US equities have hit their strongest position relative to bonds since the inauguration of the US president, which marks a crucial turning point in the international financial markets. In the recent session, stocks closed up by nearly 1%, with the SPY/TLT ratio, a crucial indicator of the comparative performance of the S&P 500 ETF and the iShares 20+ Year Treasury Bond ETF, retesting the all-time high first achieved in January 2025.

Market analysts, including Eric Balchunas, have highlighted how equities have repeatedly overcome bearish market narratives, reinforcing investor confidence. However, despite a 21% gain from April lows, the S&P 500 has struggled to break through the 6,000 level for over a month.

Stocks Outperform Bonds as Risk Appetite Returns

The latest chart data indicate that the ratio began growing in early January 2024, reaching a value of 100, and then increased steadily throughout the year. As of January 2025, the ratio had climbed above 140, signaling a phase where equities were outpacing long-term U.S. Treasuries. After a brief dip to 110 in early 2025, stocks quickly regained momentum, pushing the ratio back toward 140 by June.

US stocks have slayed yet another narrative (we’re close to 10 narrative deaths at this point) to close up 1% yest and are now at their strongest relative to bonds since Inauguration day. H/t @johnauthers for chart pic.twitter.com/jEKL7iXmrg

— Eric Balchunas (@EricBalchunas) June 17, 2025

This performance indicates a steady preference among investors for risk assets, as they rotate out of bonds amid changing economic expectations. Major support for the ratio appeared around the 110 and 120 levels, while the 140 area now acts as resistance. Each correction saw higher lows, underscoring sustained bullish sentiment in the equity market.

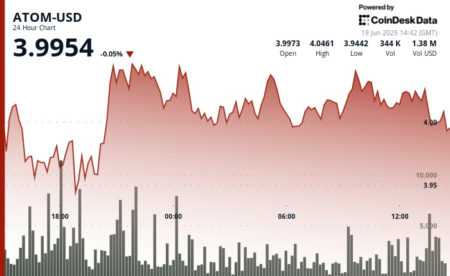

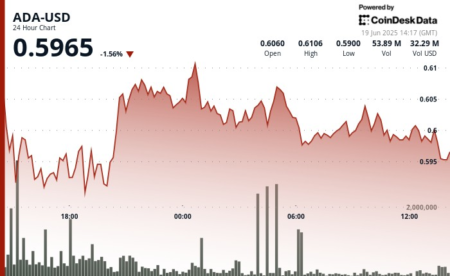

Crypto Prices React to Changing Macro Landscape

In contrast, Cryptocurrency has also experienced significant volatility, as geopolitical tensions and changes in investor sentiment influence the market. The cryptocurrency market experienced a liquidation of over $320 million in the last 24 hours, with long positions incurring the most substantial losses. The prices of Bitcoin, Ethereum, and several altcoins have declined as investors exhibit increased overall risk aversion, driven by concerns about rising conflict in the Middle East and an uncertain future related to the United States’ monetary policy.

The sell-off has not adversely impacted institutional interest in cryptocurrencies. According to recent data, there has been a lot of inflow into spot Bitcoin and Ethereum ETFs, demonstrating that long-term investors remain confident. According to market analysts, even as short-term volatility might continue, long-term involvement by institutions may support a more sustainable recovery of digital assets once geopolitical risks ease.

The current situation highlights the growing association between cryptocurrencies and traditional equities, notably when stocks outperform bonds during the current economic cycle. This correlation brings digital assets into the broader market volatility, primarily driven by risk sentiment. Consequently, crypto values will likely remain volatile in response to the changes in global equity markets in the short term.

Related: Bitcoin (BTC) Price Prediction For June 19, 2025

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here