Algorand (ALGO) is currently in a phase of technical accumulation as analysts emphasize the significance of instant finality in facilitating a potential upward breakout. Existing price patterns and DeFi activity indicate increasing engagement, while technical signals demonstrate cautious optimism for the upcoming market cycle.

Algorand’s Instant Finality and Competitive Blockchain Edge

Instant finality is a feature that Algorand maintains as a standout among leading blockchains, owing to its scalability. Algorand transactions are finalised near instantly, making the delay time as minimal as possible for customers and businesses. Market analyst Michaël van de Poppe highlights this feature as a key driver of adoption, particularly in the payment and DeFi sectors.

$ALGO is gearing up for the next leg upwards.

Their chain is one of the fastest in the ecosystem.

Their core: Instant finality.

Why is this important?

Well, it’s much easier to scale transactions and chains through instant finality.

Imagine if you’re at a shop and you’ll… pic.twitter.com/traM6OwHUo

— Michaël van de Poppe (@CryptoMichNL) June 17, 2025

This capability gives Algorand a distinct advantage over slower networks. For payment providers, near-instant settlement not only enhances the user experience but also supports greater scalability, making it easier to handle high transaction volumes efficiently.

Notably, protocols in the decentralized finance industry are built on the foundation of fast and reliable execution. Algorand’s architecture has these features, which attract projects that need reliability and speed. Additionally, these features make Algorand a compelling contender as the global demand for scalable blockchain infrastructure systems expands.

ALGO Price Action, Key Levels, and Technical Indicators

ALGO is trading at $0.1734 and is on a sustained decline after reaching a high of $0.49 earlier in the year. An active support area is visible on the daily chart at $0.1460. This zone has absorbed recent selling pressure and now defines the lower boundary of the current consolidation phase.

Source: TradingView

Technically, the 14-day Relative Strength Index stands at 33.04. This reading is near the oversold level of 30. The low RSI levels indicate that ALGO may be under pressure in the short term, although potential buyers might also be interested in the cryptocurrency should the indicator reach below 30. The MACD indicator also displays a weak bearish signal, with the MACD line at a value of -0.0096, nearly aligning with the MACD signal line at -0.0082.

If the altcoin price finds support and reverses course, levels of resistance stand at $0.2091 and $0.2750. A breakout above these levels may lead the asset to retest its high of $0.49. Long-term Fibonacci extensions suggest a target of $1 in the next cycle.

DeFi Ecosystem and User Activity Trends

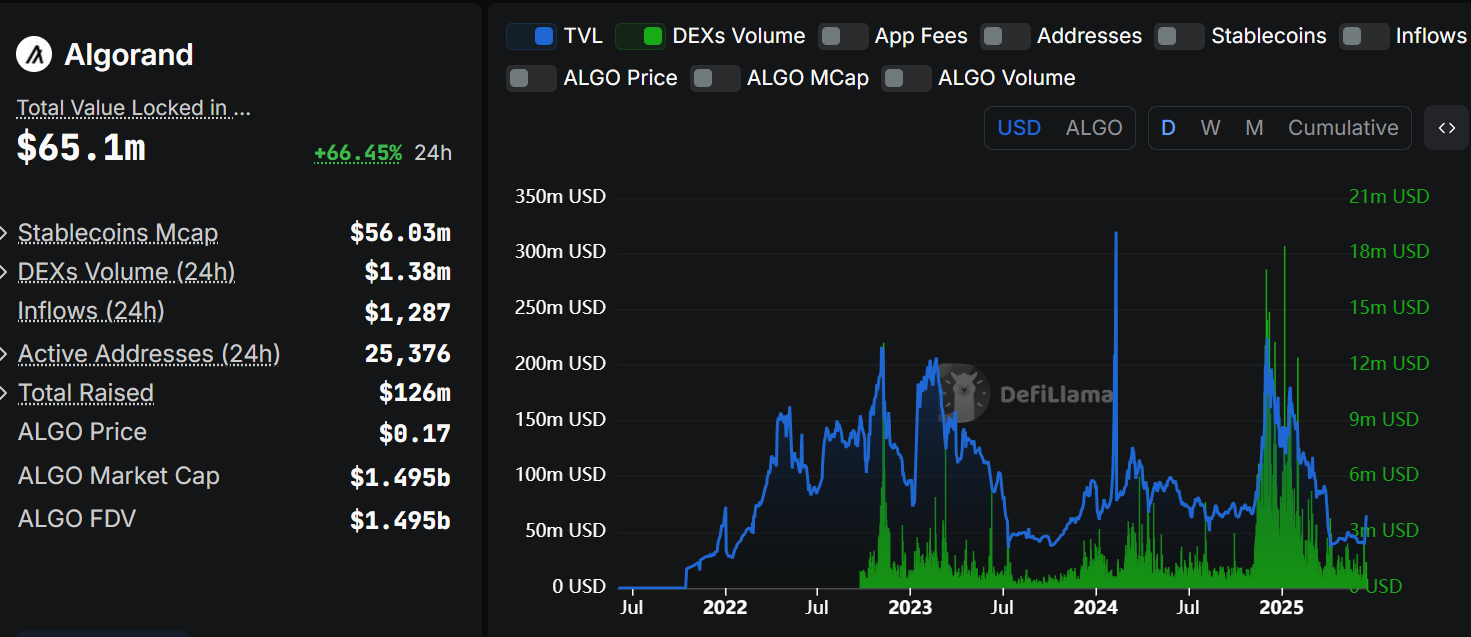

The DeFi ecosystem of Algorand is experiencing increased enthusiasm. The total amount of tokens locked amounts to $65.1 million, representing a 66.45% increase in the last 24 hours.

Source: Defillama

Additionally, stablecoins represent $56.03 million of the TVL, which highlights users’ desire for low-volatility assets. The volume in decentralized exchanges reached $1.38 million, while over 25,000 active addresses were recorded in daily activities.

Related: Altcoins To Stack Ahead of the June 17 FOMC Meeting

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here