The broader cryptocurrency market is in a bearish state, led by Bitcoin (BTC), which is grappling with maintaining its price above $60,000. Notably, the market has responded negatively in the short term to the Bitcoin halving event.

However, there are indications that several cryptocurrencies may experience a surge in their market capitalization. While the possibility of achieving increased capitalization largely depends on the broader recovery of the crypto market, these assets retain several fundamentals likely to drive growth.

In this context, Finbold has identified two digital assets likely to reach a market cap of $50 billion by May 2024. The cryptocurrencies fall under altcoins and can benefit from the anticipated altcoin season.

XRP

Undoubtedly, XRP’s price performance has been a source of frustration for many of its investors. It remains predominantly in a consolidated phase below the $1 mark. Presently, the token faces downward pressure from overall market sentiment, struggling to maintain support above the $0.50 threshold.

Nevertheless, numerous market participants remain optimistic about XRP’s prospects in the months ahead. In particular, positive developments stemming from the ongoing legal disputes between Ripple and the Securities and Exchange Commission (SEC) could serve as crucial catalysts for the token to regain momentum. Additionally, Ripple’s planned stablecoin launch is seen as a favorable move that could attract more participants to its platform, benefiting XRP.

From a technical analysis standpoint, analyst Dark Defender noted that XRP appears to be exhibiting a trading pattern reminiscent of its behavior between 2013 and 2017. Notably, the analysis highlights similarities in price movements, especially with regard to lows aligning with a key support line, which preceded a substantial uptrend in XRP’s value. As the market enters May, this pattern could potentially lay the groundwork for a rally, potentially leading to a market capitalization of $50 billion.

At present, XRP’s market capitalization is $27.64 billion, which indicates that an 80% increase is needed to reach the desired $50 billion milestone.

Dogecoin (DOGE)

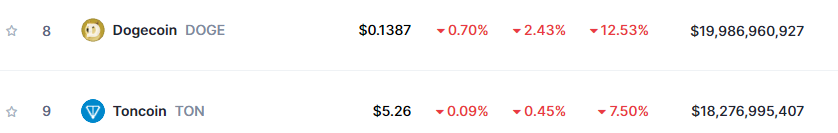

In April, the meme coin seemed poised to reach the $1 milestone and potentially achieve a $50 billion market cap, but it faced a setback due to prevailing bearish market sentiment. Notably, several on-chain metrics suggest bullish signs for Dogecoin (DOGE).

Despite recent underperformance, April 27 data from the crypto market intelligence platform Santiment revealed a 13.8% increase in non-empty DOGE wallets over the last three months. This surge indicates growing confidence in the meme coin, likely translating to investor trust.

Additionally, crypto analyst Ali Martinez predicts a potential price spike for DOGE soon. Martinez suggests that after a consolidation phase following a “descending triangle” pattern, DOGE could hit the $1 milestone, mirroring its past performance.

Additionally, Dogecoin stands to benefit from its steadfast supporters, including Tesla (NASDAQ: TSLA) CEO Elon Musk, and associated products such as the forthcoming X Payments.

Dogecoin would need a substantial 150% increase to reach the $50 billion market cap threshold.

Overall, as May approaches, the market anticipates a potential post-halving rally, which is expected to benefit the mentioned cryptocurrencies in their pursuit of reaching a $50 billion market cap.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here