Decentralized finance (DeFi) platforms continuously transform, bringing innovative financial solutions and enhancing security through distributed systems. An essential component of the dYdX Chain’s functionality is its staking mechanism: as with other Proof-of-Stake consensus mechanisms, it secures and stabilizes the chain whilst enabling the community to actively participate in governance and consensus processes.

This article provides a guide to staking DYDX tokens on the dYdX Chain, from understanding the basics of staking to managing and optimizing your positions.

The Importance of Staking on dYdX Chain

Staking in the context of blockchain technology involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network and receive rewards. In many Proof of Stake (PoS) mechanisms, staking contributes to the network’s security and efficiency. Users stake their tokens to gain the right to participate in managing the network, including voting on protocol changes and validating transactions.

dYdX Chain leverages the Cosmos SDK Staking module which supports a PoS blockchain and enables DYDX holders to become Validators and/or delegate the stake of their DYDX to a dYdX Chain Validator.

For the dYdX Chain, staking is not only a measure to secure the network but also a mechanism to reward stakers. Stakers help to decentralize the Validator set improving the decentralization of the network. In return, they earn staking rewards, which are predominantly derived from the trading fees generated by the platform.

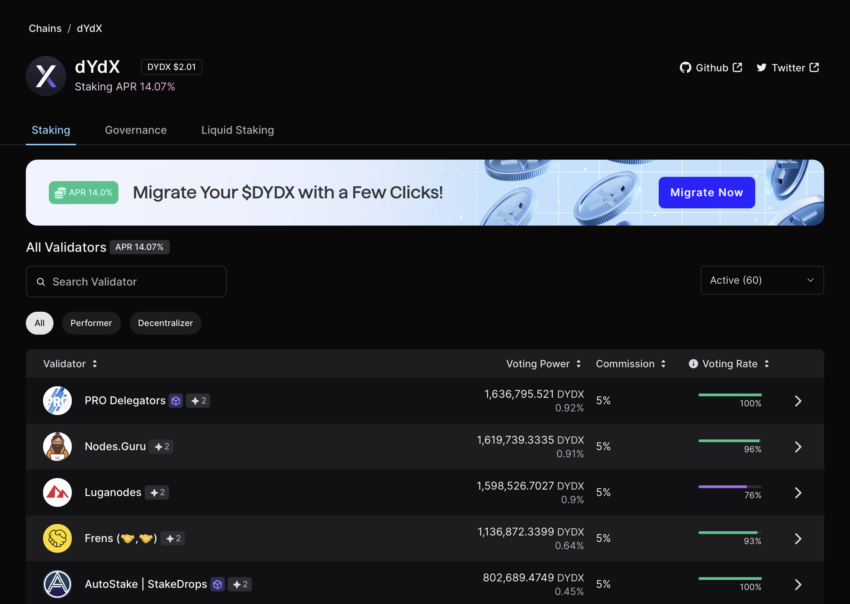

DYDX staking data. Source: Mintscan

dYdX distributes 100% of protocol fees to stakers in USDC instead of the native token. As of today, the protocol has allocated $24.6 million to over 21,000 stakers. According to Mintscan, current APR for staking DYDX sits at 19,45%.

How to Stake DYDX

The process of staking DYDX tokens involves several key steps:

Staking

Staking DYDX tokens on the dYdX Chain is key to secure the network, rewards stakers with USDC staking rewards and enables the community to participate in governance.. This guide will provide you with a clear and concise method to stake your DYDX using the Keplr wallet, which interfaces directly with the dYdX Chain, allowing for both standard and liquid staking options. Staking is also available through Ledger Live, Leap and Anchorage. Over time it’s likely there will be additional staking providers to choose from.

Step-by-Step Procedure

1. Bridge Tokens:

First, make sure your DYDX tokens are on the dYdX Chain by following the bridging from Ethereum to dYdX Chain how to guide.

2. Setup Keplr Wallet:

- New Users: Install the Keplr wallet extension, create an account, and navigate to the staking dashboard.

- Existing Users: Import your wallet using a secret phrase and navigate to the staking dashboard.

Keplr staking dashboard. Source: Keplr

Staking:

- Access the ‘Staking’ section on the Keplr Dashboard.

- Choose a Validator from the list and decide the amount of DYDX to stake.

