Ethereum price is currently navigating a critical juncture following a volatile weekend that saw both bullish momentum and short-term exhaustion. As of June 17, Ethereum price today stands near $2,578, showing signs of consolidation after a failed breakout above the $2,650 resistance zone. Traders are closely watching whether ETH can sustain support above $2,510 or face renewed downward pressure.

What’s Happening With Ethereum’s Price?

ETHUSD price dynamics (Source: TradingView)

Ethereum’s weekend rally was sharply rejected at the $2,680–$2,700 zone, a key supply area highlighted in multiple timeframes. The 4-hour chart reveals a breakout attempt from a descending wedge, but the move was quickly sold off, bringing ETH back within its short-term consolidation structure.

The Ethereum price action on the 30-minute and 4-hour charts shows prices caught between $2,510 support and $2,585 resistance, with Bollinger Bands squeezing around the current zone. This volatility compression hints at a potential breakout in either direction, likely influenced by broader market sentiment or upcoming macroeconomic catalysts.

Ethereum (ETH) Price: Key Indicators Show Mixed Momentum

ETHUSD price dynamics (Source: TradingView)

Relative Strength Index (RSI) on the 30-minute chart has recovered slightly to 44.14, up from recent oversold levels, suggesting mild bullish divergence. However, the MACD remains in negative territory, with the signal and MACD lines below zero and histogram momentum weakening, which keeps short-term pressure tilted downward.

