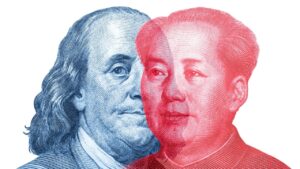

Circle Internet Financial’s stablecoin, USDC, has surpassed Tether’s USDT as the market leader in transaction volume this year, according to data compiled by Visa Inc. in partnership with Allium Labs.

The adjusted stablecoin metric, which aims to reflect the state of the stablecoin market while minimizing potential distortions from inorganic activity and artificial inflationary practices, shows USDC’s growing market share since the start of 2024.

Last week, USDC recorded $456 billion in transaction volume compared to $89 billion for USDT, with USDC accounting for 50% of total transactions since January.

This finding challenges the common perception that USDT is the industry’s dominant stablecoin, which is based on its 68% share of coins in circulation relative to USDC’s 20%, according to DefiLlama data.

Noelle Acheson, author of the Crypto Is Macro Now newsletter, suggests that the discrepancy may be explained by USDT being more widely held outside the US as a dollar-based store of value, while USDC is used in the US as a transaction currency.

Stablecoins, which aim to maintain a steady price in line with a fiat currency, typically the US dollar, play a crucial role in the crypto ecosystem by helping traders move funds in and out of tokens and facilitating payments for purposes such as cross-border remittances.

The findings come in the wake of Circle’s involvement in the US banking crisis last year, which saw the total value of USDC in circulation fall from a high of $56 billion to $23 billion in December 2023 after Circle revealed a $3.3 billion exposure to the ill-fated Silicon Valley Bank.

However, the value of USDC in circulation has since rebounded to $32.8 billion.

However, interpreting stablecoin transaction data can be challenging due to the various use cases and the potential for transactions to be initiated manually by end-users or (programmatically) through bots, as Visa’s Head of Crypto, Cuy Sheffield, explained in a recent blog.

When cleansed of trades linked to bots, the total transfer volume over the 30 days prior to April 24 fell from $2.65 trillion to $265 billion, according to Cuy Sheffield, head of crypto at Visa.

Read the full article here