In the current analysis of Cardano (ADA) on both the 4-hour and daily charts, several crucial support levels have emerged that could significantly influence the mid-term bullish momentum.

These support levels, identified through Fibonacci retracement and Ichimoku cloud analysis, are essential for traders to monitor closely.

Cardano Price Technical Outlook

4-Hour Chart Key Support Levels:

$0.4783 (38.2% Fibonacci Level): This level is the initial support. A break below it could signal weakening bullish momentum and lead to further downward pressure.

$0.4584 (61.8% Fibonacci Level): Holding above this level is critical for maintaining the bullish outlook. A dip below this point could indicate a potential trend reversal.

ADA/USDT (4H/ 1D). Source: TradingView

Daily Chart Key Support Levels:

$0.4870 (61.8% Fibonacci Level): This level on the daily chart is crucial. Staying above it supports the continuation of the bullish trend. A break below it could invalidate the current upward momentum.

$0.4501 (78.6% Fibonacci Level): Often a strong support zone, a break below this level would suggest a significant shift in market sentiment towards a bearish trend.

If ADA breaks into the daily Ichimoku cloud, targeting the range of $0.5388 to $0.5709, it could propel the price to higher levels in the mid-term.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

The Ichimoku cloud on the daily chart provides a major resistance around the $0.4645 level. Breaking inside this cloud is important for sustaining the bullish trend. A break below the cloud could lead to increased selling pressure and potential trend reversal.

On-Chain Analysis of Cardano (ADA): Bullish Indicators

The on-chain metrics for Cardano (ADA) present a bullish outlook. Here are some key points:

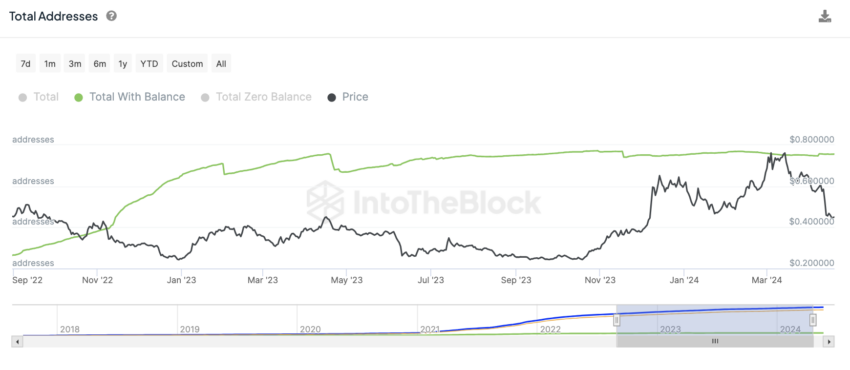

Total Addresses with Balance:

The number of addresses holding ADA with a positive balance has been steadily increasing, which indicates growing adoption and interest in the Cardano network. This metric is crucial as it shows that more participants are entering the market, which can drive demand and price appreciation.

ADA Total Addresses With Balance. Source: IntoTheBlock

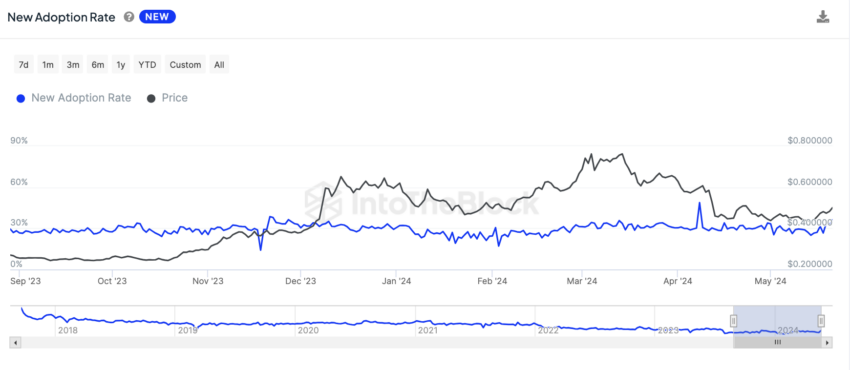

New Adoption Rate:

The adoption rate of ADA has been showing positive trends. Despite fluctuations in price, the consistent increase in new addresses suggests a healthy influx of new users. This is a positive sign for the long-term growth and stability of the Cardano network.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

ADA New Adoption Rate. Source: IntoTheBlock

Strategic Recommendations: Bullish to Neutral Outlook

Given the current technical and on-chain analysis, Cardano (ADA) shows a bullish to neutral outlook. Here are some strategic recommendations:

Keeping a close watch on these support levels is crucial to mitigate the risk of a potential price reversal.

If ADA breaks into the daily Ichimoku cloud, specifically the range of $0.5388 to $0.5709, this could signal a move to higher levels in the mid-term.

Review on-chain metrics such as the total number of addresses with a balance and the new adoption rate regularly. Increasing metrics can reinforce a bullish outlook, while stagnation or decline might signal a need to reassess positions.

Read the full article here