Key takeaways:

-

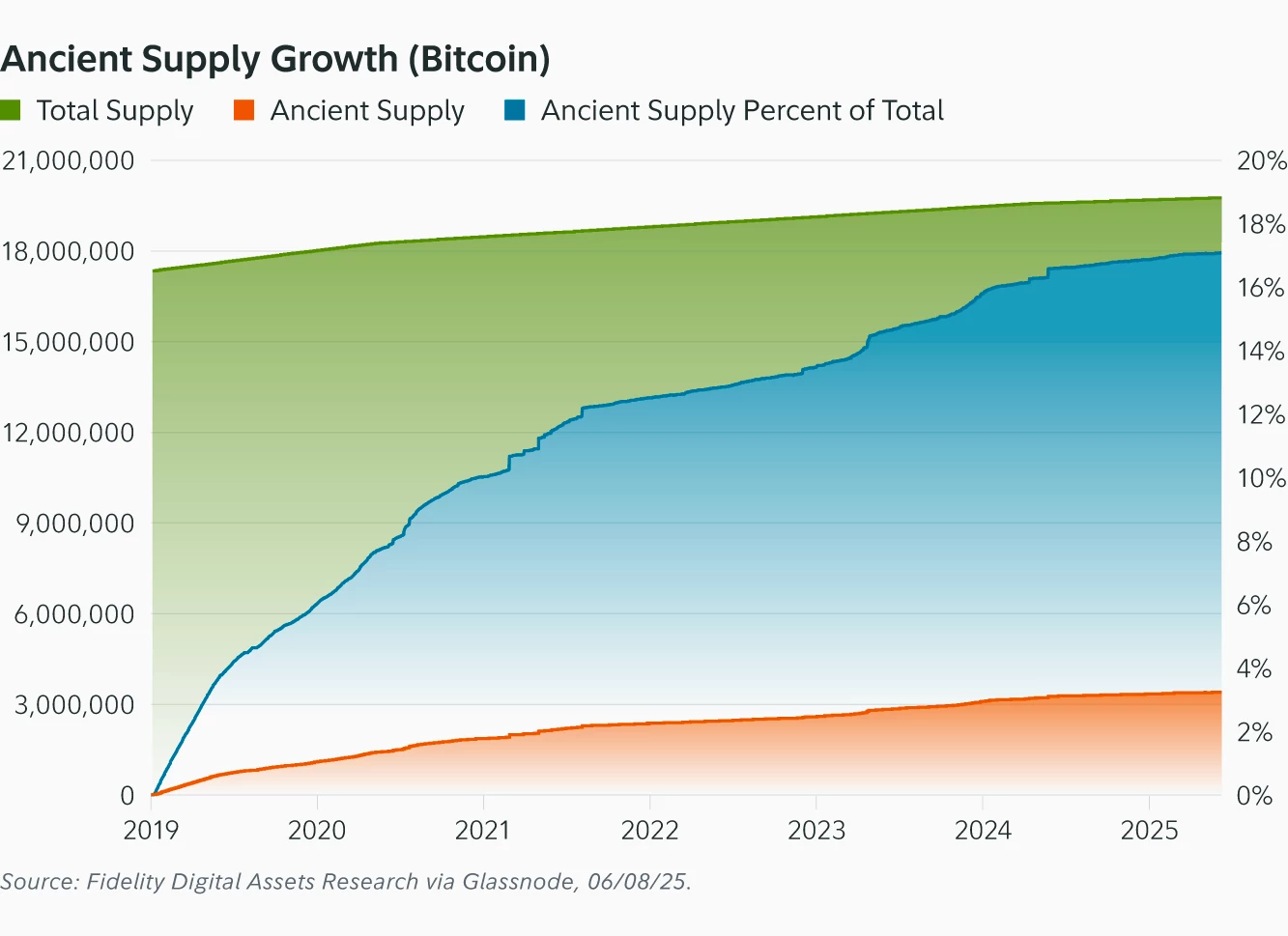

The number of Bitcoin held for over 10 years is increasing faster than new coins are mined—550 BTC/day versus 450 issued BTC/day.

-

17% of BTC is already considered illiquid, and projections suggest up to 30% by 2026.

Fidelity Digital Assets released a report highlighting a pivotal shift in Bitcoin’s supply dynamics after the 2024 halving. The report noted that the “ancient” Bitcoin supply, coins held for 10 years or more, has started to outpace new issuance, with 550 BTC entering the ancient supply category daily compared to 450 BTC issued.

This trend, coupled with steady purchasing from institutional investors, raises a compelling question: Could this increasing demand send Bitcoin’s price to $1 million?

