-

Bitcoin’s bullish momentum halted, falling 7% as geopolitical tensions rise.

-

Divergence between Bitcoin price and Binance’s Open Interest indicates cautious investor sentiment.

-

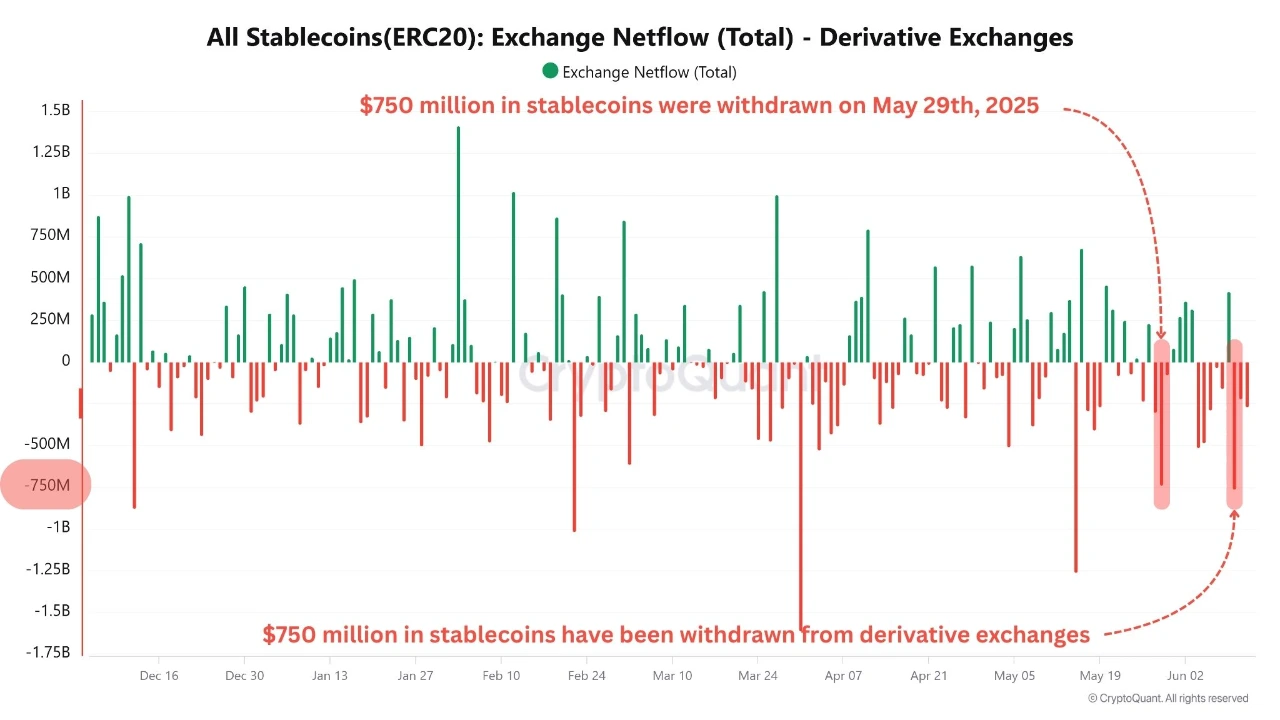

Meanwhile, derivative exchanges witnessed significant withdrawals of over $750 million in stablecoins from derivatives exchanges.

In the past 72 hours, the Bitcoin price bullish momentum witnessed a short-term halt, due to an increase in bearish pressure involving worsening geopolitical conditions. As a result, Bitcoin price suffered a loss of 7%, as it fell short of bullish strength to surpass the benchmark $112,000 ATH.

Moreover, the leveraged long positions were unwound, which further amplified downside momentum for top crypto and altcoins.

Similarly, recent on-chain metrics highlight that derivative exchanges saw significant withdrawals of stablecoins. Where these withdrawals are coupled with a notable divergence between BTC price and Binance’s Open Interest.

These converging signals strongly indicate a cautious outlook for Bitcoin in the immediate short term.

BTC Jumped From Cliff – Down 7%: What Exactly Happened?

The global uncertainty has increased recently, which has affected the financial sector, including cryptocurrencies. This happened as Donald Trump plans to put unilateral tariffs in the next two weeks.

Alongside the pessimism surrounding Trump’s tariffs, the Israel-Iran Conflict also escalated further, which has triggered aggressive selling.

The sudden spike in sell volume closely aligns with Israel’s unexpected military strike on Iran early Friday (June 13), which sent shockwaves through global markets.

Crypto is regarded as a high-risk asset and faces immediate liquidation pressure. Where traders dumped BTC in anticipation of broader market turmoil.

What DOes This Divergence Between Bitcoin Price and Binance Open Interest Means For Investors?

Recent insights from CryptoQuant reveal a notable divergence between Bitcoin’s price and Binance’s Open Interest (OI).

As the Bitcoin price neared its all-time high of $110,000- which was last seen in late May, the OI failed to match the peak levels. This is clearly indicating a weakening interest in futures trading despite strong long-term BTC price momentum.

This situation suggests a cautious sentiment among investors, highlighting potential shifts in market dynamics.

Should Investors Be Alarmed As Massive Stablecoin Withdrawals Occurred from Derivative Exchanges

According to CryptoQuant charts, over $750 million in stablecoins have been withdrawn from derivatives exchanges. This significant movement mirrors a similar withdrawal on May 29, 2025, also around $750 million.

Such synchronized outflows often indicate capital rotation or changes in trader behavior. When these occur near market highs, they may signal hedging or de-risking actions.

Currently, Bitcoin price is struggling near the key psychological level of $110,000, and last three days 7% decline has made the situation more risky for market participants.

Therefore, amid the geopolitical chaos, the absence of confirmation from Binance OI, along with repeated large stablecoin outflows, increases the likelihood of a short-term pullback. If the $101,000 support area is breached, BTC price could drop to the support zone around $96,000.

The short-term situation urges market participants to “DYOR” and should avoid “FOMO” based future decisions.

Read the full article here