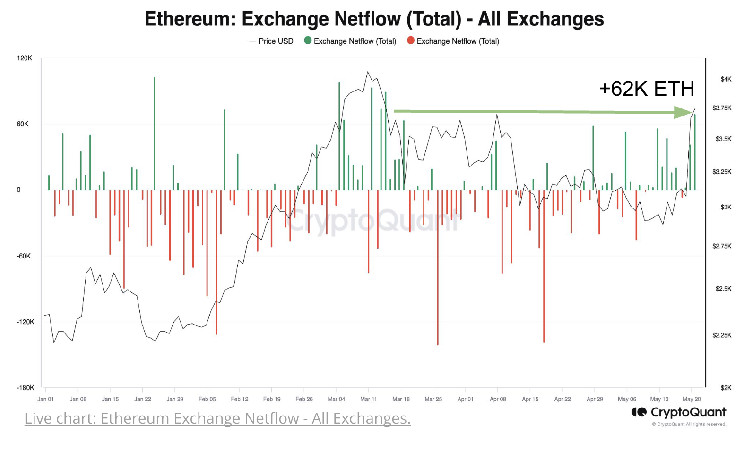

Exchanges experienced a net inflow of 62,000 ETH ($231 million) this week, suggesting a period of volatility is coming.

Daily spot buying from ETH permanent holders hit its highest level in 2024 this week.

A significant price correction is expected if a spot ether ETF is delayed or denied due to high levels of open interest.

Ether (ETH) is expected to experience a period of volatility this week due to exchange inflows spiking to the highest level since March, according to a report by data provider CryptoQuant.

The daily net flow of ETH, which tracks inflows and outflows to exchanges, hit 62,000 ether ($231 million) this week. High exchange flows are typically associated with volatility, the report said.

The surge in deposits comes on the back of a significant rally in ether, with prices rising by 22% in two days after Bloomberg analyst James Seyffart said that the odds of spot ether exchange traded-fund (ETF) approval have increased to 75% and multiple reports that filing process with the U.S. Securities and Exchange Commission (SEC), for the ETFs, are suddenly seeing progress.

Traders responded by aggressively opening ETH long positions on perpetual exchanges and buying spot, resulting in the largest daily spot buying from ETH permanent holders so far in 2024. These trades were placed in the hopes that ETH price will see a similar uptick that bitcoin (BTC) has seen since the news of the approval of U.S. spot ETFs started to make the rounds last year.

The increase in demand for ETH led to a short squeeze, with 9,300 ETH being liquidated on the short side over a 48-hour period.

CryptoQuant warns that if an ether ETF application is delayed or denied, a significant price reaction could occur due to high open interest, which currently stands at a record high of $11.7 billion.

Read more: Ether ETF Hopes Drive Futures Open Interest to Record $14B

Read the full article here