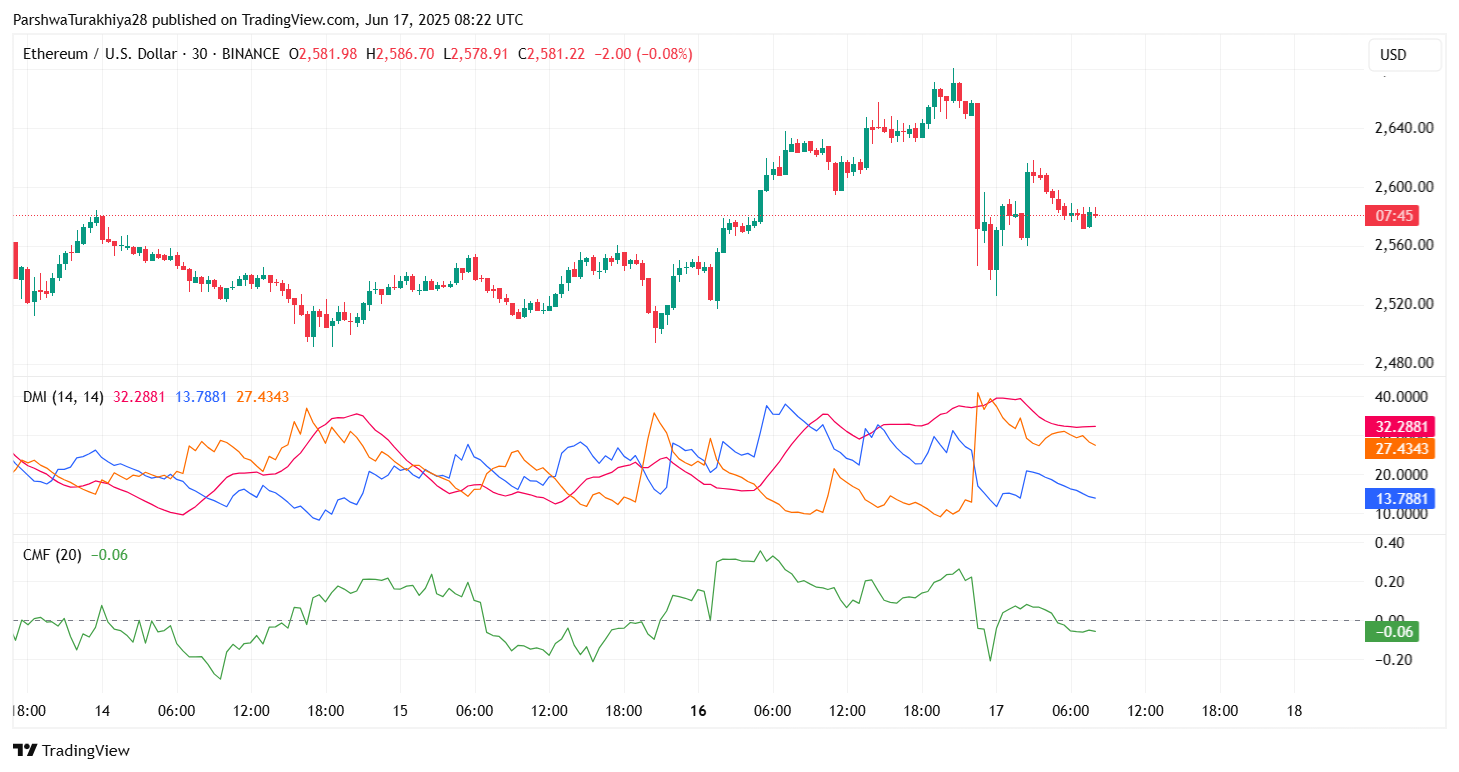

ETHUSD price dynamics (Source: TradingView)

Meanwhile, the Ichimoku Cloud shows the price hovering just below the Tenkan-Sen ($2,591) and Kijun-Sen ($2,603), suggesting bearish pressure unless a breakout above these lines occurs. The Chikou Span is flat, reinforcing the idea that the current range may persist before a breakout.

ETHUSD price dynamics (Source: TradingView)

From a volume and trend confirmation angle, the Vortex Indicator on the 4-hour timeframe still favors bulls, with VI+ at 1.066 and VI– at 0.938, but the gap is narrowing. The Directional Movement Index (DMI) shows a softening of the bullish trend with +DI (27.43) beginning to converge with –DI (13.78). However, ADX remains elevated, indicating a trend is still in play.

Ethereum (ETH) Price: Liquidity Zones and Smart Money Activity

ETHUSD price dynamics (Source: TradingView)

The latest Ethereum price update on the Smart Money chart shows ETH pulling back into a high-volume liquidity block between $2,500 and $2,530. This zone has previously acted as an institutional demand area, evidenced by a series of bullish CHoCH (Change of Character) and BOS (Break of Structure) events earlier this month.

ETHUSD price dynamics (Source: TradingView)

A successful defense of this range could push Ethereum back toward the $2,650–$2,680 resistance cluster, which aligns with the upper Bollinger Band and 100 EMA on the 4-hour chart. Conversely, a break below $2,510 could invite accelerated selling toward the $2,440–$2,470 range.

Why Ethereum Price Going Down Today?

The latest rejection at $2,680 triggered a round of short-term profit-taking, leading to increased Ethereum price volatility. The MACD cross-down and fading RSI momentum confirm the loss of bullish strength. Moreover, the Chaikin Money Flow (CMF) has dipped below zero to –0.06, indicating that capital inflows are weakening—an early warning of potential distribution.

ETHUSD price dynamics (Source: TradingView)

Additionally, the Donchian Channel and SAR (Stop and Reverse) indicators suggest the market remains undecided. ETH is testing the median band ($2,586) of the Donchian range, while the SAR dots have flipped above the price on the 4-hour chart, signaling short-term bearish reversal potential.

Short-Term Ethereum Price Forecast

ETHUSD price dynamics (Source: TradingView)

Going into June 18, Ethereum’s near-term outlook will depend on whether bulls can defend the $2,510–$2,530 demand zone. A hold above this level may allow a rebound back to $2,585 and possibly test $2,650 again. However, a failure to defend support could send Ethereum price toward lower key zones at $2,440 and even $2,380.

The structure still favors a bullish recovery if price breaks out of the descending triangle visible on the 4-hour chart, with the next upside targets at $2,700 and $2,780. But if the bearish momentum persists and breaks $2,510, the higher timeframe breakdown could extend to $2,380 and even $2,200.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here