Arbitrum’s Layer-2 (L2) ecosystem is heating up, with the traction seen in booming real-world asset (RWA) integrations and breakout DEXs (decentralized exchanges).

According to on-chain data, last week’s numbers suggest a structural shift in DeFi leadership may be underway.

Arbitrum Surges as Real-World Assets and New DeFi Leaders Drive Growth

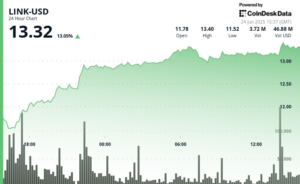

Data from Dune Analytics shows that Arbitrum (ARB) generated $1.43 million in protocol revenue last week, marking a 23% jump compared to the previous week.

The increase signals a resurgence in user activity and developer momentum on the network. Accordingly, this has cemented Arbitrum’s position among the top Layer-2 networks.

As of this writing, Arbitrum’s total value locked (TVL) sits at $2.42 billion, according to DefiLlama. A key driver of this growth is real-world assets.

Tokenized RWAs on Arbitrum have reached an all-time high of $300 million, with on-chain analysts projecting a surge to $1 billion by the end of the year. This milestone reflects the network’s fast-maturing use cases beyond traditional decentralized finance (DeFi).

Entropy Advisors highlighted that the surge was partly driven by Spiko’s tokenized short-term Eurobills (EUTBL), which added nearly $30 million overnight. The EUTBL currently accounts for $128 million, or 41.6% of all RWAs on Arbitrum.

TVL in the RWA category has grown 30x year-on-year (YoY), further highlighting institutional interest in on-chain yield-bearing instruments.

DeFi Fragmentation Challenging Arbitrum’s Growth Trajectory

Still, the revenue surge comes with a caveat. Arbitrum’s trading and protocol revenue is highly sensitive to broader market volatility.

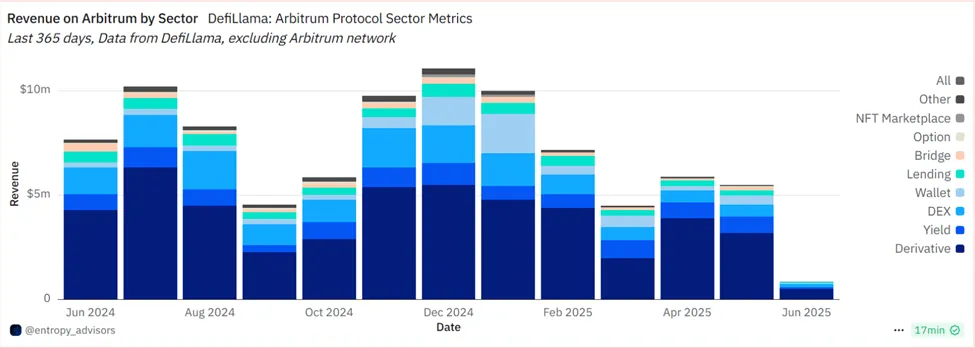

In May 2025, Arbitrum-based protocols collectively generated $5.5 million in revenue, a 6.54% month-over-month (MoM) drop.

Entropy broke down the categories, highlighting derivatives, which led with $3.18 million, followed by Yield ($781,000), DEXs ($599,000), Wallets ($421,000), and Lending ($251,000).

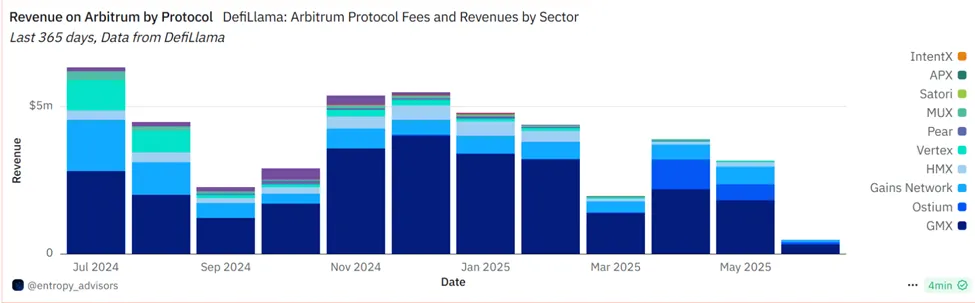

Meanwhile, GMX perpetual DEX remains dominant amid a fast-shifting derivatives sector, but rivals like Gains Network and HMX are tightening the race. Ostium, however, has emerged as a dark horse, recently surpassing Vertex in volume and market share.

This rising competition among perpetual DEXs is driving innovation and pressuring smaller protocols to differentiate or consolidate.

The yield sector is also in flux. Penpie has attracted the bulk of yield-hunting users in recent months, while other platforms like Beefy, Pendle, and Toros are competing for niche strategies and integrations. Meanwhile, in the DEX arena, Uniswap (UNI) continues to lead revenue generation, but Mayan has climbed the ranks in market share.

As DeFi narratives continue to fragment, from RWAs to advanced derivatives, Arbitrum’s ability to host a diverse range of top-performing protocols reinforces its dominance in the Layer 2 wars.

With projects like Spiko, Ostium, and Penpie gaining traction, the next wave of Arbitrum growth may come from real utility rather than hype.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here