The Ethereum Layer 2 (L2) ecosystem is experiencing a severe revenue crunch and market consolidation, according to a new report. Collective revenue for L2 networks outside of the top three, Base, Arbitrum, and Optimism, collapsed by 98% between March and May, falling from a peak of $53.8 million to under $1 million.

This dramatic decline in income for smaller L2s signals a significant shift in user activity and developer trust toward the more established networks. With the broader Ethereum scaling ecosystem evolving rapidly, capital and users appear to be gravitating toward networks with stronger fundamentals and brand recognition.

L2s fees excluding Base, Arbitrum, and Optimism have collapsed from $54M to less than $1M https://t.co/gLu77OMfk0

— Messari (@MessariCrypto) June 19, 2025

Market Share Consolidates Around Top Three L2s

The collapse in revenue signals a shift in both user activity and developer trust. While Arbitrum, Optimism, and Base continue to draw volume and usage, lesser-known L2s are struggling to maintain relevance.

The drop in income can largely be attributed to declining transaction fees and minimal DeFi activity. This suggests users are exiting these platforms or simply not engaging at the same rate.

Related: ARB Bulls Aim Higher as Bears Block $1.06 in Volume-Driven Market

Besides low usage, market sentiment toward minor L2s has also weakened due to unclear roadmaps, lack of liquidity, and fragmented communities. Consequently, investors are opting for networks that show consistent updates, ecosystem growth, and integrations with major dApps and protocols.

Technical Breakdown of Leading L2 Tokens

Among the leading L2 tokens, Base is trading at $0.000003 with highly volatile intraday swings. Resistance is firm at $0.0000033, while support appears at $0.00000305.

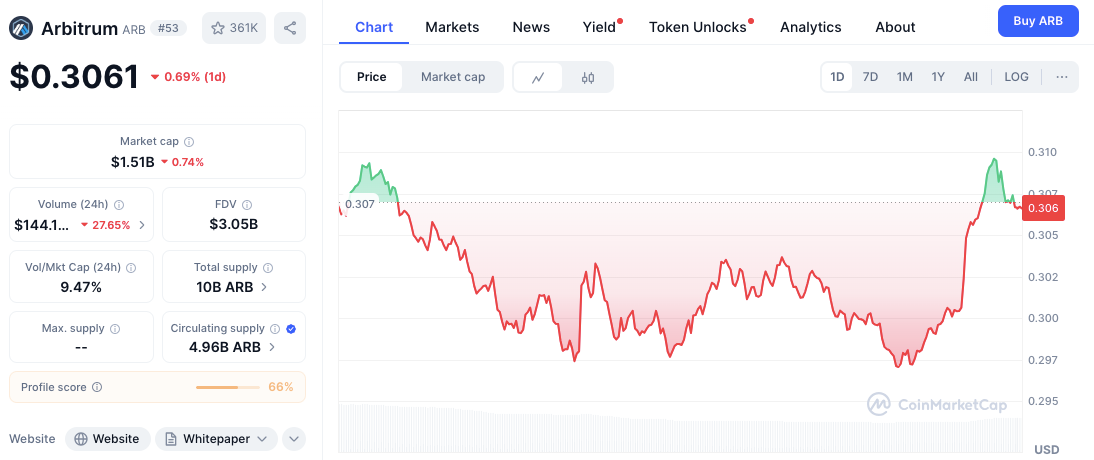

Source: CoinMarketCap

Daily volume is low at $12.9K, indicating thin liquidity and high price risk. The token’s large supply of 929.45 billion limits its upside potential unless demand spikes dramatically.

Related: Crypto Market on Alert From This Week’s $209 Million Tokens Unlock

Source: CoinMarketCap

Arbitrum’s token (ARB) hovers around $0.3065, showing a V-shaped recovery after dipping to $0.295. Resistance levels include $0.307 and $0.310, while $0.295 and $0.300 serve as critical support points. Despite minor pullbacks, the trend remains stable.

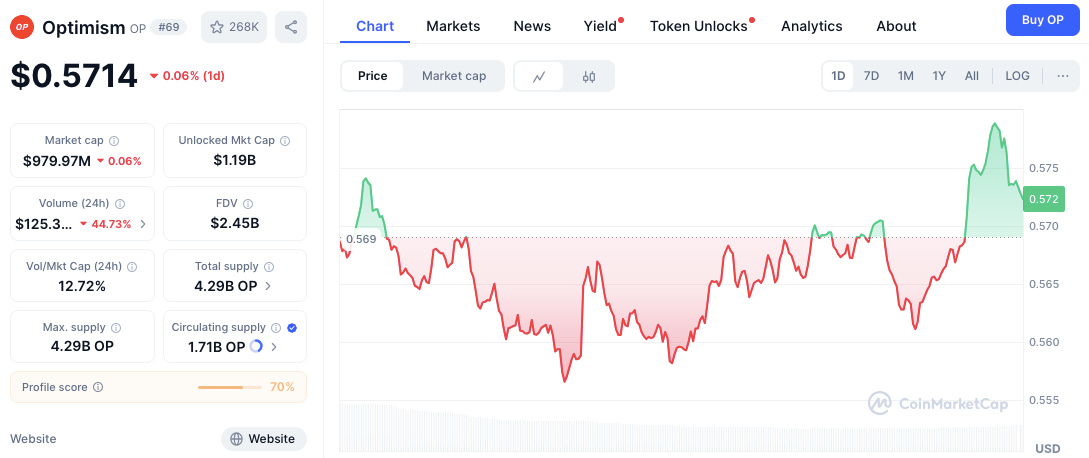

Source: CoinMarketCap

Optimism (OP), priced at $0.5717, reflects a bullish accumulation pattern. With support at $0.560 and resistance around $0.575, the token shows short-term strength. A breakout above $0.575 may lead to a move toward $0.585.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here