Shiba Inu is currently facing a significant hurdle that could result in further price decline.

June 2025 has remained bearish for Shiba Inu, with its price declining 9.02% month-to-date (MTD). This decline might not surprise early investors as June has historically been a bearish month for SHIB.

For context, SHIB recorded a loss of 4.75% in June 2021, followed by 12% and 11.5% declines in 2022 and 2023, respectively. Shiba Inu continued the downturn in the subsequent year, plunging about 32.3% by 2024.

While many investors expected this month to be different due to the anticipation of the 2025 bull run, SHIB is experiencing a nearly 10% MTD decline.

Shiba Inu Historical Performance Chart

Most Investors Incur Losses

Currently, SHIB is trading at $0.00001156, representing a 22.12% decline over the past month. The token has plummeted by 0.36% in the past day and 1.36% over the past week.

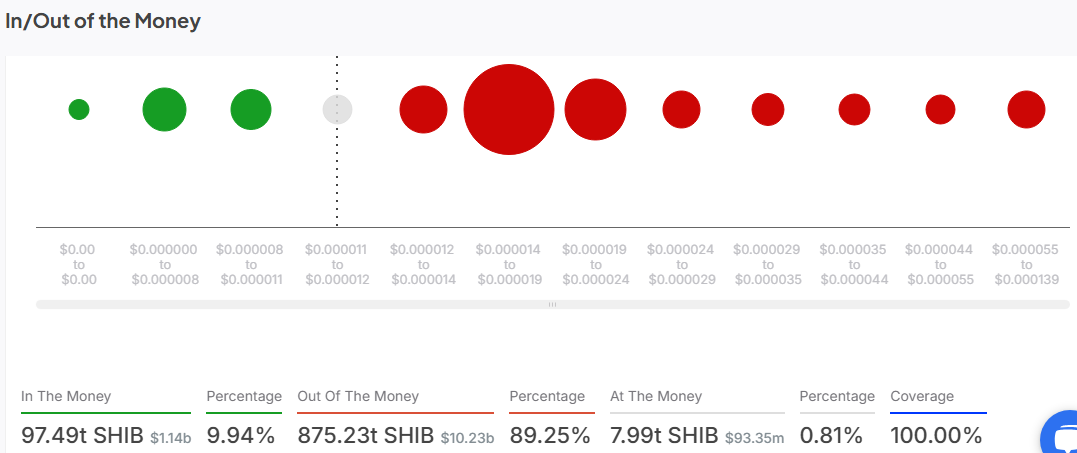

The recent downturn has impacted investors’ portfolios, with most individuals experiencing losses at the current price. According to IntoTheBlock’s In/Out of the Money chart, only a handful of Shiba Inu holders are currently experiencing investment gains.

The data suggests that 462,750 addresses are profitable, with a cumulative holding of 97.49 trillion SHIB tokens. In contrast, around 940,450 addresses holding a combined 875.23 trillion SHIB are currently in losses.

Additionally, only 45,340 addresses are currently breakeven, meaning they are neither in profit nor loss at the current price. Notably, the metric also comprises tokens held in Shiba Inu’s burn addresses.

IntoTheBlock In and Out of the Money metric for SHIB

Strong Resistance Ahead for Shiba Inu

While investors hope Shiba Inu recovers its lackluster performance, the asset faces major resistance. The coin’s immediate resistance zone lies within the $0.000012 to $0.000014 price range, where around 100,379 addresses hold 75.47 trillion SHIB.

While this supply zone might be easier to overcome, the next resistance could pose a significant challenge for Shiba Inu.

The next resistance level is around the $0.000014 to $0.000016 price region, where about 177,210 addresses hold 527.83 trillion SHIB tokens.

On the other hand, the next available support for SHIB is situated in the $0.000008 to $0.000011 price mark, where 210,070 addresses acquired 43.17 trillion tokens.

If bears breach this support, the next available support lies around the $0.000007 price mark, where 53.22 trillion SHIB tokens are held across 190,200 addresses.

In the meantime, investors remain confident in Shiba Inu, with most holding the token for the long term in anticipation of a price surge.

IntoTheBlock data shows that 1.13 million addresses have held 782.86 trillion SHIB tokens for over a year. In comparison, 284,300 addresses hold 174.71 trillion tokens between one and twelve months.

Read the full article here