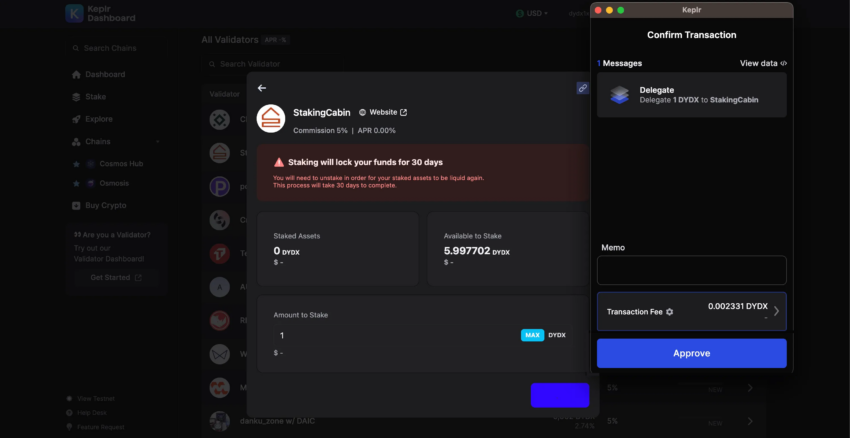

- Confirm the transaction by paying the required gas fee.

Staking DYDX. Source: Keplr

Follow this How-to-Stake guide for further information.

Liquid Staking Option

You can also opt for liquid staking through platforms like Stride, Quicksilver and pStake Finance, which allows you to stake DYDX and receive liquid staking tokens in return.

Staking DYDX is a straightforward process: once your tokens are bridged and your Keplr wallet is set up, you’re ready to jump in. By staking, you not only help secure the network, you receive 100% of protocol fees distributed to dYdX Chain Stakers. Choose your Validator/s wisely to maximize your returns and secure your investment.

Redelegating

Redelegating DYDX tokens allows you to shift your staked tokens from one Validator to another on the dYdX Chain without undergoing an un-bonding period. This guide will walk you through the process of re-delegation using the Keplr wallet, ensuring your tokens remain active and continue earning rewards while switching Validators.

1. Access Validators List:

Log into your Keplr wallet and navigate to the staking section where your current validators are listed.

2. Initiate Redelegation:

- Click the arrow next to the validator where your DYDX tokens are currently staked.

- Select “Redelegate” from the options.

3. Select New Validator:

- Choose a new validator to whom you wish to shift your delegation.

- Enter the amount of DYDX tokens you want to redelegate and confirm by clicking ‘Redelegate’.

- Complete the transaction by paying the necessary gas fees on the dYdX Chain

4. Confirmation

After the transaction, check your dashboard to confirm the update to your staked tokens’ allocation.

Re-delegation is a valuable feature that enhances flexibility in staking strategies without sacrificing reward potential. It’s essential to consider the performance and reliability of new Validators Remember, the slashing risk of your tokens will follow the original Validator’s performance until the end of the u-nbonding period.

Unstaking

Unstaking DYDX tokens is a process to remove your tokens from being actively staked to a Validator on the dYdX Chain. This guide provides an overview of the steps to withdraw your stake using the Keplr wallet, detailing the un-bonding period and the management of the tokens post-unstake.

Step-by-Step Procedure

-

Access Keplr Dashboard:

Open your Keplr wallet and navigate to the validators to whom you have staked DYDX tokens. -

Begin Unstaking:

- Click on the Validator from whom you wish to remove your stake.

- Enter the number of DYDX tokens you wish to un-stake and confirm by clicking ‘Undelegate’.

- Pay the necessary gas fee on the dYdX Chain to process the transaction.

-

Un-bonding Period:

Note that your DYDX tokens will enter a 30-day un-bonding period, during which they are not active but still under the slashing risk from the original validator.

Un-staking DYDX tokens allows you to regain control of your assets, but it requires understanding the risks and timing due to the un-bonding period. Once unstaked, you can choose to restake with a different Validator or manage your tokens as you see fit. This flexibility supports diverse strategies aligned with your investment goals and risk tolerance.

Key Considerations in Staking

Validator Performance

The choice of Validator is crucial since a Validator’s performance and reliability affect the staking rewards. Validators with high uptime and efficiency in transaction processing are likely to generate higher rewards for their stakers.

Slashing Risks

Staking on blockchain networks involves certain risks, including slashing. If a Validator acts maliciously or fails to fulfill their duties, they and their stakers may be penalized by slashing (partial loss) of the staked tokens. Therefore, choosing a reputable and reliable validator is essential.

Lock-Up Periods

Staked DYDX tokens are locked up during the staking period, which means they are not liquid and cannot be traded or transferred. Understanding the terms related to the lock-up period, including any conditions that might affect the ability to withdraw or move staked tokens, is vital for effective staking strategy planning.

Advanced Staking Strategies

Experienced stakers might engage in strategies such as staking derivatives, where they use synthetic assets to represent staked tokens, allowing them to remain liquid. Additionally, dynamic staking strategies might involve shifting stakes between validators based on performance and reward forecasts.

Conclusion

Staking DYDX tokens secures and stabilizes the network, rewards stakers with 100% of protocol fees distributed in USDC and enables the community to participate in governing a fully decentalized market leading protocol. To date over 15%(153M) of the total DYDX token supply is locked up and securing the dYdX Chain. When selecting Validators DYOR, manage risk, and if you decide to engage in advanced staking strategies understand the risks.

Read the full article here