In January 2025, the cryptocurrency market proved it can still move just as fast as it did in the final quarter of 2024 and as in the most dynamic periods in its history.

Bitcoin (BTC) underwent a remarkable journey since the year started as it hit lows just under $90,000 as recently as January 13 only to recover toward new all-time highs (ATH) above $108,000 on January 20.

By press time, BTC is 14.40% in the green year-to-date (YTD) and is changing hands at $107,378.

Considering the pace and the volatility, many traders are looking to determine Bitcoin’s next move and whether the upswing can be sustained through the final 11 days of January or if a new downturn is in the cards.

Given the setup, Finbold decided to utilize its very own artificial intelligence (AI) price prediction tool and try to find out how Bitcoin will perform in the January 20 to February 4 timeframe.

Finbold AI predicts Bitcoin price target for February 1

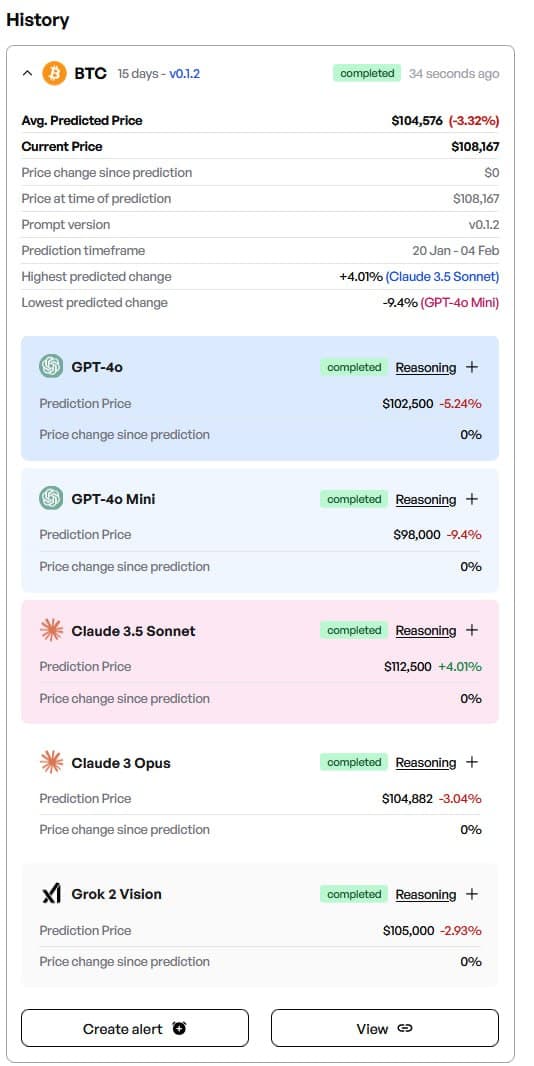

At a glance, four of the five advanced models utilized by Finbold’s prediction tool forecasted a downside, and, on average, they estimated Bitcoin would land at $104,576 – 2.6% below the press time price.

The most bearish model – ChatGPT-4o mini – after utilizing numerous trading signals such as the relative strength index (RSI) and the simple moving average (SMA), concluded BTC would collapse 9.4% by early February and trade at $98,000.

The regular ChatGPT-4o proved only slightly less bearish as it forecasted a 5.24% drop to $102,500.

Elsewhere, Claude 3 Opus and Grok 2 Vision proved equally conservative with their forecasts, with the former predicting a 3.04% correction to $104,882 and the latter a 2.93% drop to exactly $105,000.

Claude 3.5 Sonnet, on the other hand, completely broke from the crowd as it estimated Bitcoin is likely to find new highs at the beginning of February and change hands at $112.500 – a significant 4.01% above the January 20 price.

Why a February Bitcoin price correction is in the cards

Despite the strong momentum observable at the start of the penultimate version of January, the logic behind the AI forecasts is difficult to miss. Strong rallies frequently lead to noteworthy pullbacks and a drop to approximately $100,000 by early February falls in line with such trends.

Furthermore, Bitcoin is, at press time, benefitting from several substantial external tailwinds. To begin with, despite bringing an uptick in the monthly inflation reading, the latest CPI report proved something of a catalyst for many assets as it, despite being concerning, fell below expectations.

Finally, Monday itself is a major external booster for the cryptocurrency market as the day will witness the inauguration of Donald Trump – widely seen as the most digital assets-friendly president America ever elected – and the departure of Gary Gensler – widely seen as a major enemy of the industry – from his seat as the Chair of the Securities and Exchange Commission (SEC).

Featured image via Shutterstock

Read the full article here