The President Trump-backed crypto project, World Liberty Financial, has a new investor—which just snapped up $100 million worth of WLFI tokens.

In a joint statement with World Liberty Financial issued Thursday, United Arab Emirates-based crypto fund Aqua 1 Foundation said that it bought the large sum of WLFI tokens “to help accelerate the creation of a blockchain-powered financial ecosystem.”

It added that the buy was helping merge the worlds of traditional finance and decentralized finance.

“Together, WLFI and Aqua 1 are building the definitive bridge between legacy systems and blockchain innovation—an institutional-grade marketplace delivering unparalleled access to traditional assets,” the joint statement read.

Decrypt reached out to both WLF and Aqua 1 Foundation for comment, but did not immediately receive a response from either party.

WLFI is World Liberty’s native governance token. In the crypto and decentralized finance space, holders of a governance token can vote to make changes to how the project is run.

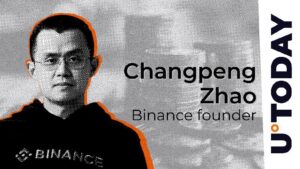

Only accredited investors can buy WLFI tokens right now, but the project also has a stablecoin, USD1, which is available on major crypto exchanges. World Liberty Financial has drawn increased scrutiny of late over the use of USD1 to settle a $2 billion investment from Abu Dhabi-based sovereign wealth fund MGX into leading crypto exchange Binance.

Details on the Ethereum-based World Liberty Financial platform are so far vague, but those behind the project have said it will be a decentralized finance—or DeFi—borrowing and lending platform where users will be able to earn rewards with their crypto.

DeFi projects are experimental apps that typically work to do things that banks do—but in a faster, more efficient, and decentralized way without middlemen involved.

World Liberty was first teased by President Trump’s son, Eric, last year and is led by DeFi builders Chase Herro and Zak Folkman, along with the Trump family and Witkoff family.

The Witkoffs are close with the Trumps and Steve Witkoff—a long-time golfing buddy of President Trump—now works as the White House’s special envoy to the Middle East.

Lawmakers—particularly Democrats—have raised concerns about conflicts of interest with the project, especially as the Trump family has made millions from token sales. President Trump recently disclosed a $57.3 million windfall from the project’s token sale.

In May, Sen. Richard Blumenthal (D-CT) started an investigation into World Financial Liberty and its ties to the President.

A business entity linked to President Trump and his family, DT Marks DEFI LLC, this month cut its ownership share in World Liberty Financial from 60% to about 40%.

Edited by Andrew Hayward

Read the full article here