Today, Ethereum has suffered a double-digit price decline as escalating geopolitical tensions between Israel and Iran rattle investor confidence across global markets.

On-chain data reveals that ETH’s sharp decline has sparked a surge in short positions across its futures market, signaling that many traders are now betting on further price losses.

ETH Crashes Amid Middle East Turmoil

The airstrike launched by Israel on Friday has intensified fears of broader conflict in the Middle East, sending shockwaves through both traditional and digital asset markets.

ETH, the second-largest cryptocurrency by market cap, has been hit hard, plunging over 10% in the past 24 hours as traders respond to growing geopolitical uncertainty.

On-chain data suggests that many traders expect this price dip to continue, as reflected by the coin’s long/short ratio readings. At press time, this stands at 0.86, indicating more traders are betting against the altcoin.

ETH Long/Short Ratio. Source: Coinglass

This ratio compares the number of long and short positions in a market. When an asset’s long/short ratio is above 1, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

Conversely, as seen with ETH, a ratio below one indicates that most traders are positioning for a price drop. This shows the heightening bearish sentiment and growing expectations of a continued decline.

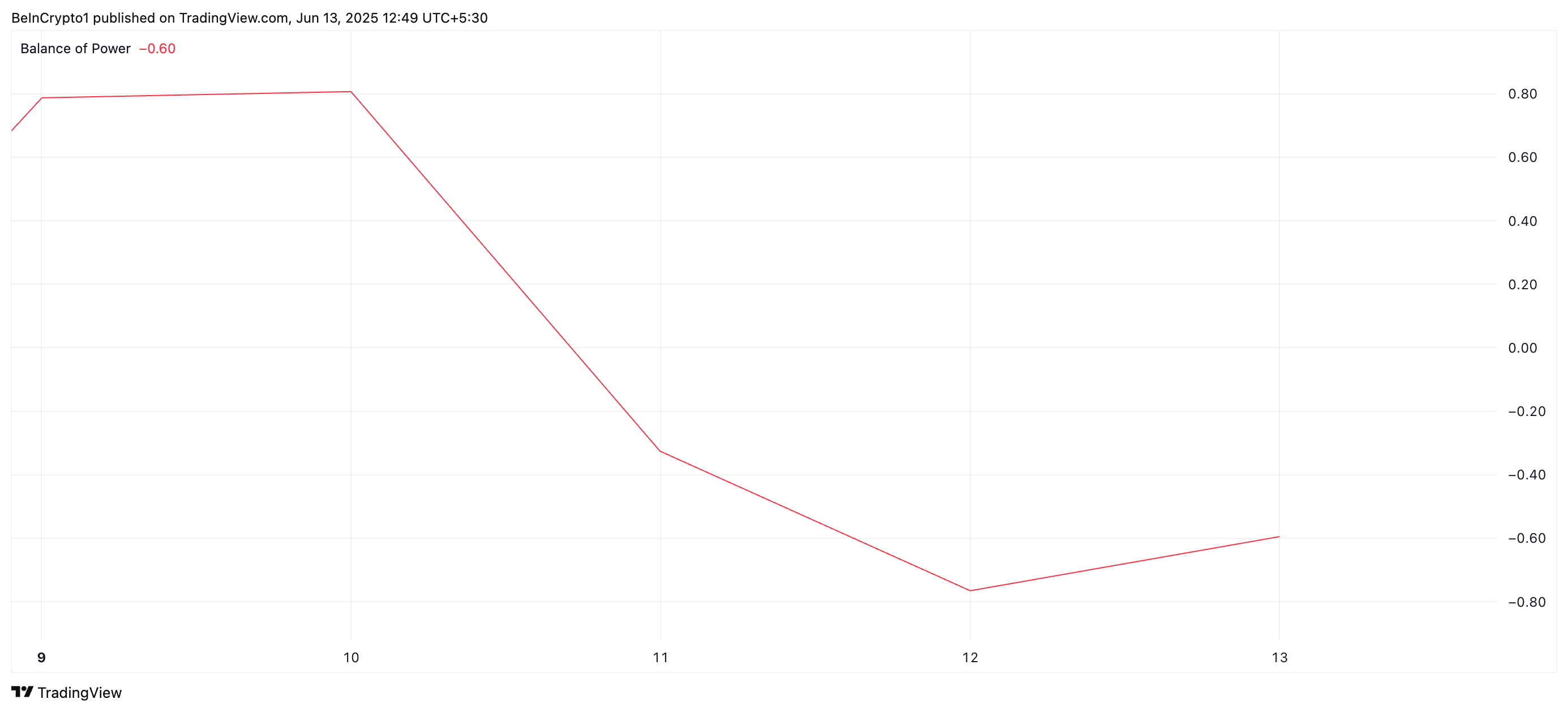

Furthermore, ETH’s negative Balance of Power (BoP) supports this bearish outlook. At press time, this momentum indicator is at -0.69, confirming the waning demand for the leading altcoin among market participants.

ETH BoP. Source: TradingView

The BoP indicator measures the strength of buyers versus sellers in the market. A negative BoP reading suggests that selling pressure dominates, indicating a lack of fresh demand and a higher likelihood of continued price decline.

Market Awaits ETH’s Next Move

At press time, ETH trades at $2,523, holding just above the support floor at $2,424. If sell-side pressure strengthens, the coin could break below this floor, potentially triggering a further drop toward $2,027.

ETH Price Analysis. Source: TradingView

Conversely, a renewed wave of buying interest could invalidate the bearish outlook. In that case, ETH might rebound and rally toward $2,745.

Read the full article here