The convergence of Bitcoin accumulation and scarcity

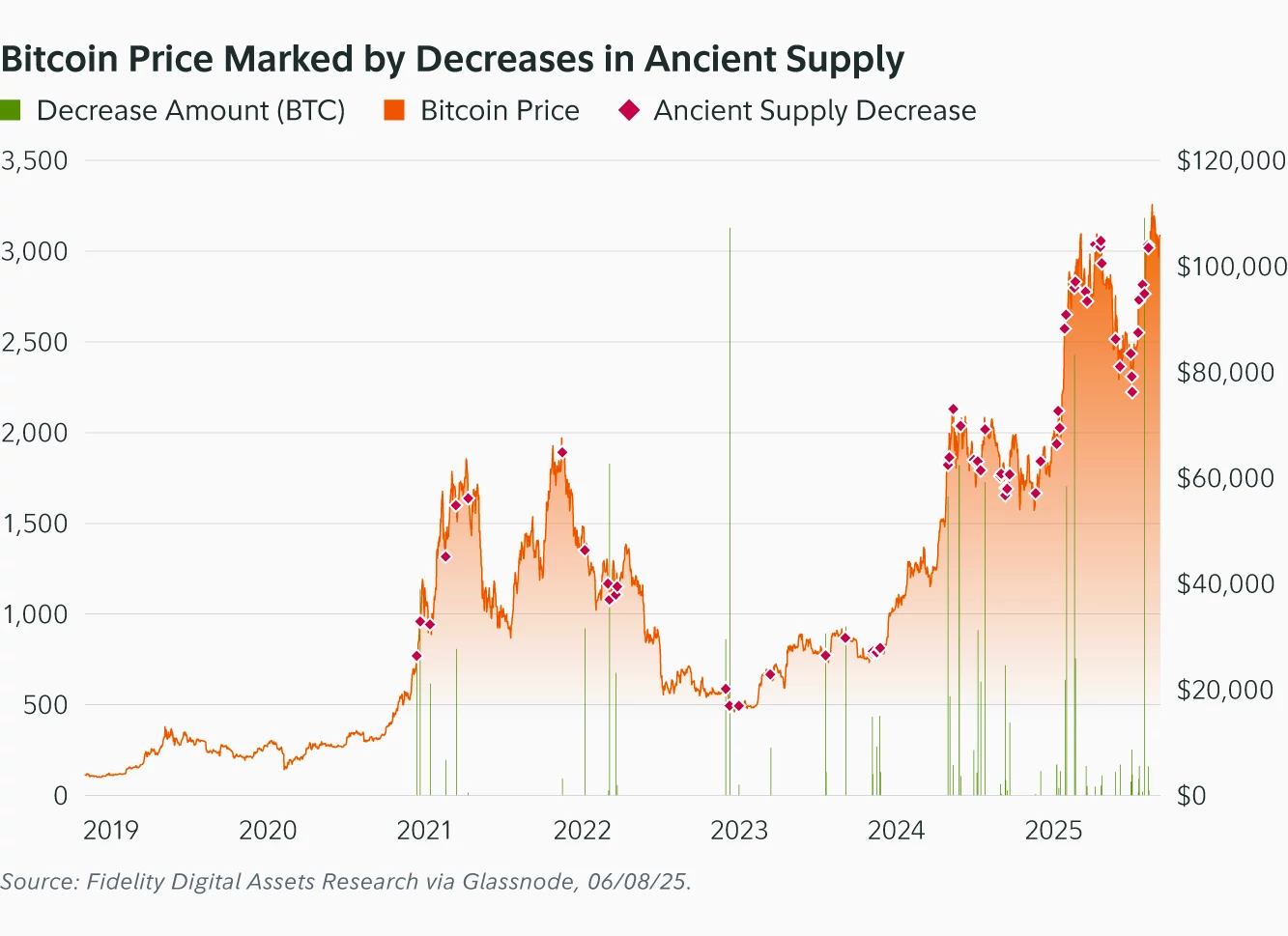

The current Bitcoin ancient supply is over 17% of the total issuance (3.4 million BTC valued at $360 billion at $107,000/BTC). This reflects strong holder conviction, with daily decreases occurring less than 3% of the time. The report projects this share could reach 20% by 2028 and 25% by 2034, tightening available supply.

At the same time, institutional investor capital is accelerating. According to Bitwise, Bitcoin inflows are expected to reach $120 billion by 2025 and $300 billion by 2026 in its base case scenario.

Diverse participants drive this: nation-states potentially reallocating 5% of gold reserves ($161.7 billion, or 7.7% of supply), US states adopting at 30% ($19.6 billion), wealth management platforms allocating 0.5% ($300 billion), and public companies doubling holdings ($117.8 billion). In a bull case, inflows could exceed $426 billion, absorbing over 4 million Bitcoin (19% of supply), further tightening liquidity.

This institutional accumulation, alongside ancient supply growth, suggests a scenario where a significant portion of Bitcoin’s supply becomes illiquid, potentially amplifying analysts’ price targets due to increasing demand.

Related: Price predictions 6/18: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, SUI, BCH

Bitcoin to $1 Million: A supply-demand thesis

Reaching $1 million per Bitcoin requires a market capitalization of $21 trillion, a tenfold increase from the current $2.10 trillion with 19,880,604 BTC mined, or 94.66% of the 21 million total. The fixed supply and growing illiquidity could facilitate BTC’s next significant milestone.

Historical trends after the halving events (2013, 2017, 2021) exhibit rallies driven by reduced supply growth and rising demand, supporting the thesis that current dynamics could lead to a similar outcome.

The impact of the ancient supply is evident, with 17% of the supply illiquid and projected to grow, the liquid supply diminishes. If institutional investors continue accumulating, 30% of the supply could become illiquid by 2026 (6.3 million BTC).

However, certain challenges still exist. After the 2024 US election, ancient supply has declined on 10% of days—nearly four times the historical average—indicating even long-term holders can sell during volatility. Similarly, five-year holder supply decreased 39% of days post-election, three times the typical rate, correlating with sideways price action in Q1 2025.

This suggests that while illiquidity trends are strong, market conditions can trigger supply increases, potentially moderating price appreciation.

However, Bitwise noted $35 billion in sidelined demand in 2024 due to risk-averse policies at Morgan Stanley and Goldman Sachs, which manage $60 trillion in client assets. Its bear case projects over $150 billion in inflows, while the bull case exceeds $426 billion, absorbing 4,269,000 BTC, underscoring significant demand potential.

Thus, Bitcoin’s ancient supply and projected institutional inflows form a narrative of increasing scarcity. While reaching $1 million is a mighty target, the current trajectories suggest it is a realistic price target.

Related: Norwegian crypto firm K33 raising more funds to buy up to 1,000 BTC

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here