AERO has seen significant price movement recently, fueled by Coinbase’s decision to add decentralized exchanges (DEXes) on its Base Blockchain to its main application.

As the biggest DEX, Aerodrome is poised to benefit greatly from this shift, which has sparked investor optimism.

Aerodrome Takes The Spotlight

The open interest in AERO has experienced a substantial rise, increasing by 112% over the past five days. From $22 million, it has now reached $47 million, driven by traders placing short contracts out of fear that the price might fall. However, the market sentiment is shifting as the funding rate is back in positive territory.

With the funding rate turning positive, it’s clear that many are betting on a recovery for AERO. This could drive additional buying interest, strengthening the bullish outlook for the token.

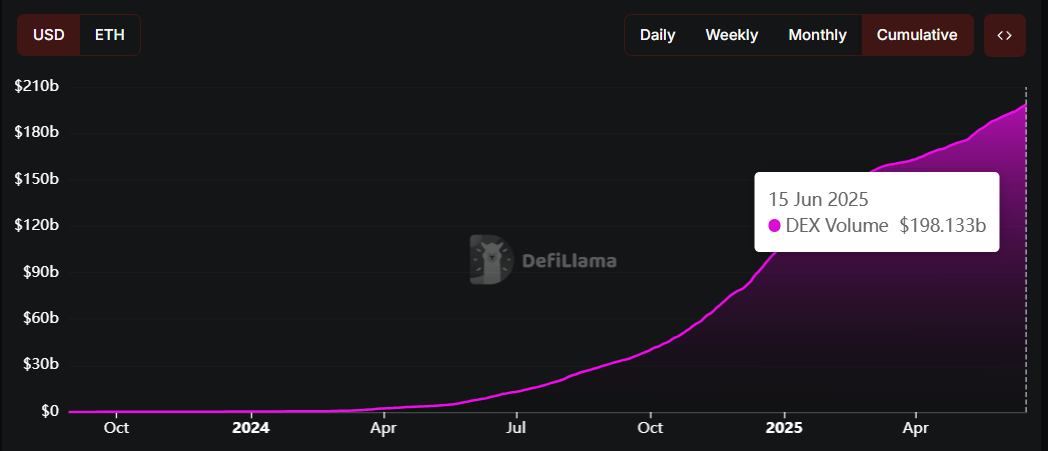

Aerodrome, the decentralized exchange platform, has accumulated a significant DEX volume, nearing the $200 billion mark. This is a notable achievement for the platform and highlights its growing influence in the decentralized finance (DeFi) space. The recent addition of Base Blockchain to Coinbase’s main application will likely further accelerate the platform’s growth and transaction volume.

As the biggest DEX on Base, Aerodrome stands to benefit immensely from this addition, attracting more users and liquidity. This increased activity is expected to push DEX volume even higher, creating a positive feedback loop that can further support AERO’s price.

AERO Price Prepares To Reach Next Target

Despite a volatile market that limited gains for many altcoins in Q2, AERO has managed to perform well, rising by 72% since the beginning of April. Currently trading at $0.75, AERO has demonstrated resilience and positive momentum.

The next key target for AERO is $1.00, which represents a 32% increase from its current price. Coinbase’s announcement of integrating Base Blockchain into its platform is a major catalyst for this price move. To reach this target, AERO would need to secure the $0.85 level as support, which would provide the necessary foundation for further upward movement toward $1.00.

However, if AERO fails to break through $0.85 or experiences profit-taking from investors, it could see a decline. A fall through the $0.74 support level would send the price down to $0.61, invalidating the bullish thesis and signaling a potential trend reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here