The number of Bitcoin whale wallets has been on the rise in the past ten days, with a converse scenario seen among retailers, a historical bullish indicator.

Market intelligence platform Santiment highlighted this diverging market sentiment in a tweet on Thursday, as Bitcoin continues to hover around $105,000. Bitcoin started the week on a positive note, rallying to $109,000, but has quickly reversed, with current corrective momentum pushing prices to $103,402 at some point.

Whales and Retailers Share Diverging Sentiments

Meanwhile, Santiment identified that large and small Bitcoin holders are handling the recent dip differently. One group is buying more, and the other is paper-handing their BTC stash, but both hint at the market’s next move.

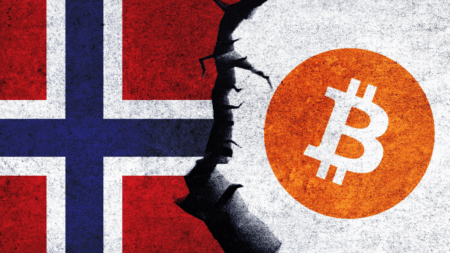

Specifically, whale wallets holding at least 10 BTC ($1.05 million) have increased by 231 in the past ten days, indicating that large holders are leveraging the dip to accumulate the crypto firstborn. However, retailers are FUDing out of their Bitcoin holdings, as addresses holding between 0.001 and 10 BTC have reduced by a staggering 37,465 (-0.16%) in the same timeframe.

Bitcoin Whale and Retail Network Activities in the Past 10 Days/Santiment

This suggests that Bitcoin is being exchanged between individuals and whales, as large holders scoop up the bitcoins that retailers are selling. Notably, Santiment has hinted at what this may mean for Bitcoin’s price.

What It Means for Bitcoin’s Price

The on-chain analytical firm highlighted that this indicates that whale and shark wallets are growing while smaller wallets are shrinking. Additionally, it suggests that large holders remain confident in Bitcoin’s near and long-term bullish momentum, while retail investors are panicking amid the recent drawdown.

Historically, this diverging sentiment often precedes bullish reversals. Santiment emphasized that it was the right combination for positive momentum to return to the crypto market.

Historical Performance Supports Bullish Outlook

Moreover, Bitcoin is still in a bull market, and historical data suggest that there is still time. A recent report from The Crypto Basic highlighted that while Bitcoin may be in its last lap, it still has time for more upside, as identified in its historic cycles and timeline.

Furthermore, an analysis by Coinvo has projected a rally to $290,000 by the end of 2025, “if everything goes according to plan.” The commentary also drew inspiration from Bitcoin’s usual uptick to an ascending trendline in each of its last two cycles and the possibility that BTC would continue the trend this cycle.

At the time of writing, Bitcoin trades at $105,524, 174% away from the $290,000 target.

Read the full article here