Key takeaways:

Bitcoin (BTC) reclaimed $108,000 on Monday after retesting the $104,000 support level over the weekend. The gains came as conflict broke out in the Middle East and investors scaled back expectations for interest rate cuts in the United States, signaling stronger confidence in Bitcoin’s upside potential.

Traders’ sentiment remained steady despite the worsening socio-economic outlook, as shown by Bitcoin derivatives metrics.

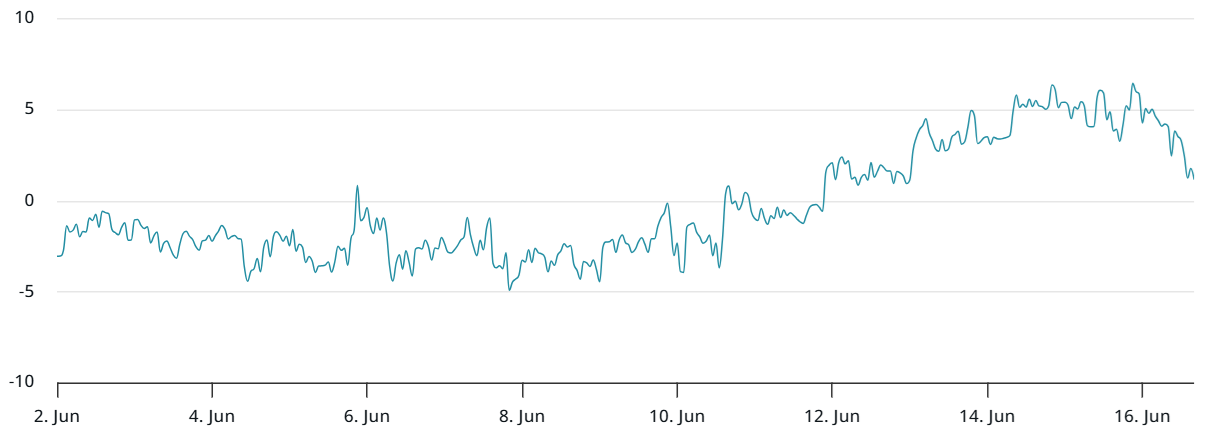

The Bitcoin futures premium reached 5% on Monday, the baseline for neutral markets. These monthly contracts typically trade at a 5% to 10% premium to account for the longer settlement period. Although below the 8% recorded in late May, there was little reaction during the $101,000 retest on June 5, indicating market resilience.

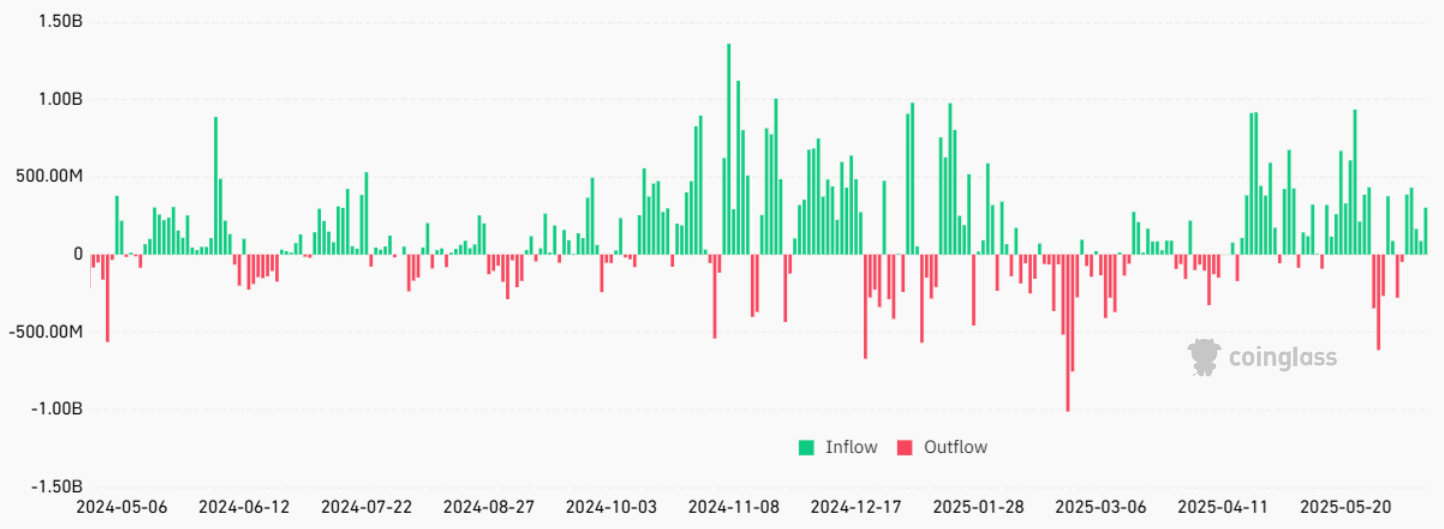

US-listed spot Bitcoin exchange-traded funds (ETFs) saw $301.7 million in net inflows on Friday, and Strategy’s announcement of an additional $1.05 billion purchase on Monday helped ease traders’ concerns about a potential economic recession and the adverse effects of the conflict involving Iran, one of the world’s largest oil producers.

Oil prices initially surged on Sunday, with West Texas Intermediate (WTI) futures reaching $78 before pulling back. By Monday, WTI futures had dropped to around $71.50 per barrel, a move that coincided with a 1.5% gain in Nasdaq futures. According to Yahoo Finance, market participants expect tensions in the Middle East to ease.

Bitcoin faces hurdles from energy costs and delayed Fed rate cuts

The path for Bitcoin to reclaim $110,000 may be more challenging than expected, as some analysts point to the risk of rising energy prices. Philippe Gijsels, chief strategy officer at BNP Paribas Fortis, told CNBC on Monday that “the market reaction has been very modest, so there is room for disappointment if things were to escalate.”

In addition to concerns over energy markets, heightened uncertainty is also reducing the likelihood of the US Federal Reserve cutting interest rates. Rising inflationary pressure has pushed traders to price in a 63% chance that the Fed will maintain rates at 4% or higher by November, up from 56% a month earlier, according to CME FEDWatch.

Bitcoin traders’ growing confidence was also evident in the BTC options market, where the 25% delta skew (put-call) dropped to a neutral 1% on Monday, after reaching 6% on Sunday. Readings above 5% are generally seen as bearish, reflecting higher demand for protective put options from market makers and arbitrage desks.

Related: Trump’s Truth Social files S-1 for dual Bitcoin and Ether ETF

Bitcoin is trading just 4% below its $111,965 all-time high from May 22, despite mounting uncertainty and recession fears, while derivatives metrics remain neutral. This environment favors further price appreciation, as bears have failed to trigger panic amid escalating global tensions.

Ed Yardeni of Yardeni Research reportedly noted on Monday that US President Donald Trump “doesn’t seem as ready to pivot away from his trade war as hoped,” adding that the trade war debate is far from being over.

Ultimately, Bitcoin’s path to $112,000 remains closely tied to reduced tariff-related uncertainty, regardless of developments in the Middle East.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Read the full article here