According to the latest report from CoinGecko, the NFT market is experiencing a period of significant difficulty.

Unlike the rest of the crypto assets, where there is an increase in participation, in the non-fungible token exchanges it is still a bear market.

The perspective emerges both on the front of the prices of the major collections and on the overall sales volumes of the market.

Let’s see everything in detail below.

CoinGecko: the crypto winter for the NFT market is not over yet

According to CoinGecko, the largest independent cryptocurrency data aggregator, the NFT market is still in a bear market.

From the latest report published, it clearly emerges how the community has significantly reduced its investments in the sector.

In fact, while on one hand the market for crypto assets has grown significantly during 2024, we cannot say the same for the counterpart of non-fungible tokens.

Especially in the third quarter, CoinGecko observes trading volumes decreasing by 61% from 3.1 to 1.2 billion dollars. At the same time, NFT loan volumes also dropped drastically by nearly 74%, going from 1.1 billion to 284 million dollars.

After the strong boom of 2021, this market niche has not recovered, despite continuing to innovate technologically.

Users prefer to allocate their liquidity towards assets that are more easily liquidated and with greater Yield opportunities.

Contributing to this grim scenario for the NFT market is also the influence of Bitcoin, which in the last 2 years has increased its dominance over the rest of the sector by 50%.

Furthermore, the absence of a favorable landscape for speculation and the emergence of a wide range of different investment options have drained much of the liquidity that was present until recently in the NFT world.

This type of unique assets in their kind, however, remain a fundamental resource for activities such as tokenizzazione, gaming, and l’arte.

More and more organizations are implementing non-fungible tokens within their activities, reflecting the utility value of this revolution still underappreciated by the market.

Prices of the major collections according to CoinGecko data

According to CoinGecko data, the main collections of the NFT market are losing value in terms of dollars and ETH.

Compared to the historical highs recorded at the end of 2021, today the quotations of the most established collections are in a strong drawdown.

For example, the “CryptoPunks”, which in October 2021 had a floor price of 120 ETH, now are worth just 26.29 ETH.

Converting to FIAT according to the historical prices of Ethereum, the loss appears even more dramatic with over 350,000 dollars of value wiped out.

The overall capitalization of the collection remains at 267,742 ETH, equivalent to approximately 700 million dollars.

Source: https://www.CoinGecko.com/en/nft/cryptopunks

The same fate of the CryptoPunks has also befallen other NFTs in the market such as the “Bored Ape Yacht Clubs”, “Azuki”, “Mad Lads” etc.

As highlighted by CoinGecko, all those cryptographic artworks that experienced skyrocketing increases during the last bull market are now in the icy bear market.

Only a few exceptions of collections created more recently are saved, such as Milady and Pudgy Penguins, which have increased their floor price over the past year.

In any case, last week there was a small sign of recovery: while the crypto market was dropping, the market cap of NFTs rose by 0.58%.

It could be the beginning of a long recovery phase for the quotations, which will need to be confirmed in the coming months to gain credibility.

The total global #NFT market cap is up 0.58% to $69.4B, while the total #crypto market cap is down 1.5% to $2.26T today.

Are you watching any NFT collections? 👀https://t.co/cSds1qt3K4 pic.twitter.com/qSnxKpUP7P

— CoinGecko (@coingecko) October 9, 2024

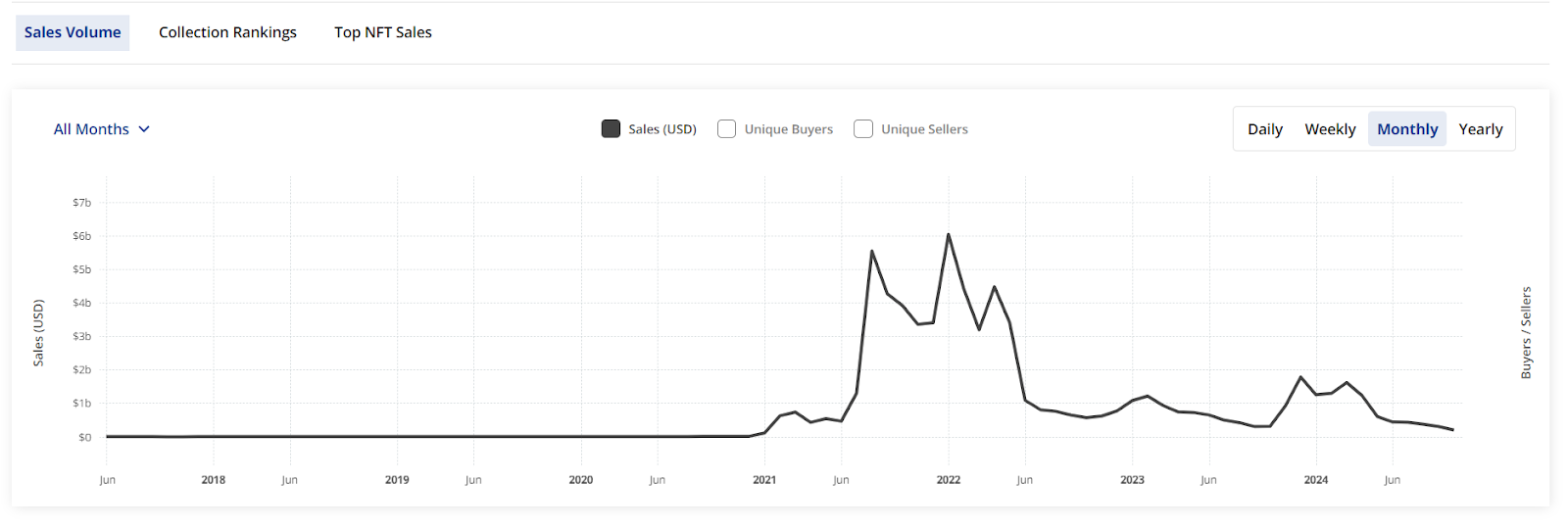

Sales volumes declining for the NFT market throughout 2024

As mentioned in the CoinGecko report, even the sales volumes of NFTs are in sharp decline, reflecting the market’s low interest in these products.

In the last 30 days, sales on Ethereum have decreased by 43% to 110 million dollars.

The same on Bitcoin and Solana have dropped by 16% and 39%, respectively, while the largest loss was on Polygon with a decline rate of 70%.

Overall, the NFT market processed sales for 303 million dollars in the month of September, compared to 370 million in the previous month.

This scenario has remained unchanged since December 2023, with data in downtrend for each following month.

Only in March 2024 was there an increase in trading volumes, supported by the general market euphoria which was then dampened in the following weeks.

From the CoinGecko and CryptoSlam data, we notice that compared to the top in December, sales have decreased by over 1.4 billion dollars.

If we take as a reference the all-time high of January 2022, when sales reached 6 billion dollars, the losses reach 95%.

Source: https://www.cryptoslam.io/nftglobal?timeFrame=month

It is evident that the NFT market is still in crisis and has not managed to emerge from the bear market of 2022.

The first indicator of a recovery in this sense would be to see for two consecutive months sales volumes exceeding one billion dollars, showing continuity in speculations.

Until then, it is likely that the NFT sector will continue to underperform Bitcoin and the other crypto tokens.

Read the full article here