks — about $8b (360.2m AVAX) is staked today.

Third, every Avalanche L1 validator pays a small monthly continuous fee in AVAX, as part of ACP-77. Depending on how many validators there are, these fees range from the hundreds to thousands. Blockworks Research’s Boccaccio has drawn up some nice estimates here for the Gunzilla chain:

Finally, there is a minimal, indirect fee on ICM that is burned whenever transactions interact with the C-Chain.

Avalanche’s path forward

When all is said and done, Avalanche’s business strategy rings familiar: Reduce upfront costs to subsidize long-term growth.

Ethereum is doing the same by forfeiting short-term execution fees to L2s in hopes of attracting data availability fees in the long run. Celestia is also practically giving DA away for free now in pursuit of long-term growth.

Read the full article here