In Q1 2024, Korean crypto markets witnessed their highest trade volume in over two years, with KRW overtaking USD in cumulative trade volume, Kaiko says.

Trade volume in Korean crypto markets soared to its highest level in over two years in early March, driven by an improved macroeconomic environment and heightened competition among local exchanges, according to data from blockchain analytics firm Kaiko.

Despite Upbit‘s longstanding dominance in the South Korean crypto scene, boasting an average market share of 82% over the past three years, the recent changes in the landscape appear to have brought more competition to the market, with Bithumb and Korbit launching zero-fee campaigns toward the end of 2023.

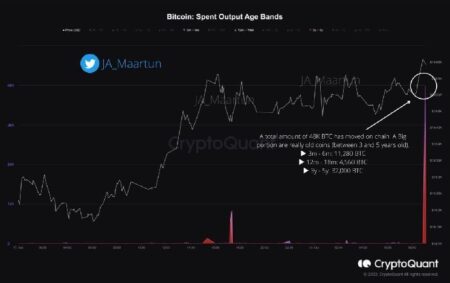

Trave volume on Korean crypto exchanges in Q1 2024 | Source: Kaiko

You might also like: Bitcoin ETFs under review by South Korean regulators, FSS governor shares insights

Although Korbit’s market share has seen minimal growth, hovering around 1% in 2024, Bithumb experienced a significant surge, tripling its market share in the months following the implementation of its zero-fee policy in October 2023, analysts at Kaiko say. Despite the success of the zero-fee strategy in driving trade volume, the analysts noted that Bithumb faced a substantial revenue decline of 60% in 2023, prompting the exchange to discontinue the initiative.

“The significant decline in revenue may have prompted the exchange to discontinue its zero-fee campaign on Feb. 5, just five months after its launch.”

Kaiko

Although there has been a slight decrease in KRW volumes in early April, Kaiko says market sentiment across the Asia-Pacific region could receive a boost given the recent approval of spot Bitcoin and Ethereum exchange-traded funds (ETFs) in Hong Kong.

As crypto.news reported earlier, HashKey and Bosera International secured conditional approval from the Hong Kong Securities and Futures Commission for two spot crypto ETFs, signaling a pivotal moment for Asian investors. It’s anticipated that the Hong Kong Stock Exchange will require approximately two weeks to finalize preparations for product listing and related matters.

Read more: Crypto.com to launch services for retail traders in South Korean market

Read the full article here